Partnering for digital transformation: a EUR15 billion opportunity for EMEA operators

Where do we go next? After nearly a decade of disruption, telecoms operators in most developed and many developing markets, in Europe and elsewhere, can think again about growth. Now is the time, therefore, for operators to define how they will grow during the next business cycle.

It is clear that part, if not all, of the answer to this question lies with digital and the Internet. Telecoms operators will thrive or struggle depending on their ability to adapt or transform their strategy and operations to make the most out of the content, services and technology enabled by the Internet.

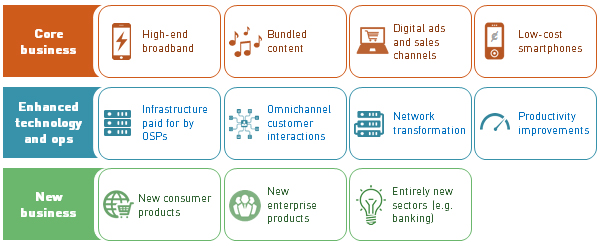

This ‘digital transformation’ takes many guises (see Figure 1). For some operators, it means focusing on their core business, providing best-in-class connectivity for their customers to access online content and services with the best possible quality of experience. For others, it means entering new markets, thanks to lower barriers to entry made possible by the Internet. For all, however, digital transformation also means working differently, investing differently, to make the most of the rapid pace of change in software and networking that is taking place, driven by the largest Internet players.

Figure 1: Selected ongoing digital transformation initiatives [Source: Analysys Mason, 2017]

Operators that are trying to protect their core business will find that differentiation is a challenge

For operators that are focused on shoring up their core business, a key challenge is differentiation. On the one hand, they face competition, which in Europe remains as intense as ever in both mobile and fixed markets. How can they convince end users that they are worthy of their loyalty, rather than ‘me-too’ providers that can be joined and left every 12 to 24 months purely based on prices? On the other hand, they are also victims of their success in launching increasingly high-quality broadband services: voice and messaging services are now add-ons to broadband access, and superfast broadband (30Mbit/s or 50Mbit/s and more) is available through both fixed and mobile networks in many countries, so most people can get entry-level broadband that is ‘good enough’ for their use. How can operators convince them to upgrade to better, but more-expensive products (including fibre-based access)?

There is no single answer, but many operators are now effectively using online content and applications as drivers of demand for connectivity, through advertising (for example, Virgin Media is promoting 200Mbit/s fibre broadband by emphasising low-latency gaming), bundling (for example, many operators are bundling Netflix with broadband and offering differentiated promotions with different tiers of broadband) and digital marketing.

Some operators are entering new markets and have many assets to help them do so

Operators that are entering new markets are experimenting in a wide range of ways. In the USA, Verizon and to a lesser extent AT&T are making large bets on new markets: digital advertising (Yahoo!, AOL), pay-TV (DirecTV) and many other acquisitions, which must be large scale to make a difference in hundred-billion-dollar businesses. In Europe, Orange has entered the retail banking market in Poland, and is preparing to launch in France. Partly this is a portfolio strategy: make a lot of bets and see what sticks.

However, the market entry strategy of most operators relies on assets that they have had all along but did not previously exploit outside telecoms: customer relationships, including billing, which make it possible to act as a payment channel for small transactions (for example, app stores); a physical presence in tens of thousands of neighbourhoods, which are fast becoming expensive advertising billboards but can also act as points of contact and service centres for many new services; and trust – although operators complain that they are being held to higher standards of data protection and privacy than other businesses, in practice this has helped them become trusted and liked by consumers. Consumer surveys regularly value telecoms brands highly, often in the top three in many countries.1 This is despite the fact that the telecoms industry only represents 1–3% of GDP in most developed markets.

Operators are engaged in network and operations transformations in order to reduce cost and improve performance

Finally, every operator is now engaged in a deep transformation of their networks and operations, to make the most of technology pioneered online by ‘web-scale’ online service providers. This involves making more extensive use of software and cloud platforms to increase the agility of networks and platforms. Where it once took months and millions of Euros in investment to launch a new service, dedicated hardware, virtualisation and software-defined networking (SDN) now enable operators to reallocate resources and launch new services in weeks, if not days. They are also investing in customer care platforms that enable them to interact with customers whenever, wherever and however these customers want, improving satisfaction and retention. Ultimately, the goal is to reduce costs and improve productivity – to the benefit of operators themselves, their investors and their customers.

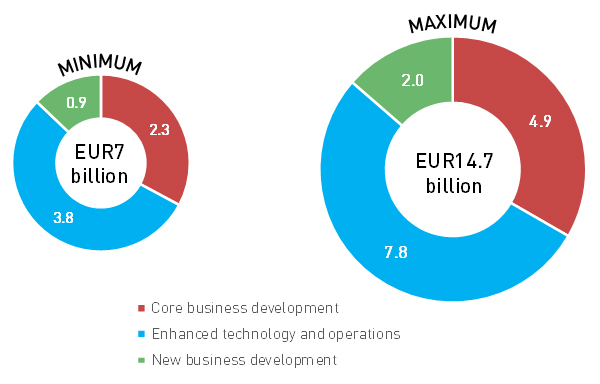

This feels like a long and hard journey, but make no mistake: the digital transformation is happening fast, and the rewards for the telecoms sector as a whole are significant. We estimate that successful transformation, through judicious investment and partnerships, could add up to EUR15 billion to operators’ cashflow in Europe, the Middle East and Africa (EMEA) by 2021, a 50% increase on current levels (see Figure 2).

Figure 2: Estimates of the cashflow impact of digital transformation through partnerships, EMEA, 2021

Analysys Mason recently published a report on the value of partnering for digital transformation: Operators' digital transformation: unlocking EUR15 billion through partnerships with OSPs.2 Other recent research on digital services and transformation includes Telecoms operator growth strategies: case studies and analysis.3 To discuss how the Internet content, services and technology can benefit telecom operators’ performance and prospects, please contact David Abecassis (Partner – Consulting) or Stephen Sale (Research Director).

1 For example, BrandZ ranks Vodafone as the most valuable UK brand and BT is at number four. For more information, see www.research-live.com/article/news/vodafone-uks-most-valuable-brand/id/5023372.

2. See Analysys Mason’s Operators' digital transformation: unlocking EUR15 billion through partnerships with OSPs. Sponsored by Google.

3. See Analysys Mason’s Telecoms operator growth strategies: case studies and analysis.

Downloads

Article (PDF)Authors

David Abecassis

Partner, expert in strategy, regulation and policy

Stephen Sale

Research DirectorLatest Publications

Pay TV and streaming video in the Netherlands: trends and forecasts 2023–2028

Forecast report

Operator strategies for IP–optical convergence

Strategy report

Pay TV and streaming video in Finland: trends and forecasts 2023–2028