The launch of Disney+ is not a disruption on its own, but it is part of a wider change with big consequences

The Walt Disney Company (Disney) will launch the OTT service Disney+ in the USA in November 2019, to complement its other services Hulu and ESPN+. The company also plans to launch the service in Asia–Pacific and Western Europe from 4Q 2019 onwards, and then in Central and Eastern Europe and Latin America in 2020, as content rights that are currently licensed to third parties are due to expire. This comment explores the market impact of this launch and the potential strategic responses for pay-TV providers and operators.

Disney+ will be broadly additive to other OTT services when launched; it will not be a ‘Netflix killer’

New OTT services are often sensationalised as ‘Netflix killers’ and Disney+ is the latest service to be described as such. Disney’s acquisition of 21st Century Fox in March 2019 strengthened its content assets and increased its stake in the US OTT service Hulu. Disney then announced, in May 2019, that it would take full control of Hulu in 2019 with the option of buying Comcast’s stake in the company by 2024. Disney is therefore well-positioned to offer a strong initial content proposition over a tried and tested platform. The launch of Disney+ is also expected to be to the detriment of rivals’ content portfolios (especially Netflix’s), because Disney previously licensed high-value content to other players which it is now bringing back ‘in house’.

Hulu has the third-largest subscriber base of all premium OTT video services in the USA after Amazon and Netflix. It has 28.1 million users as of March 2019. Disney’s stated strategy is to preserve Hulu for adult audiences with a proposition focused on drama, while Disney+ will be family-friendly and will offer children’s content. ESPN+ will continue to focus on sports. It is very likely that Disney will bundle its OTT services together at a discounted rate.

The overall market impact of Disney’s OTT strategy will be positive from a total consumer spend point of view; we anticipate that the ASPU of OTT video users in North America will increase from USD25.3 per month in 2018 to USD38.6 by 2023. This will primarily be achieved by service stacking, that is, the practice of buying multiple OTT video services. In November 2018, we forecast that OTT video ASPU in Western Europe would grow from USD14.2 (EUR12.6) in 2018 to USD16.7 (EUR14.8) by 2023, but we are likely to revise this upwards in light of recent service launches and announcements.

Disney+ adds competitive pressure to pay-TV providers and other OTT players as part of a wider market shift

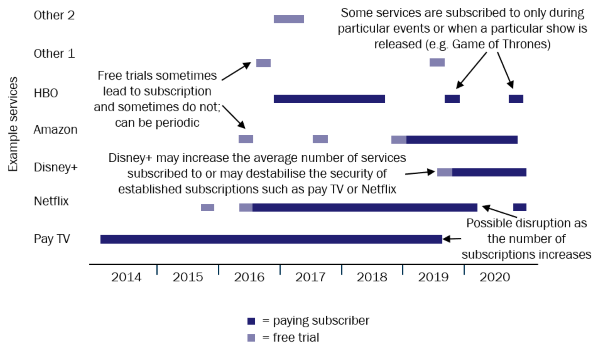

The average consumer in Europe and the USA used 2.6 OTT video services in 2018, according to our Connected Consumer Survey. We anticipate that service stacking will increase in the short term but will decrease long-term as unified solutions come to market. Disney+ will be affordable and will offer an appealing, but still limited, content portfolio. It is therefore unlikely to be a direct driver of cord cutting on its own. However, the combined effect of Disney+’s launch alongside moves by Apple and others may be significant. It is possible that the arrival of both Disney+ and Apple’s TV platform in 2019 will be the critical shift that leads consumers to consolidate services. This is likely to increase churn for less-established OTT players with niche propositions, but could also disrupt established long-term subscriptions to pay-TV services or to Netflix.

Figure 1: Example of a US consumer’s TV and video subscriptions over time

Source: Analysys Mason, 2019

From a content proposition point of view, we expect that Amazon Video (especially in areas without Prime, Amazon’s all-inclusive delivery service for goods bought from its online store) will be affected more-significantly than Netflix by the arrival of Disney+. This is partly due to Netflix’s greater wealth of original content and Amazon’s greater dependency on library content, but also due to the demographics of the services’ audiences; our Connected Consumer Survey established that Amazon Video customers were marginally more likely to identify children’s content and movies (the core of Disney+) as their most-important content genres.

Pay-TV providers and operators must increase OTT integration while cultivating their own ‘niche content leadership’

The strategies of pay-TV providers, telecoms operators and OTT players appear to be converging around two categories of approach, as explored in previous Analysys Mason research. ‘Niche content leaders’ use targeted content investment to excel in a particular genre, such as sports, drama or children’s content. ‘Super aggregators’ focus on providing a platform-centric offering through which multiple OTT services can be subscribed to, or at least accessed, ideally with unified search and discovery. Disney is pursuing the former while Amazon, for example, is pursuing the latter. Players can also pursue both strategies at once (as Apple does).

Pay-TV providers must consider both the wider market trend of players moving towards content niches and platform business models, but can also respond directly to the launch of Disney+. A large number of pay-TV providers around the world have historically included Disney channels in their portfolio. Family content is also important to pay-TV providers and fits with operators’ multi-play bundling strategies that target the ‘whole home’. Accordingly, we expect that operators and pay-TV providers will pursue partnerships with Disney. Similarly, it is highly likely that Disney will be open to operator partnerships and service integration in order to achieve its ambitious growth targets (its CFO forecast 60 million to 90 million subscribers worldwide by 2024 in a recent earnings call1).

Pursuing other content categories may become more prudent for operators if Disney+ corners the family market. A diversified portfolio of content that is established through partnerships could easily incorporate Disney+’s offerings, and for this reason we encourage pay-TV providers to accelerate their plans to move to a service platform that will allow them to unify and integrate multiple OTT services into their wider pay-TV experience. The role of a provider’s own content may lessen over time. Therefore, operators may wish to provide a unified experience through which customers can continue to view content from many different sources, while their own exclusive content serves as the ‘hook’ to keep consumers engaged in their platform rather than that of rivals.

1 Variety (2019), Disney+ to Launch in November, Priced at $6.99 Monthly. Available at https://variety.com/2019/digital/news/disney-plus-streaming-launch-date-pricing-1203187007/.

Downloads

Article (PDF)Authors

Martin Scott

Research DirectorLatest Publications

Pay TV and streaming video in Belgium: trends and forecasts

Forecast report

Pay TV and streaming video in Austria: trends and forecasts 2023–2028

Forecast report

Pay TV and streaming video in Sweden: trends and forecasts 2023–2028