Google’s Xively acquisition may be more about the smart home market, than competing with IoT platforms

Google announced its intention to acquire the IoT platform Xively from LogMeIn for USD50 million on 15 February 2018. The move aligns Google with other cloud providers, particularly Amazon Web Services (AWS), that have expanded their IoT propositions through acquisition. However, the timing and nature of the deal suggest that it may be driven by Google's ambitions in consumer electronics and the smart home, rather than by the need to add generic features to Google Cloud.

The purchase of Xively is similar to moves by AWS and Microsoft, but is much later

Xively was founded in 2003 and offers a platform for IoT device connectivity. The acquisition highlights Google's attempts to increase its involvement in the IoT value chain. Google released its Cloud IoT Core to offer IoT hosting services based on its cloud infrastructure in September 2017. With the addition of Xively platform, Google builds on its solution with a device connectivity element, offering a turnkey solution to integrating devices into the cloud.

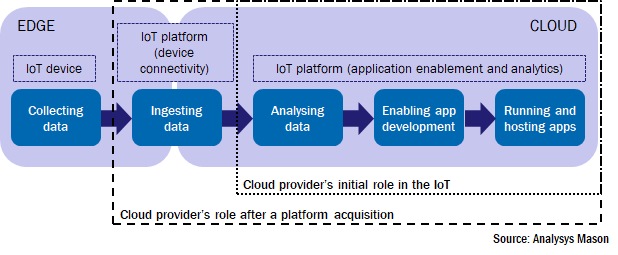

Google's move is similar to, but later than, those of its direct rivals; AWS bought 2lemetry in 2015 and Microsoft Azure acquired Solair in 2016. AWS and Azure initially used their cloud infrastructure to support data hosting requirements for IoT and then used the acquired platform to move along the value chain to simplify solution development for customers (see Figure 1).

Figure 1: Data flow in an IoT system and the role of a cloud provider

Google would have a lot of work to do to compete directly with AWS and Azure. Since AWS acquired 2lemetry and Azure acquired Solair, the companies (particularly AWS) have built out their IoT tools. For example, the IoT tools that AWS has, or is planning, include: IoT Core, Greengrass, IoT Device Management, IoT Device Defender, IoT analytics, FreeRTOS, IoT 1-click and others. AWS is trying to provide a full set of options for IoT developers in many vertical markets and, in doing so, is giving less space for niche providers to compete.

Xively and other developments suggest that Google is aiming to strengthen its role in the smart home business

Despite the similarities with AWS and Azure's purchase of an IoT platform, Google may be trying something different with its acquisition of Xively. If the IoT platform capabilities were so important it could have bought a platform earlier, or even created one internally. Furthermore, to compete with AWS or other platform providers like PTC ThingWorx, it will need to be followed up with other acquisitions or internal developments.

Xively may be part of Google's strategy to build up capabilities for consumer electronics and smart home devices, rather than a horizontal platform for all verticals.

A week before the Xively announcement, Google’s parent company Alphabet said that it was folding Nest into Google to better co-ordinate these smart home products with other efforts, such as Pixel, Google Home and Chromecast. With the addition of a platform, Google, not only consolidates its hardware and software consumer products, it also establishes an ecosystem that connects different stakeholders operating in this market. Google’s recent IoT hire and Xively’s activities suggests that the Xively acquisition might support Google’s revised approach to the smart home and connected consumer market.

Google has hired Injong Rhee, who was Samsung Electronics' CTO and head of research for software and services, to lead its IoT business. While at Samsung, Rhee was involved in developing Samsung Pay, the KNOX device security platform and the Bixby virtual assistant. In a LinkedIn post announcing his arrival at Google, Rhee emphasised his mission to consolidate the company's IoT efforts under distinct consumer and enterprise product lines, but did not provide details of Google's IoT strategy. Interestingly, Samsung IoT's vision in 2017 was to consolidate its IoT solutions under a single IoT platform that connects to all its consumer electronics and home appliances.

Xively, like many other IoT platforms is positioned as a horizontal platform. However, most of Xively's use cases are for smart home and consumer-related applications such as connected water heaters, pet trackers, thermostats and lighting solutions. Xively's consumer and device background combined with Google's hardware and applications may be part of an effort to build a more comprehensive smart home platform.

The Xively sale may represent an overhaul of the IoT platforms market

The sale of Xively has implications beyond Google. LogMeIn bought Xively for USD12 million in 2014. The sale price to Google represents a healthy return, but it also marks LogMeIn's exit from the IoT platform business. Xively had failed to gain significant traction – it reported annual revenue of just USD3 million in 2017. In a crowded market, we expect other IoT platforms to either consolidate or be quietly closed as the market is left to just a handful of players. This also has implications for telecoms operators – the performance of Xively shows how hard it is to develop a horizontal IoT platform but the reduction in the number of platforms should leave a smaller number of viable suppliers as potential partners, which will probably have a positive impact on the development of the IoT market.