Amazon has acquired streaming rights to the English Premier League – operators must adjust their strategy

Amazon announced in June 2018 that it had acquired exclusive live streaming rights to 20 English Premier League (EPL) football games in the UK, per year, between 2019 and 2022. This is a small number of games compared with the 160 per year acquired by BT and Sky in February 2018. However, the acquisition portents a shift in the relationship between OTT providers and traditional pay-TV businesses. These 20 games will be distributed at no extra cost to Amazon Video customers because the company aims to encourage more customers to its delivery and entertainment package Amazon Prime.

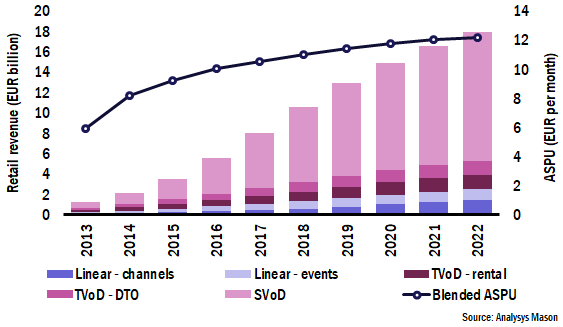

Consumers in Europe spent EUR8.1 billion on OTT video in 2017 and this will more than double to EUR18.0 billion by 2022. OTT video players have, to date, made tentative investments in live sports.1 The acquisition by Amazon of a small number of games in one of Europe's most-viewed sporting leagues will be considered by many to be the tipping point where OTT video becomes a mainstream contender for premium sporting content. This comment explores the impact of the acquisition of sports rights by OTT players on traditional pay-TV businesses. Sports rights are a critical part of many pay-TV propositions, but this may not necessarily continue to be the case.

Amazon's acquisition does not necessarily mean that sports rights are going to continue to increase in value

Until 2017, there was a tacit consensus that the costs of sports rights would grow in line with competition. The increased bidding activity of OTT players influenced this assumption. However, the increased willingness of OTT players to invest in sport does not necessarily mean that the cost of sports rights will climb. 'Financial discipline' has become the watchword of bidders in 2018 auctions. In the February 2018 EPL auction, BT and Sky bid EUR5.0 billion overall for the "best five of the seven packages"; this is 13% less than the EUR5.8 billion spent by the same companies in February 2015. BT and Sky agreed to a mutually beneficial exchange of sports coverage, which reduced their incentive to outbid each other. Even without such agreements, pay-TV providers that have already invested in sports can exercise similar financial discipline in forthcoming auctions – in June 2018, Telefónica paid 5% less than in the previous auction for La Liga rights (still paying EUR980 million per season). The operator stated that "Telefónica has always defended that the La Liga matches are a very attractive content, but that its acquisition had to be carried out at the appropriate price."

The relationship between OTT players' acquisition of streaming rights and pay-TV providers; purchase of big-ticket packages of exclusive match coverage does not, therefore, seem to be intrinsically linked to higher prices. Indeed, the business case for investing in sports rights is not static – investment strategies must be flexible, and pay-TV providers are beginning to act upon this realisation. Partnerships, financial discipline and a considered approach to alternative content investment should be key considerations for any operator interested in sports rights.

OTT delivery of live TV and video content is becoming mainstream – and will be worth billions

Sport is a fundamental part of many linear OTT video propositions. Revenue from linear OTT propositions from pure-OTT providers, as well as from traditional pay-TV providers that are becoming OTT players, will grow rapidly to 2022. Consumers in Europe spent EUR8.1 billion on OTT video services in 2017. This will more than double to EUR18.0 billion by 2022. Live streaming content, of both events and channels, is sufficiently lucrative in Western Europe that traditional broadcasters and operators will fight to retain the majority of live streaming rights until 2022, but this will still swell OTT revenue. For example, satellite player Sky will be a significant agent of change in the European OTT video landscape in the next 5 years, launching its Sky Q service OTT from 2018, and contributing to the large growth in linear users in the UK, Germany and Italy (around 2 million users each by 2022).

Figure 1: OTT video retail revenue by service type and blended ASPU, Europe, 2013–2022

In our report OTT linear services: how pay-TV providers can turn increased competition into an opportunity, we outline an approach where traditional pay-TV providers begin to treat third-party linear OTT services as regular TV channels in order to integrate their content. Indeed, within weeks of Amazon acquiring the EPL rights, BT announced an exclusive partnership agreement with Amazon to include Prime Video within their set-top box, making them the only UK operator to have full integration of all the channels required to watch all EPL games through one service.

Sports content is not the only option for investment – an increasing number of operators are looking to original drama

Sports rights investments have been important for enabling operators to differentiate their services, but alternative, lower-cost content options should not be overlooked. Players that have hitherto avoided content investment altogether have instead differentiated on price or user experience to attract TV customers. This creates challenging commercial and creative constraints. Some alternatives to sport investment may offer a degree of content differentiation at a lower cost. One such example is drama, an approach championed by players such as Orange and Telekom Deutschland. A further point of comparison: in 2015, the Spanish arm of Telefónica bought the Spanish arm of Canal+ (the second-largest pay-TV provider in Spain) for EUR707 million; this is less than the EUR1 billion it spends annually on football rights and in the longer term, this acquisition may provide the greater RoI.

Analysys Mason recently published Investing in sports rights: how operators can identify value and ensure the best return. This report reviews the value of sports investment for operators and determines whether such investment is sustainable, or if a change of approach may yield greater returns.

1 Examples include Amazon’s acquisition of US Open tennis, and Facebook’s airing of Major League Baseball in America. EPL rights have been acquired by OTT players in south-east Asia, and by DAZN in Germany. At the time of writing, Facebook was also rumoured to be considering a bid for EPL rights in Southeast Asia.

Downloads

Article (PDF)Authors

Martin Scott

Research DirectorLatest Publications

Pay TV and streaming video in Austria: trends and forecasts 2023–2028

Forecast report

Pay TV and streaming video in Sweden: trends and forecasts 2023–2028

Forecast report

AI series: who will be the GenAI winners and losers in the TMT industry?