Iliad’s market entry and the 5G spectrum auction outcome could split the Italian mobile market in two

Two main events happened in the Italian mobile market in 2018.

- Iliad’s market entry. A new operator, Iliad (named after and fully owned by the French telecoms group), entered the market in May.

- The 5G spectrum auction. Spectrum in the 700MHz, 3.6–3.8GHz and 26.5–27.5GHz bands was awarded to operators in early October. All four mobile network operators (MNOs) as well as the fixed operator Fastweb purchased spectrum that can be used for 5G.

These two events are not likely to affect each other in the short term (although Iliad was included as an additional bidder in the spectrum auction and had a portion of the spectrum in the 700MHz band reserved for it as a new entrant), but this might change in the medium term.

Indeed, the combination of these two events could split the Italian prepaid mobile market into two segments: a ‘premium’ segment and a ‘low-end’ or ‘value’ one, with TIM and Vodafone focused on premium customers and Wind 3 and Iliad focused on those in the low-end segment.

Iliad’s market entry

Iliad’s go-to-market strategy

Iliad entered the Italian mobile market on 29 May 2018 and since its launch has adopted an aggressive and disruptive pricing strategy. The first 1 million clients paid an activation fee of EUR10 (with no associated traffic allowance) and now pay a recurring monthly charge of EUR6 for unlimited voice minutes and text messages and 30GB of data. By comparison, other mobile operators’ monthly recurring charges are in the range of EUR8–EUR10 (with no one-off fees) for similar allowances.

Iliad has also developed a simple commercial offer that is predominantly based on connectivity services with limited customisation options.

Impact on competitors’ positioning

The other MNOs have reacted to Iliad’s market entry by putting differentiated commercial strategies in place to retain their subscriber base.

- Wind 3 has introduced a set of competitive offers that are in line with Iliad’s pricing. For example, the entry-level bundle provides 500 voice minutes and 5GB of data for EUR5 per month. Wind 3 was the only value-oriented operator in the Italian market before Iliad joined, and as such, has been the most affected by Iliad’s entry.

- Vodafone and TIM have each launched a low-cost sub-brand (Ho.mobile and Kena, respectively). Their objective is to avoid churn to Iliad without increasing their market shares. This is coherent with the role of these operators in the high-value end of the market; they have been trying to increase revenue, since before Iliad’s entry, by selling services beyond basic connectivity, as well as through bundle offers. This is reflected in the wide range of retail prices that are available through a large number of offers. Ho.mobile and Kena have designed and priced their offers in line with Iliad’s, in order to limit the revenue cannibalisation of their parent operators.

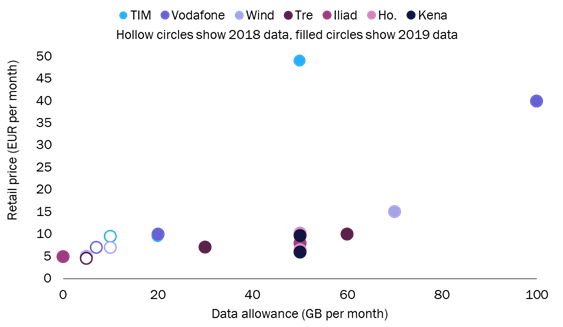

Figure 1 shows the retail prices and data allowances of mobile offers that were available in January 2019 compared to those that were available in January 2018 (that is, before and after Iliad’s entry). It can be seen that data traffic allowances have increased significantly more than retail prices.

Figure 1: Retail prices and data allowances of mobile offers, Italy, January 2018 and January 2019

Source: Analysys Mason, 2019

Impact on prepaid ARPU

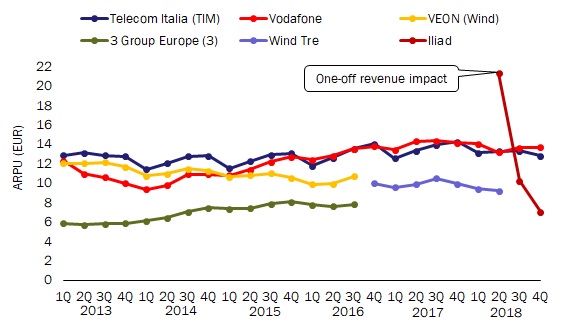

Figure 2 shows the mobile prepaid ARPU in Italy on a quarterly basis over the last 5 years. Iliad’s ARPU1 has been declining since its entry to the market, mainly due to the end of the ‘one-off’ effect experienced in the third and fourth quarters.

Iliad’s increased monthly charges (compared to when it first entered the market) may result in a slowdown of its revenue growth rate, so its impact on the overall market ARPU may be limited.

Figure 2: Mobile prepaid ARPU, Italy, 2013–2018

Source: Analysys Mason, 2019

Impact on market shares

Iliad’s customer base reached 635 000 after 1 month of operation, and grew to 2 230 000 by the end of 3Q 2018 with a monthly growth rate of more than 50%. However, it will be challenging to maintain such a growth rate in the medium term due to increasing retail prices, a lack of ‘novelty’ surrounding the operator and potentially unsatisfactory service quality (indeed, Iliad’s subscriber base only grew to 2 800 000 by the end of 4Q 20182).

There may be a limit to the size of the value-seeking prepaid segment, and the inferior quality of service in this segment may deter customers that are quality-sensitive. As may be expected, market research3 shows that Iliad and Wind 3 offer the worst quality of service of all the Italian mobile operators; at the same time, Wind 3 continues to lose market share despite being the cheapest operator (at least for some levels of usage).

The 5G spectrum auction

The 5G spectrum auction outcome

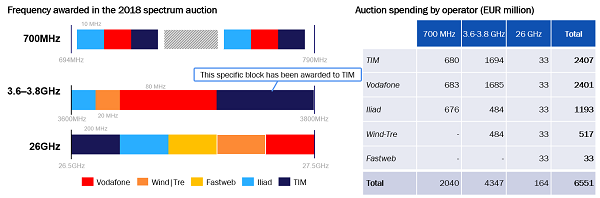

The 5G spectrum auction took place on September 2018, a few months after Iliad’s market entry. MNOs invested more than was expected. Vodafone and TIM invested more than twice as much as the other competitors, mainly in the 3.6–3.8GHz band (the most valuable one for implementing 5G features). This has resulted in significantly different spectral holdings among players.

Figure 3 summarises the 5G auction results, both in terms of spectrum holdings and investments.

Figure 3: 5G auction outcome, Italy, 20184

Source: Analysys Mason, 2019

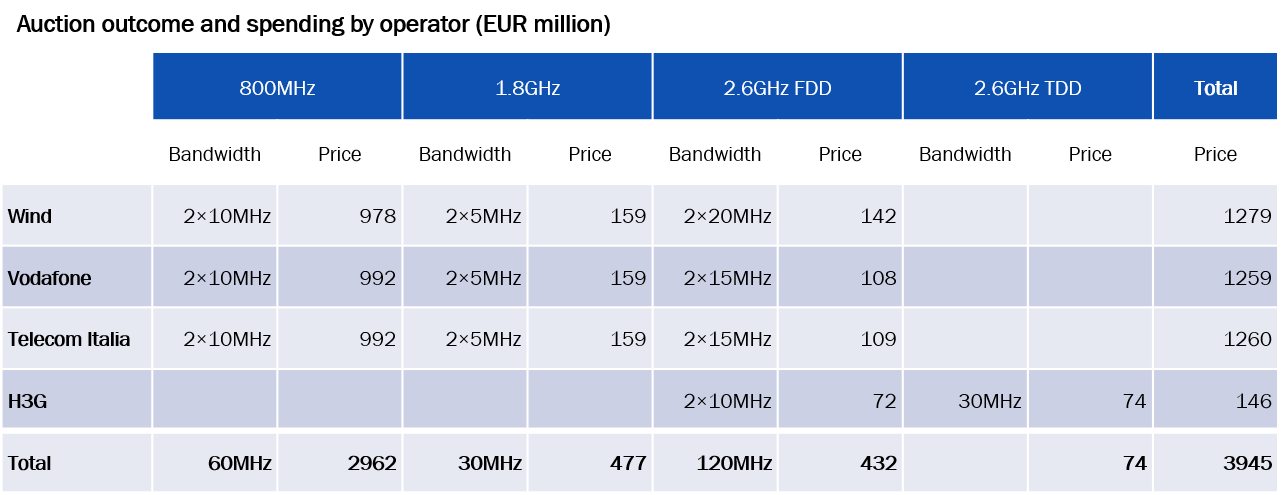

The 5G spectrum auction outcome was significantly different to the 4G one (reported in Figure 4 below). In the 4G auction, all MNOs (except for H3G) invested a similar amount of money for comparable spectrum holdings. As such, there were no clear reasons for operators to differentiate their strategies in order to proportionally monetise their investments.

Figure 4: 4G auction outcome, Italy, 2018

Source: Analysys Mason, 2019

Strategic implications

Vodafone and TIM need to carefully build their value proposition around 5G services in order to gain as much profit as possible (and as soon as possible) from their additional spectrum investments. The elements that they have to consider are the following.

- Service offerings, for example:

- providing an appropriate IoT service range to the market

- setting the ‘right’ level of wholesale prices to be able to maintain some competitive advantage over access seekers and buyers.

- Business models, for example:

- making use of partnerships with service providers for 5G-based attractive use cases

- focusing on alternative services: 5G is expected to make access network convergence happen even more than it has happened with 4G.

TIM and Vodafone have also announced plans to form a 5G joint venture as a means of managing the cost side of the 5G business case in order to make the payback of investments more affordable.5

In this context, a price war is neither attractive nor affordable, at least for the high-end players (that is, TIM and Vodafone). Conversely, it looks like the battle is to be fought on the service differentiation field. A different strategy (that is, a more price-oriented one) could instead be pursued in non-5G segments (for example, on 4G services), where TIM and Vodafone might potentially opt to compete through the low-cost brands Ho.mobile and Kena.

Conclusion

Iliad’s market entry and the 5G auction outcome are likely to have opposite effects on mobile service prices. It will be vital for the high-end players TIM and Vodafone to differentiate their offerings from those of their low-end competitors in order to justify price differentials and allow their considerable spectrum investments to be recouped; at the same time, Iliad may retain its aggressive pricing strategy which will put further pressure on the market ARPU.

It is difficult to know which of the two effects will prevail. There is a risk of market ‘bi-polarisation’, whereby there are both high-end (high price, high quality) and low-end (value) offerings, with high price and service quality variance between the two poles and a lack of mid-range offerings.

1 As estimated for the period 29 May–31 December 2018.

2 Iliad (France, 2019), Press release. Available at https://www.iliad.fr/finances/2019/CP_190319_Eng.pdf.

3 HDBLOG.it (Italy), Vodafone migliore operatore in Italia per Altroconsumo, il peggiore è Iliad. Available at https://www.hdblog.it/2019/01/02/vodafone-migliore-operatore-altroconsumo-tim-iliad/.

4 Spectrum in the 700MHz band will only be available by mid-2022 and for this reason it is unlikely to offer significant competitive advantages for very early 5G deployments.

5 TIM (Italy, 2019) TIM’s BOARD OF DIRECTORS APPROVED THE 2019–2021 STRATEGIC PLAN “TIMe to deliver and delever”. Available at https://www.telecomitalia.com/content/dam/telecomitalia/en/archive/documents/media/Press_releases/telecom_italia/Corporate/Financial/2019/PR-TIM-Strategic-Plan.pdf.