NFV-enabled IoT networks: operators may need to reconsider their approach

31 July 2018 | Research

Article | PDF (3 pages) | IoT Services| Cloud Infrastructure Strategies

New market entrants are making use of their network functions virtualisation (NFV)-based IoT solutions to provide an agile, cost-effective approach to scaling IoT businesses. Established operators may need to reconsider their approach to NFV to ensure that their IoT networks remain competitive. This article explores the threats and opportunities that some of these new players pose to established operators, and is based on research from our new report, NFV-enabled IoT networks: opportunities and threats for operators.

Established operators face challenges in defending and growing their share of the IoT connectivity market. Network virtualisation of the core network will be instrumental in overcoming some of these barriers, but operators also have an opportunity to explore new types of partnerships.

The number of IoT connections will grow significantly; competition for the IoT connectivity market is increasing

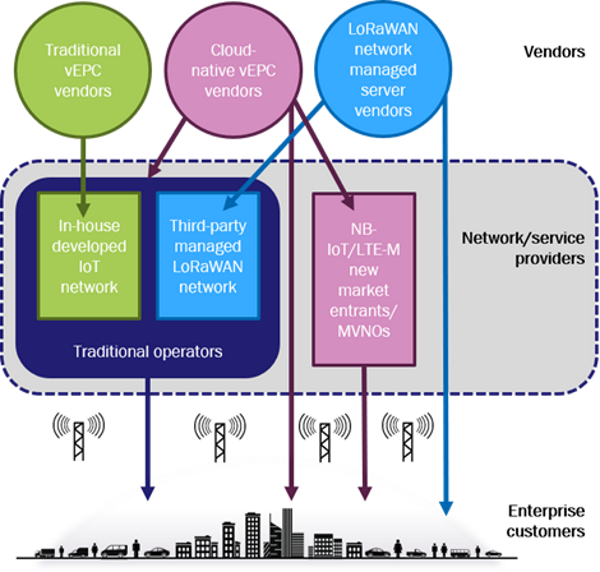

The IoT market has been slow to take off but this is expected to change as LPWA networks become established and commercial activity increases. Traditional cellular networks and nascent LPWA networks (especially NB-IoT and LTE-M) are expected to support large volumes of IoT connections in the future. Analysys Mason estimates that there will be 5.1 billion IoT connections by 2026, generating connectivity revenue of around USD30 billion. Competition for the IoT connectivity market is increasing as new LPWA players and both established and new IoT MVNOs enter the market (see Figure 1).

Figure 1: Operators compete with new entrants and MVNOs for the IoT connectivity market

Source: Analysys Mason, 2018

The growth in IoT traffic needs to be supported by virtualisation and automation

Many operators have a virtualisation strategy for their mobile core, but there is little clarity on the degree to which the IoT core network will benefit from virtualisation, if at all. For many operators, IoT generates minimal revenue at present, hence the currently planned investment in virtualisation is low. An NFV-based network brings benefits such as automation and scaling on-demand, which will be critical as the number of IoT connections increases. However, NFV requires operators to carry out a far-reaching transformation of their networks and requires new skillsets that operators do not always have. The emergence of LPWA has resulted in some operators starting to deploy virtualised components to support it (for example, Deutsche Telekom’s virtualised C-SGN for NB-IoT), but most operators have not articulated their plans for IoT network virtualisation.

LoRa network operators are leapfrogging established players with fully virtualised network infrastructure

LoRaWAN network owners have an initial advantage with regards to network virtualisation. The LoRaWAN network lends itself to the decomposition of the network server into fine-grained functions (microservices) that can run in virtual machines (VMs) or in containers in public clouds such as AWS. Both LTE-M and NB-IoT networks need an evolved packet core (EPC), the virtualisation of which is more complex. Companies such as Actility, Kerlink and Senet have developed virtualised solutions from the outset and are supplying the growing number of LoRaWAN network owners.

New-entrant NB-IoT/LTE-M players are using NFV-driven innovation to deliver their own IoT networks or provide network-as-a-service models to other operators

We expect that the number of NFV-enabled, new-entrant IoT network providers will explode in the next 3 years as systems integrators, cloud providers and network equipment vendors target the IoT opportunity. New market entrants have built virtualised IoT core networks based on LoRaWAN technology or the EPC. Some new market entrants are starting up with innovative NFV-enabled approaches in direct competition with operators. Many new entrants such as monogoto see operators as important channel partners for developing IoT networks based on innovative NFV technology that costs less than the technology that is available from traditional vendors. Others, such as JpU, are encouraging operators to create off-brand channels using such NFV technology.

Operators should consider working with new-entrant players to further their virtualised network capabilities

Operators should consider working with new-entrant players to further their virtualised network capabilities. In doing so, operators could benefit from both a low risk investment approach to delivering IoT until there is more certainty regarding the IoT opportunity and a cost-effective virtual IoT core network on a network-as-a-service model that could be less expensive to deploy and operate than their own. Operators should consider working with new entrants or more established players with virtualised solutions (such as Nokia WING) to further develop their IoT connectivity offering.

Downloads

Article (PDF)Authors