Zero-rating popular services can help operators in MENA to address customers’ demand for better value

Mobile operators in the Middle East and North Africa (MENA) received low scores for customer satisfaction in our latest Connected Consumer Survey. Most major operators in the region received a lower Net Promoter Score (NPS) than operators elsewhere.1

Operators in MENA have been offering service and content bundles to encourage data consumption, increase customer satisfaction and improve the perceived value-for-money of mobile tariffs. However, service bundling alone does not necessarily lead to an improved NPS. Operators should therefore review their approaches to bundling third-party content. In this comment, we suggest that operators should experiment with new content and pricing models to address consumers’ demand for greater value-for-money.

Price satisfaction is the major determinant of customers’ willingness to recommend an operator in MENA

We conducted an on-device survey of 4500 smartphone users in Morocco, Oman, Qatar, Saudi Arabia and the UAE between August and October 2018 as part of our Connected Consumer Survey. The results show that most of the operators in the region have an NPS that is below zero; Ooredoo in Qatar and operators in Saudi Arabia are the exceptions. The scores were generally low compared to those in other regions such as Sub-Saharan Africa, the USA and Western Europe.

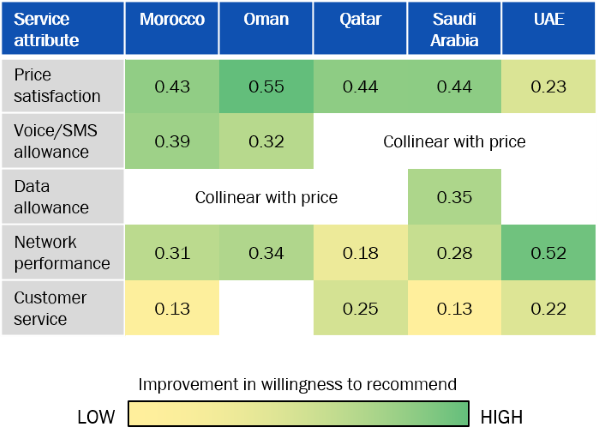

NPS is a relatively simple measure of customer satisfaction but it can be very revealing when used with other metrics. We used regression analysis to isolate the effect of a one-point improvement in an individual’s satisfaction rating for different aspects of mobile services (price, network performance, service allowance and customer service) on the overall willingness to promote, as measured by NPS (Figure 1).

The results show that price satisfaction has the biggest effect on NPS. A one-point improvement in this metric (for example from ‘neutral’ to ‘satisfied’) correlates with an average increase in willingness to recommend of 0.4. Operators that are able to increase price satisfaction could potentially see a relatively large increase in NPS (by 10 points or more) if the benefits were fully realised.

Figure 1: Impact of customer satisfaction with specific aspects of mobile services on consumers’ willingness to recommend an operator2

Source: Analysys Mason, 2019

The inclusion of zero-rated social media has a strong effect on NPS, but the impact of music and video bundles is less clear

Operators have taken different approaches to mobile pricing in order to improve data monetisation while offering customers a differentiated experience. These approaches include time-based pricing (for example, Etisalat’s ‘Start/Stop’ on-demand data service), sub-branding (for example, EITC’s ‘Hello!’ prepaid cards to target blue-collar workers) and low-speed unlimited mobile data.

Operators have also been offering bundles, often with content from third-party providers. However, our survey results show that the hard-bundling of content is often associated with a higher intention to churn. This could be because customers perceive little added value and differentiation from such bundles, especially if most operators offer the same package. Alternatively, customers might be tempted to change operators if the offer is discontinued or might churn to another operator in search of different content.

On the other hand, the survey data shows that respondents on zero-rated or service-based tariffs (for example, 2GB of data that is dedicated for use with WhatsApp), had a higher NPS and a lower intention to churn than the average. Using linear regression to isolate the effect of zero-rating and service-based pricing on customers’ willingness to recommend, we found that social media- and chat-based tariffs strongly correlate with an improved NPS. The sample size for customers with zero-rated media tariffs (music and video) was too small to draw a firm conclusion, but we have found strong link with improved KPIs in other regions, particularly for video tariffs.

It is currently more common for operators in MENA to offer a dedicated allowance for social media services than for music or video streaming. Operators tend to offer video bundles on a co-branded basis, or provide a free subscription to customers that are on specific tariffs. In both cases, video usage eats into the standard data allowance.

Operators should start experimenting with new content and service-based pricing in preparation for the launch of 5G

The first 5G services are expected to be commercialised in in the Gulf Co-operation Council (GCC) in 2019. Fixed–wireless access will probably be the first use case, but media and entertainment services are likely to be affected the most by 5G-enhanced mobile network performance. As such, local operators should experiment with new pricing methods and types of content. They can consider the following two approaches.

- Offer higher-quality and enhanced video content. Streaming on-demand videos in very high-definition on mobile devices allows a more immersive experience. Service-based pricing can be used to capture this value with premium video packs, for example. Operators could potentially restrict eligibility in order to support upsell efforts. For example, T-Mobile in Germany has been successful in using its StreamOn video service over 4G to drive the upsell of postpaid plans.

- Bundle new types of content such as games. Operators can consider mobile gaming to be a showcase for 5G to serve the younger customer demographics. For example, Sprint has partnered with Hatch Entertainment to offer mobile gaming services on its 5G network, and Verizon is testing a game streaming service for both home and mobile users over 5G.

Operators are increasingly under pressure to find new ways to monetise mobile data traffic and increase customer satisfaction while customers want to maximise the value of their subscriptions. Operators should therefore continue to offer customers unconstrained access to social media and chat apps, but also experiment with new types of content and pricing models. These initiatives will help with the introduction of mobile 5G services.

Further analysis of these and related issues can be found in our Connected Consumer Survey 2018: mobile customer satisfaction in the Middle East and North Africa.

1 NPS is a proprietary standard metric used to calculate customer loyalty and satisfaction. Respondents are asked to rate whether they would recommend a product, service or company to a friend on a scale from 0–10.

2 White spaces represent instances where the impact of a factor is not statistically significant and collinearity with another factor means that the two factors had the same statistical effect.