Incumbent operators’ enterprise portfolios are underperforming compared to their consumer divisions

Most incumbent telecoms operators in high-income countries are reporting a considerable gap between the performances of their enterprise and consumer divisions. Enterprise divisions have experienced substantial declines in mobile ARPU as competition in the enterprise market has intensified. Rising demand for data has failed to offset declines in other services, but operators have the potential to reverse this decline in enterprise revenue as ARPU stabilises and growth opportunities in new services arise.

This article examines the financial performance of incumbent operators’ enterprise and consumer divisions in high-income countries and the reasons for the current divergence in these divisions’ growth rates.

Incumbent operators’ enterprise divisions are performing considerably below their consumer divisions

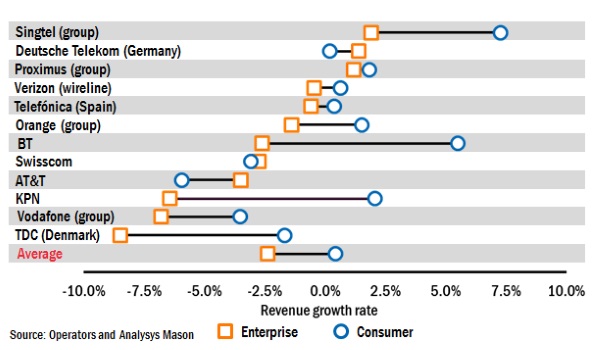

Figure 1: Selected telecoms operators’ revenue growth rates by division, 1H 2016–1H 20171

Telecoms operators’ consumer revenue grew by an average of 0.4% in 1H 2017, whereas their enterprise revenue declined by an average of 2.4%, creating a gap of almost 3% between the divisions in terms of revenue growth. Enterprise revenue only grew faster than consumer revenue for three of the twelve incumbent operators in our sample.2

Many factors have affected both telecoms operators’ enterprise and consumer divisions, such as large declines in fixed voice. However, there are three primary reasons for the divergence between enterprise and consumer revenue observed for many incumbent operators.

- Rising competition. Enterprises have historically had less choice than consumers in terms of telecoms service providers, leading to many incumbents controlling a substantial share of enterprise subscribers. The poor performances of most incumbents’ enterprise divisions may indicate a change in this trend, as market saturation and rising competition reduces enterprise revenue. Indeed, our survey found that countries where incumbents have a particularly high share of enterprise subscribers reported the highest rates of intended churn. This indicates that challengers are gaining ground in the enterprise market, which is putting pressure on many incumbents’ enterprise divisions.

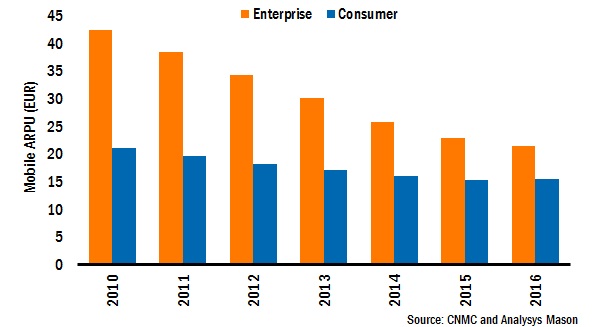

- Faster falls in enterprise ARPU. Enterprise mobile ARPU has fallen much faster than consumer mobile ARPU, with a corresponding impact on enterprise revenue. The data from CNMC in Spain, one of the few regulators to report data for enterprise and consumer mobile revenue streams separately, illustrates this trend (Figure 2). Enterprise mobile ARPU fell by an average of 11% per year between 2010 and 2016, compared to an average of 5% for consumer mobile ARPU. We believe ARPUs in other markets have followed a similar trend.

- Enterprise mobile data revenue is growing more slowly than consumer revenue. Rising demand for enterprise mobile data has failed to offset declines in voice services. Growth in cellular data usage has also been stronger for consumer than for enterprise users, contributing to the divergence in growth rates. For example, mobile data revenue from consumers in Spain increased by 15% in 2016, while enterprise mobile data revenue only increased by 9%.

Figure 2: Telecoms operators’ mobile ARPU by division, Spain, 2017

Mobile ARPU stabilisation and growth in new services may ease the pressure on operators’ enterprise revenue

The improving trend in consumer revenue could indicate the future trajectory of enterprise revenue. Consumer revenue is now flat (on average), following several years of decline, and is even rising in some countries (Figure 1). Some of the factors responsible for declines in enterprise revenue are now weakening (for example, declines in mobile ARPU are slowing and the migration from legacy services is largely complete), and there is growth in new service areas, such as security. Operators may therefore be better placed to stabilise or even grow their enterprise revenue.

1 Figures are based on raw quarterly data, which does not represent organic or comparable figures published by operators.

2 We only considered large incumbent operators, as smaller operators often do not provide a split of enterprise and consumer revenue.

Downloads

Article (PDF)Enterprise video

Results of our survey of 1600 enterprises