Operators in Asia with fixed–mobile convergence ambitions should consider the opportunity presented by small and medium enterprise ICT

While telecoms operators in Asia have found it increasingly challenging to grow consumer telecoms revenues, enterprise ICT appears to provide an opportunity for steady growth. The enterprise ICT space has historically been dominated by fixed network operators. There has, however, been an increasing demand for mobility in enterprise ICT. Providing ICT services to small and medium enterprises (SMEs) could be an attractive growth area for operators in Asia with fixed–mobile convergence ambitions.

SME ICT services are attractive, especially for enterprise market challengers in emerging markets

Revenue is generally concentrated among large accounts in the enterprise ICT market, but SMEs remain a significant, often overlooked opportunity. Analysys Mason estimates that between 40–60% of the overall enterprise market revenue come from SMEs, with SMEs in more mature markets making larger contributions. Analysys Mason Research expects healthy growth from the SME ICT segment in Asia at a CAGR of 4% to reach revenue of USD73 billion in 2020.1 Emerging markets will drive the majority of SME ICT segment growth at a CAGR of 5%.

For a market challenger looking to make inroads into the enterprise ICT market, the SME segment represents an ideal entry point. This is due to the following general SME characteristics:

- Simpler ICT requirements – SMEs have less demanding ICT requirements, and complex ICT set-ups are rarely present. In fact, many SMEs prefer pre-packaged solutions.

- Easier to win over – Large enterprises rarely switch their ICT service providers, due to perceived operational risks in changes to legacy systems and networks. SMEs, on the other hand, have lower barriers to switching and can be persuaded to do so relatively easily.

- Potentially overlooked by incumbents – There are a small number of mega-accounts delivering disproportionally large revenue streams at the top end of the enterprise ICT market. Incumbent operators in that market naturally focus their efforts on these accounts, which means that the SME segment may be potentially underserved.

Telecoms operators with fixed–mobile convergence ambitions should take an active role in SME ICT

Recent fixed–mobile convergence strategy has centred on consumer broadband and mobile services bundling, network integration and other opex savings, yet SME ICT services could also form a key part of fixed–mobile convergence strategy.

The enterprise ICT space has historically been dominated by fixed network operators. There is, however, an increasing demand for mobile services in enterprise ICT. The SME segment is of particular interest to operators with fixed–mobile convergence ambitions. Many SMEs in Asia, for example, are expected to adopt ICT applications that require both fixed and mobile connectivity, which presents an opportunity.

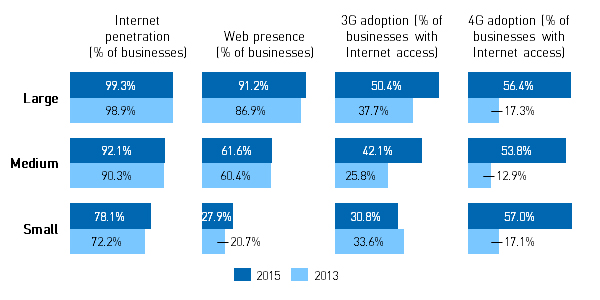

Figure 1: ICT adoption among businesses in Hong Kong [Source: Census and Statistics Department, Hong Kong, 2016]

Even in a highly developed market like Hong Kong, overall enterprise Internet penetration grew from 75% to 80% between 2013 to 2015, with SMEs driving the majority of this growth (see Figure 1). SMEs’ increased web presence means that these businesses will also require ICT services beyond pure Internet access, including website hosting, cloud applications and even digital payment capabilities. Adoption of mobile technologies also shows significant growth between 2013 and 2015. The potential for first-time fixed and mobile ICT adoption is even larger in emerging markets in Asia.

Pre-packaged solutions, distributed through enhanced sales and technical support channels, are the key to success

While SME ICT is an attractive opportunity for certain operators in Asia, these players would be required to adopt a delivery model that goes beyond the traditional connectivity business. Operators that aim to successfully tap into the SME ICT market should:

- Develop pre-packaged solutions that enable savings or convenience – A key value proposition that operators with fixed–mobile convergence bring to SMEs is a standardised solution. SME decision makers are often business owners with basic ICT skills, therefore cost savings and process simplifications are key selling themes.

- Build sales channels that are capable of more highly skilled, consultative ICT sales – ICT sales require more customer education, and salespeople able to propose customised solutions. The latter is a complex skill for those working in typical operator sales channels that only sell connectivity products. Channel partnerships are therefore critical.

- Establish technical support for all components of the pre-packaged solution – Similar to the demand on sales channels, servicing SME ICT requires technical support capabilities for all components in the pre-packaged solution. These components are often third-party products. In-house training supported by clearly defined service-level agreements with solution partners are important.

Analysys Mason has extensive experience on enterprise strategy, including all aspects of go-to-market strategy, implementation support or specific initiatives such as the Internet of Things.

1 Analysys Mason SME ICT Forecast 2015–2020