COVID-19: telecoms operators will not be immune to the impact of the outbreak – recovery could take up to 4 years

13 May 2020 | Research

Article | PDF (4 pages) | IoT Services| Fixed Broadband Services| Mobile Services| Operator Investment Strategies| Global Telecoms Data and Financial KPIs| European Core Forecasts| SME Services| Video, Gaming and Entertainment| Enterprise Services

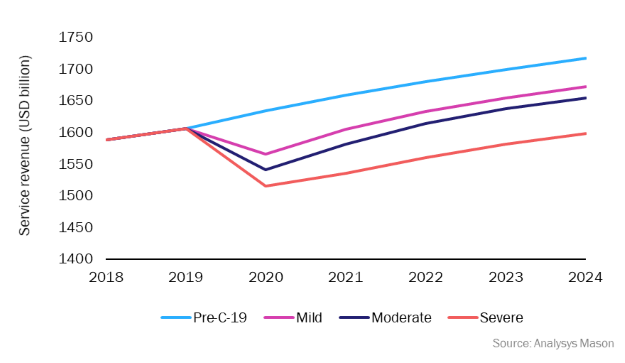

The ongoing uncertainty around the impact of COVID-19 makes a single forecast of limited value. Instead, Analysys Mason has created three different scenarios (defined in terms of real GDP)1 to reflect the likely range of economic impacts that the pandemic may have on operators' telecoms service revenue worldwide: mild, medium and severe. In our mild forecast, telecoms service revenue will fall by 2.5% worldwide in 2020 and return to 2019 levels in 2021. In the severe forecast, service revenue will fall by 5.7% worldwide in 2020 and not return to 2019 levels until 2024. In all scenarios, fixed business service revenue will see the greatest declines in USD dollar terms, but mobile business service revenue will decline faster in percentage terms. We expect operator's service revenue in North America, followed by Western Europe, to be the hardest hit, both in USD dollar and percentage terms. This article summarises the findings of our latest COVID-19 scenario forecast COVID-19 scenarios for telecoms operator service revenue: worldwide forecasts 2019–2024.

Telecoms operator service revenue worldwide will contract by between –2.5% and –5.7% in 2020 and these losses will not be fully recouped in future years

Figure 1: Telecoms service revenue, by COVID-19 scenario, worldwide, 2018–20242

Our analysis shows that telecoms operators are not immune to the impact of the COVID-19 pandemic, although the severity of their exposure will depend on a range of regional factors. We expect worldwide operator service revenue to decline between 2019 and 2020 by between USD40 billion and USD92 billion, whereas our previous (pre-COVID-19 (pre-C-19)) forecast predicted growth of USD27 billion (+1.8%) for the same period.

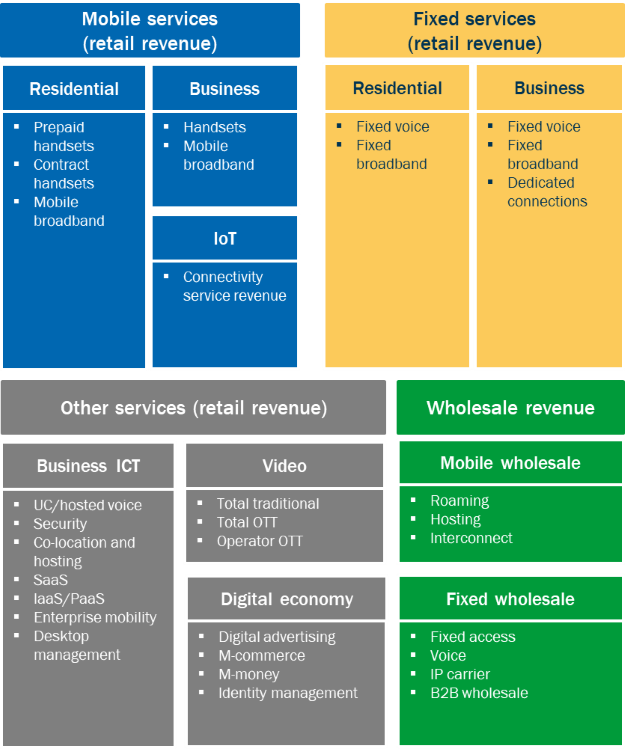

We drilled into our revenue taxonomy to quantify the impact of COVID-19 on each of ten service elements for three GDP scenarios

We used third-party economic forecasts to define our three COVID-19 scenarios. Regional scenario variations reflect the different timings of the COVID-19 outbreak and the depth of the impact (including the likely duration of any lockdown, age distribution of population and dependency on exports) and the differences in initial economic performance.

We broke telecoms operator revenue into ten key service elements and identified the unique responses to the crisis for each component (see Figure 2).

Figure 2: The elements of telecoms operator service revenue modelled in our COVID-19 forecast

Source: Analysys Mason, 2020

Fixed business services will be hardest hit, whilst mobile services are most vulnerable to deeper economic instability

In descending order of their impact on 2020 revenue losses, each service element will be affected as illustrated in Figure 3.

Figure 3: Range of changes in telecoms operator revenue by service element, (mild to severe COVID-19 scenario), worldwide, 2019–2020

| Service element | Retail revenue change (USD billion): pre-COVDID-19 | Revenue change (USD billion): mild to severe COVID-19 scenario | Key driver | |||

|---|---|---|---|---|---|---|

|

Business fixed services |

|

–2.3 |

|

–13.1 to –19.8 |

|

Expected business closures |

|

Mobile wholesale |

|

–1.5 |

|

–11.3 to –14.8 |

|

Loss of roaming revenue |

|

Residential mobile services |

|

+13.9 |

|

–8.9 to –31.1 |

|

Discretionary spending curbed |

|

Business mobile services |

|

+1.4 |

|

–8.9 to –14.8 |

|

Reduced business travel |

|

Video |

|

+1.9 |

|

–3.3 to –8.7 |

|

Loss of sports programming |

|

Fixed wholesale revenue |

|

–0.9 |

|

–1.6 to –2.3 |

|

Following retail trends |

|

Mobile IoT |

|

+0.8 |

|

+0.7 to +0.6 |

|

Projects deferred |

|

Digital economy services |

|

+3.8 |

|

+0.8 to +1.1 |

|

Digital advertising losses |

|

Residential fixed services |

|

+5.8 |

|

+1.3 to –2.7 |

|

Spending constraints |

|

Business ICT services |

|

+3.8 |

|

+4.3 to +3.1 |

|

Unified communications (UC) and security increases |

|

Total telecoms operator service revenue |

|

+26.7 |

|

–40.2 to –91.6 |

|

|

Source: Analysys Mason, 2020

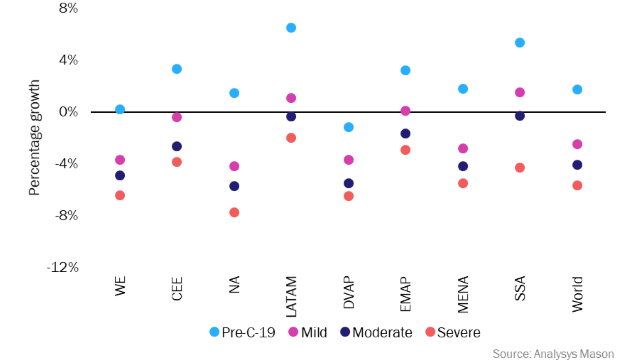

The impact of the COVID-19 outbreak on operators' revenue will differ between regions, with developed markets likely to fare worse

Geographical variations are largely determined by the timing of the virus outbreak, the economic ramifications of each country's response to the pandemic and the service mix of the regional revenue streams.

Figure 4: Annual growth in telecoms service revenue, by COVID-19 scenario, worldwide, 2020

- North America has the strongest potential decline of any region in 2020 (at –8.5%) as the severe scenario economic downturn translates into sharp losses in residential mobile and business telecoms services revenue.

- The relatively high, nominal growth rates for Latin America are due to high inflation. We expect significant losses here due to recession, especially in mobile prepaid due to the reduction in migrant workers employed in the region and curtailing of tourism.

- In Europe, voice and broadband services account for more than 50% of business fixed services revenue, resulting in a greater overall impact than in regions such as Asia–Pacific, where corporate business data services dominate. Extensive lockdowns in Western Europe and expectations of high unemployment mean that the impact on mobile services revenue may be particularly strong here.

- Both developed Asia–Pacific and emerging Asia–Pacific have a similar potential for operator revenue losses (relative to their previous growth expectations), but in the most-severe COVID-19 scenario, these revenue losses will be higher in emerging Asia–Pacific because the risk of extended economic disruption is high in developing areas where it may be hard to contain the virus.

- We expect a hefty, short-term decline in the Middle East and North Africa as the impact of loss of oil revenue hits the economy hard, although we expect stronger resilience in the long run due to extensive government financial reserves.

- Sub-Saharan Africa presents the most-optimistic, mild-growth scenario (+2.6%) due to existing strong growth trends, continued dependency on mobile services and the later arrival of COVID-19 in this region. The potential for severe disruption to economic activity (and food security) inform the pessimistic severe scenario.

Our forthcoming forecasting work will build on this analysis at a country-level

We will continue to update our forecast products according to the original timetable. As we take into account the actual economic impact of COVID-19 as it unfolds in each country, we will be able to identify the most-realistic outcome from the range of results discussed here.

1 More details about the sources of our GDP scenarios can be found in Analysys Mason’s full forecast COVID-19 scenarios for telecoms operator service revenue: worldwide forecasts 2019–2024.

2 This revenue chart makes use of ‘supressed zero’ to focus on the detailed trajectory. To gain a better understanding of the absolute impact, Analysys Mason has provided whole-scaled charts in the data annex of the full forecast.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Author

Hilary Bailey

Research Director | Head of DataRelated items

Pay TV and streaming video in Switzerland: trends and forecasts 2023–2028

Forecast report

Pay TV and streaming video in the Netherlands: trends and forecasts 2023–2028

Forecast report

Pay TV and streaming video in Finland: trends and forecasts 2023–2028