TV and VoD service distribution over unmanaged IP networks will transform the market

In a series of articles, we have discussed how TV and VoD markets are changing in terms of content creation, funding, business models and pricing dynamics. This article focuses on changes in TV and VoD distribution.

IP provides network operators with the possibility of offering services to consumers over either managed or unmanaged networks, but unmanaged networks seem to be best suited to the seamless delivery of TV content anywhere, anytime and on any device. However, there are concerns in the industry about the quality of experience that this will deliver. When unmanaged IP-delivered TV services reach mass-market acceptance, the TV and VoD market will be completely transformed. Unmanaged IP delivery will facilitate greater competition from new players and their focus on providing greater choice and flexibility will transform the traditional TV value chain. We are already seeing some of these dynamics taking place.

Unmanaged IP TV distribution seems to favour seamless TV delivery

Consumers are keen to watch TV, live or on demand, anywhere and on any device. This creates a problem of ‘divergence’ rather than convergence for broadcasters and operators. For example, in Europe this means that they have to deliver their services using at least six or seven different physical networks, each with a different associated standard:

- terrestrial spectrum (DVB-T)

- wired cable (DVB-C)

- satellite (DVB-S)

- wired (DVB-IPTV)

- Internet (DVB-DASH and other similar)

- mobile (DVB-T Lite (broadcasting))

- mobile (eMBMs (mobile)).

Broadcasters, pay-TV retailers, operators and vendors need to ensure the interoperability of all these networks and standards if consumers are to have a seamless experience.

In this context, it is increasingly evident that IP standards over broadband services on both fixed and mobile physical networks could provide the wide reach and ubiquity required, and could become the common standard. Many will consider that the prospects of TV delivery over unmanaged IP networks could simplify reaching mass-market and niche target audiences. Others will argue that some interoperability issues will persist even when using unmanaged IP delivery – for example, because some TV and VoD offers are not compatible with all Internet browsers. Therefore, although IP broadband delivery might become the default delivery mechanism in the future, players and regulators will need to protect consumer choice and avoid uncompetitive practices in the value chain.

The struggle between managed and unmanaged TV distribution is one of quality of services versus quality of experience

It appears that a full IP delivery of TV services over unmanaged networks (broadband using open Internet) using a single standard could be the easiest way (in terms of network and standards) to offer the seamless experience that consumers are demanding. The issue is that the quality of experience over unmanaged IP delivery is not always comparable to the quality of service over broadcast networks. Despite this issue, some owners of premium sports rights and pay-TV operators are already offering premium sport over unmanaged IP delivery, which indicates that they believe either that the quality issue will be resolved over time or that at least some subset of consumers will accept some trade-off in quality in exchange for lower cost or more convenience. What remains uncertain is if this unmanaged IP delivery will be accepted by the majority of viewers and consumers and if so, when.

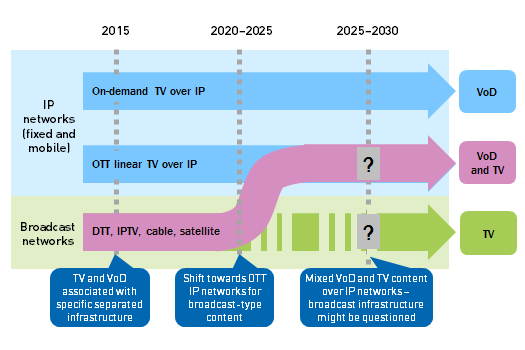

Figure 1: Potential evolution of the delivery of TV and VoD services, by network type [Source: Analysys Mason 2016]

Consumers will determine whether the new or the traditional TV and VoD players will win

The transformation of TV distribution leads to two different strategies for new and traditional TV players

- Internet-based new VoD and TV players such as Netflix will continue to push unmanaged TV delivery. They have led the way in challenging the physical video market. Their future strategy is likely to evolve to make their VoD and TV offers increasingly attractive. As they build scale, they will seek to use unmanaged TV delivery to target the much larger traditional TV market, both advertising and pay TV. This will be their preferred route to market (unless operators offer them a better economic deal for managed delivery).

- Traditional TV players will try to delay the impact that unmanaged IP delivery of TV could have on their P&L statements. They are focusing on the compatibility and interoperability of different networks and standards to protect their established position. However, they are commercially obliged to launch unmanaged TV delivery services to retain viewers or subscribers. This will allow them to prepare for, prioritise and promote this service if and when the threat becomes unavoidable. In the meantime, they will try to minimise the impact by offering wholesale deals on managed networks to new Internet players so that the impact on their P&L statements is as marginal as possible. They will also explore the opportunity to target non-home markets using unmanaged IP delivery.

Between the two strategies, viewers and consumers will ultimately determine the long-term winner based on the extent to which they accept the (currently) lower quality of experience of TV delivered over unmanaged IP networks in exchange for the benefits of flexible pricing models and convenience. For broadcasters, one of the key strategic concerns is how long the transformation of the TV and VoD market will take.

Analysys Mason is working on several projects that examine the technical, economic and regulatory conditions for IP distribution of TV services. This expertise enables us to understand market dynamics and advise clients on strategies for TV and VoD distribution that respond to their growth objectives.