Cisco and BroadSoft are a good fit for each other and for their operator customers

03 November 2017 | Research

Article | PDF (3 pages) | Future Comms| SME Services| Enterprise Services

Cisco announced its intention to purchase BroadSoft for USD1.9 billion on 23 October 2017. The deal is the latest in a series of recent consolidations for enterprise communication vendors – Mitel purchased ShoreTel and Genband and Sonus (now rebranded as Ribbon Communications) also merged in 2017.

BroadSoft provides unified communications solutions, selling exclusively through service providers, rather than directly to enterprises. It claims 25 out of the largest 30 telecoms operators as clients, including Telstra, Verizon and Vodafone, as well as a number of smaller European operators.

Additional funding and sales and marketing resources should help BroadSoft better serve telecoms operator customers, but the implications of this latest deal are relatively limited for these operators. The deal reinforces the model of network operators as the main provider of voice, as well as more advanced communications, services. Indeed, it can be seen as an expression of Cisco’s confidence in its existing system of using operators as a channel to market.

However, other potential deals could pose a greater threat to telecoms operators’ interests, such as an aggressive move from AWS (or another big Internet company) to focus on selling advanced communications solutions directly to enterprises, rather than through operators. Operators should therefore be broadly content with Cisco’s acquisition of BroadSoft – there are many positives for them in the deal.

Cisco can address many of BroadSoft’s weaknesses

Cisco can tackle many of the weaknesses that BroadSoft had as an independent company, if managed correctly. BroadSoft identified competitors with the following characteristics as risks to its business in its 2016 10K filing:

- those with greater “financial, technical, marketing and other resources” that can “devote greater resources to the development, promotion, sale and support of their products”

- those that have “more extensive customer bases and broader customer relationships”

- those with “longer operating histories and greater brand recognition”.

Cisco can eliminate all of these risks.

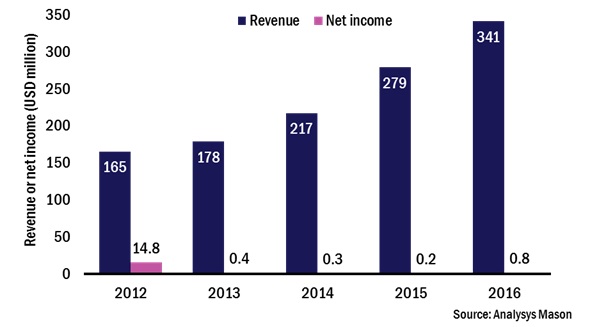

BroadSoft’s recent financials have shown that its spending has been constrained by its (relatively) small size. Revenue has grown impressively (Figure 1), more than doubling during 2012–2016, while net income has been less than USD1 million each year, with the exception of 2012. These low net income figures are largely due to large hikes in spend on research and development (from USD35 million in 2012 to USD77 million in 2016) and sales and marketing (from USD46 million to USD107 million over the same period). It appears that BroadSoft’s management has spent as much as it could to grow the business without ever causing losses. Spend levels could now be increased, with Cisco’s backing.

Figure 1: BroadSoft’s revenue and net income, 2012–2016

Significant additional spending will be required from Cisco, both to add features to BroadSoft’s platform and to merge this with its own efforts – most importantly by merging it with (or superseding) Spark, but also to integrate WebEx. These developments will benefit customers. For example, Verizon offers BroadSoft’s Team-One product to some customers and One Talk (based on Cisco’s product) to others, with only limited integration between them. Cisco should be able to offer a seamless proposition to all customers following this deal.

BroadSoft will also need sales and marketing support to further its international expansion. The USA still accounted for 52% of its business in 2016. More rapid expansion came elsewhere, however – revenue in Europe, the Middle East and Africa grew by 60% in 2016 compared to 2015.

It is not BroadSoft’s technology or customer base alone, but the combination of both that is key for Cisco

Gaining such a strong position in the unified communications market would be challenging for Cisco without the acquisition of BroadSoft, particularly in the SME segment. The attraction is not BroadSoft’s technology – Cisco could have obtained similar for less than the USD1.9 billion it is paying for the company (perhaps through the acquisition of BroadSoft’s smaller competitors).

Equally, it is unlikely that BroadSoft has many customers that are not also Cisco clients, at least to some degree. BroadSoft will bring relationships with different people in its customers, but, again, Cisco could probably have reached these people itself with time and investment.

The value of BroadSoft to Cisco is more likely to come from the combination of a mature, well-established technology solution and a wide customer base that trusts this solution, which in turn will give Cisco the references to win new clients.

Other mergers may be more dangerous for telecoms operators

The Cisco–BroadSoft deal reinforces the conventional model of telecoms operators selling communications solutions to enterprises. Cisco should provide the support BroadSoft needs to grow, provided that it successfully managed the acquisition (and it should have the experience to do so, having completed over 200 M&A deals) and supplies sufficient funding for product development and sale/marketing support.

More radical changes could hit this market and provide a greater threat to operators’ positions. A combination of AWS (which has been gradually expanding its Chime unified communications solution) and either 8x8 or RingCentral (both of which are rumoured to be for sale), for example, would rely on telecoms operators for little more than the underlying connectivity.

Further moves by Facebook or Microsoft could also reduce the potential market for advanced enterprise communications solutions, as could continued growth from Slack. These may not replicate the features of BroadSoft (and may not need to), but they could reduce the space for telecoms operators and their vendors to provide solutions.

The products and market positions of BroadSoft and Cisco make them a good fit, both for each other and for their operator customers. These operators should be considering how they can work with the combined entity to defend against greater threats to their enterprise communications business.

Downloads

Article (PDF)Authors