Sky’s partnerships with Netflix and Spotify signal its adoption of a more-aggressive OTT strategy

In early 2018, European pay-TV provider Sky announced separate deals with OTT players Netflix and Spotify to integrate their services and content into its Sky Q set-top box (STB). This development denotes a shift in approach for Sky, which has historically kept tight control over the service delivered over its high-end STBs and has not allowed third-party service integration. Sky's move is a response to a wider shift in customer expectations of the value delivered by pay-TV services, and this readjustment aligns well with other pay-TV providers' priorities for enhancing customer satisfaction.

Sky's integration of Netflix's and Spotify's services into the Sky Q platform will improve customer satisfaction and retention

Sky is a prominent player in the pay-TV market in Europe: the company has established direct-to-home (DTH) operations in five European countries and its OTT video service, NOW TV, is also available in some parts of Europe. Sky Q is the brand of the company's highest tier of service and its take-up counterbalances the ARPU dilution caused by its low-priced NOW TV service. Customers of Sky Q gain access to 4K content, a higher-specification STB/UI, and an enhanced multi-screen service compared to 'regular' Sky TV. Sky Q will be made available as an OTT service later in 2018, without a dependency on DTH.

Sky's planned integration of Netflix's and Spotify's services and content into Sky Q, as well as its announcement about increased 4K programming, must be seen within the context of their slowing retail customer growth. It gained 0.6 million subscribers in 2017, down from 0.9 million in 2016, and this growth is primarily related to its OTT brand, NOW TV, which is helping to offset DTH customer losses.

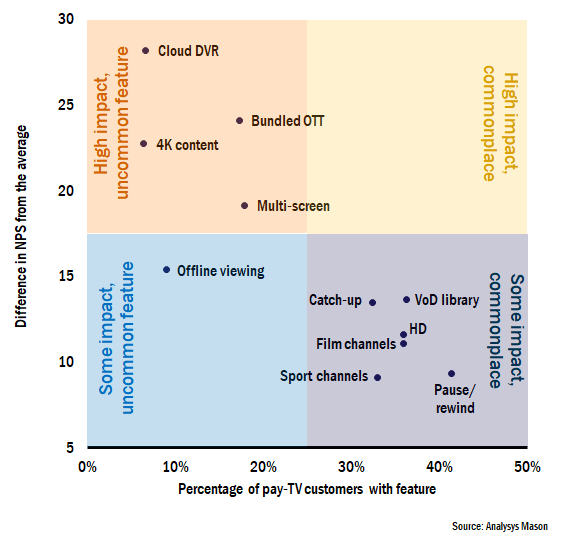

Sky's plans will increase the value proposition of its core pay-TV service. This will improve retention of its existing subscriber base and help it to upsell Sky Q to lower-end pay-TV customers. Results from Analysys Mason's Connected Consumer Survey 2017: TV and video in Europe and the USA identified a strong correlation between higher Net Promoter Score (NPS) for pay-TV services and the use of 4K content and integrated OTT services as part of a pay-TV proposition (see Figure 1).

Figure 1: Difference in NPS in relation to the average scores given for different features of – and additions to – a pay-TV service, by penetration1

Some – particularly uncommon – features of a pay-TV service correlate with higher customer satisfaction scores, and Sky's planned service adjustments focus on the top-left corner of Figure 1. However, it is not always possible to draw direct links between NPS and the availability of certain features; for example, customers appear to be happier with pay-TV services in the UK, where a number of features also happen to be more commonplace, but the former may not be the result of the latter. However, the higher NPSs given by customers that have specific features do support the hypothesis that particular value-added services (VASs) appear to have a positive effect on customer satisfaction.

Sky's move to integrate Netflix and Spotify services (which align with the features shown in the top-left quadrant in Figure 1) indicates that Sky is aiming to adopt a high-impact strategy.

- 4K is on the cusp of mass-market take-up. Few respondents to our survey (less than 10%) claimed to view 4K content in 2017, but their NPS was 23 points above the average. Through its partnership with Netflix, Sky will have access to a large amount of new 4K content, which will help Sky to realise its plan to double the amount of 4K content available on its Sky Q platform in 2018.

- Pay-TV customers with bundled OTT services were, on average, 24 points more satisfied than customers without these services. Sky's integration of Netflix and Spotify content will not include these services for free, but many Sky customers already use both services.

Netflix and Spotify are seeking service-provider partnerships to widen their audience and build secondary revenue streams

Netflix's partnership with Sky is a further boost to the company's B2B2C revenue. It also broadens Netflix's addressable audience to include older consumers that subscribe to pay-TV services but cannot directly access Netflix on their TV set and may not wish to engage on non-TV devices.

The timing of the announcement was also convenient for Spotify – the company launched its initial public offering (IPO) in early April 2018 and is seeking revenue growth. The company has aggressive targets for 2018 – aiming to add 20 million subscribers, and to improve profitability, though they still anticipate an annual loss of between USD286 million and USD411 million.2

The OTT market generally – and the OTT video market specifically – is crowded, with few profitable companies. This overcrowding will lead to a rationalisation of the number of OTT players in the market in the medium term. Netflix and Spotify's deal with Sky is part of their bid to survive.

The most-likely-to-survive OTT players will fit into one (or more) of the following three categories.

- OTT players that do not have video as their prime business. This group includes device manufacturers, telecoms operators, retailers, Alibaba, Amazon, and Google). These players can offer video at a loss as part of a wider strategy to support their core revenue-making business and can therefore survive on the basis of the 'indirect value' of offering video.

- OTT players that have significant international scale. Netflix is an early candidate for this group: a key factor in the company's future profitability may be in being able to control their marketing costs, and partnerships such as that with Sky may reduce subscriber acquisition costs (SAC). Other potential players in this category may include major pay-TV providers that evolve into network-agnostic OTT players.3

- OTT players that generate significant revenue from B2B2C arrangements. Asian OTT players such as hooq and iflix derive most of their income from such deals, and Netflix's recent moves also demonstrate a willingness to develop this opportunity.

OTT players must gain scale and control costs to survive. Predictable relationships with service providers, such as this deal with Sky, represent one way to achieve this end, but even then, there will be many businesses that do not succeed.

Analysys Mason conducts its Connected Consumer Survey annually. The latest video report in this series is available here.

1 Questions: “Which of the following services does your pay-TV provider include as part of their service to you?”; “Which of the following features do you buy as part of your pay-TV service?”; n = 3684.

2 New York Post (26 March 2018), Spotify sees revenue growth ahead of April IPO. Available at: https://nypost.com/2018/03/26/spotify-sees-revenue-growth-ahead-of-april-ipo/.

3 For more information, see Analysys Mason’s The dish-free Sky Q service marks the beginning of the end for triple-play.

Downloads

Article (PDF)Authors

Martin Scott

Research DirectorLatest Publications

Pay TV and streaming video in Austria: trends and forecasts 2023–2028

Forecast report

Pay TV and streaming video in Sweden: trends and forecasts 2023–2028

Forecast report

AI series: who will be the GenAI winners and losers in the TMT industry?