Safaricom’s Masoko is a bold venture into ecommerce in Sub-Saharan Africa, but it will face challenges

Safaricom launched ecommerce marketplace Masoko in Kenya on 21 November 2017.1 Masoko follows the marketplace model used by Amazon and Alibaba. Safaricom screens merchants and provides ecommerce enablement services such as payment processing or customer support channels, but does not own the inventory on offer. Safaricom is well-placed to benefit from the growth in demand for ecommerce thanks to its dominant position in Kenya's mobile payments market. However, Masoko will require significant long-term investment to maintain a strong position, especially if Safaricom expands Masoko outside of its Kenyan home market.

Ecommerce is growing rapidly in Sub-Saharan Africa (SSA), and Safaricom has key advantages thanks to M-Pesa

Despite early challenges,2 Safaricom is well-positioned to capitalise on ecommerce in Kenya thanks to its mobile money leadership. Safaricom's 71% mobile market share of subscribers and 19.3 million M-Pesa active users will help Masoko attract merchants to the platform. M-Pesa may also allow Masoko to provide merchants with competitive pricing for use of the platform, an advantage that Masoko will need because it will face strong competition from Rocket Internet's ecommerce incumbent Jumia.3

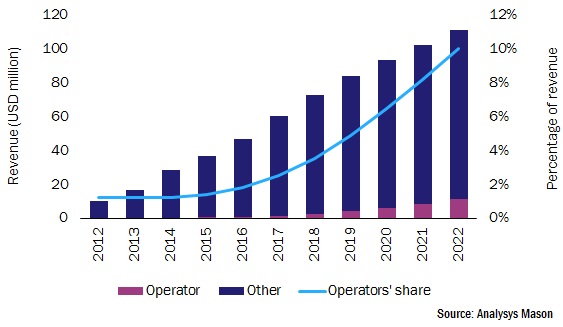

Safaricom is exploring Masoko's entry into other African countries over the next 2 to 3 years. This is a sensible move given the rapid growth of ecommerce in SSA, particularly on mobile. According to our most recent forecast, ecommerce transaction values in SSA will grow at a CAGR of 9% to 2022, to reach USD11.6 billion in 2022. We expect operators to win up to 10% of this revenue from SSA m-commerce transactions by 2022 (see Figure 1).

Figure 1: M-commerce transaction revenue, and operators' share, Sub-Saharan Africa, 2012–2022

Marketplaces are useful exploratory vehicles, but do not address the logistical and institutional challenges of ecommerce

Operators' ecommerce activities have focused on nascent ecommerce markets.5

- Softbank was an early investor in Alibaba, and is the majority stakeholder in Indian ecommerce site Snapdeal. Softbank reportedly also invested USD2.5 billion in Snapdeal's competitor Flipkart in August 2017 after talks of a potential merger between Flipkart and Snapdeal.6

- Nigeria-based Jumia (formerly known as Africa Internet Group) is Africa's largest ecommerce company, with operations in 23 countries. MTN, Millicom, and Orange have invested in Jumia, along with Rocket Internet, Axa, and Goldman Sachs. The company raised EUR225 million (approximately USD256 million) in funding in March 2016.

- Telkom Indonesia's strategic investment vehicle, TelkomMetra, launched ecommerce site Blanja.com in a joint venture with eBay in 2013. In April 2017, TelkomMetra and eBay announced a IDR310 million (USD25 million) investment in Blanja to fund growth.

- Indosat's m-commerce marketplace initiative Cipika was launched in 2014. Limited adoption led Indosat to shut down the initiative in June 2017. Games marketplace Cipika Play, however, remains active.

Softbank's sizeable ecommerce investments – over USD4 billion to date7 – illustrate the kind of commitment that is required to compete against players like Amazon or Alibaba.

In contrast, in marketplaces like Cipika or Masoko the operator provides the platform but does not take risk over inventory and logistics (which are expensive and hard to get right). Marketplaces allow operators to take a capex-light approach to entering ecommerce. They make sense as exploratory vehicles, but Indosat's experience illustrates two key issues for operator marketplaces in emerging markets.

- Physical goods fulfilment faces significant logistical challenges which can only be alleviated through large investments that exceed most operators' appetite.

- Digital content is more-closely aligned with operators' activities and distribution channels. Localised and well-segmented digital content carries fewer risks for operators and can provide modest monetisation in a shorter timeframe.8

For Safaricom, Masoko's market entry may help drive awareness of ecommerce in East Africa. Safaricom may even achieve some scale as an early market entrant (as MercadoLibre did in Latin America).

In (e)commerce, however, scale is everything. Growth markets where infrastructure is a limiting factor consequently lack the critical mass of small and medium-sized online merchants that populate successful marketplaces like Amazon and Alibaba. Moreover, one of the most important roles of ecommerce platforms is to reduce merchants' costs associated with fraud, counterfeit goods and dispute resolution. It remains to be seen whether Masoko can deliver those benefits to merchants at a greater scale or lower cost than competitors Jumia and KiliMall.

Safaricom will need to defend itself against global players

India's ecommerce evolution could serve as a cautionary example – when early entrants had tested out what worked, Amazon invested heavily to take a leading position. Alibaba could also do something similar in SSA because it has direct access to the Chinese centres where a large proportion of goods sold in marketplaces are manufactured.

To maintain Masoko's leadership in the long term and fend off competition from global players, Safaricom may have to take a more significant role in ecommerce enablement services. For example, it may need to further invest in logistics, broaden its customer support capabilities or invest in identity management and fraud prevention tools.

1 In August 2017, the launch was reported to be planned for early 2018.

2 On 30 November 2017, the Communications Authority of Kenya questioned Safaricom's ability to offer ecommerce delivery services. Masoko partnered with Wells Fargo Courier and Sendy to deliver goods sold on the platform. Safaricom is an investor in Sendy.

3 30-day active M-Pesa users during the first half of Safaricom's 2018 financial year. See Safaricom's report available at www.safaricom.co.ke/images/Downloads/Resources_Downloads/HY2018/Safaricom_HY18_Presentation.pdf.

4 See Analysys Mason's Digital service opportunities for operators: worldwide trends and forecasts 2017–2022.

5 See Analysys Mason's Ecommerce enablement solutions: revenue opportunities for operators.

6 The merger would have given Flipkart a stronger position in its race to compete against Amazon for dominance of the Indian ecommerce market. For a discussion of the Indian ecommerce market, see Analysys Mason's Amazon and Flipkart lead the race to dominate India's ecommerce market.

7 This figure includes Softbank's USD20 million investment in Alibaba in 2000, USD627 million investment in Snapdeal, and a USD1 billion investment in US-based sports ecommerce company Fanatics in August 2017.

8 Operators’ with large physical retail store networks can arguably use them to strengthen their ecommerce proposition. Safaricom will use its stores as pick-up points for goods bought on Masoko.