Contract wins by IoT MVNOs mean they should not be ignored by MNOs

Traditional, global MNOs continue to win the vast majority of IoT contracts. However, IoT MVNOs, such as Cubic, Globetouch, Truphone and others, pose a threat and have successfully won high-profile benchmark contracts, with customers in the automotive industry that include Audi, GM and Kia Motors. We estimate that at least 20 firms (excluding MNOs) are offering worldwide or regional IoT connectivity.

The threat to large established operators from smaller players is increasing with these highly visible, well-publicised reference deals with car companies, which lend the MVNOs credibility and from which the MVNOs will gain experience and revenue. MNOs need to consider how to counter these smaller competitors, starting with an assessment of why they are losing contracts. This article is based around two of Analysys Mason's recent reports: IoT MVNOs: case studies and analysis and IoT MVNOs: strategy responses of established operators.

Over half a billion connections for IoT could be awarded as part of regional deals

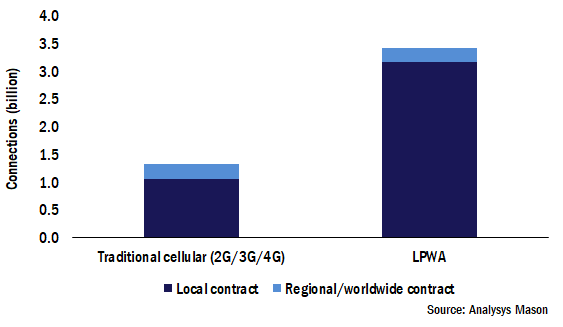

We estimate that contracts awarded as part of a global or regional contract for IoT connectivity will account for 275 million of the 1.3 billion cellular connections and 250 million of the 3.4 billion LPWA connections by 2025 (see Figure 1). We expect that, with the exception of extremely large countries (such as China and the USA), most embedded connectivity contracts for cars will be awarded as part of a regional contract, as has been the case with most contracts to date (for example, for BMW, General Motors, Volkswagen and others). The large number of connections involved in connected car contracts means that almost half of cellular connections could be awarded as part of a regional deal (as is the case in Western Europe).

Figure 1: The addressable IoT connectivity market, worldwide, 2025

For LPWA, we expect a smaller share of connections to be included in regional deals because many of the use cases are for solutions such as smart cities or smart meters, for which connectivity will be contracted locally.

The numbers shown in Figure 1 represent Analysys Mason's forecast for IoT connectivity worldwide in 2025, but this forecast potentially underestimates the impact of regional deals. For example, if a popular consumer electronics device (such as a new Apple Watch) is supplied with connectivity as part of regional contract, this could significantly increase demand for a regional deal.

Customers are demanding regional contracts for connectivity because they want:

- to connect devices that will roam between countries (for example, tracked shipping containers);

- to simplify the procurement and management of connected devices such as monitored industrial hardware, even if they do not roam (or even move in some cases);

- some combination of these two demands (such as for connected vehicles or consumer electronics).

MVNOs are winning contracts through a combination of flexibility and price

No single factor explains why IoT MVNOs are winning significant deals (and, as noted earlier, MNOs are winning the majority of deals and of connections), however, some of the following factors may explain these wins.

- MVNOs may simply be cheaper, and may be more willing than MNOs to accept low-margin connectivity contracts. Venture-backed MVNOs may be using some of their investors' money to win deals to help gain market share and, with it, credibility.

- MVNOs may offer more commercial flexibility. MVNOs may be more flexible in how contracts are structured, for example by eliminating any upfront costs or minimum commitments.

- MVNOs may offer more technical flexibility. Customers of regional and global connectivity are likely to have specific technical requirements, such as multiple APNs and MVNE offerings, that standard mobile operators are unwilling (or unable) to offer.

- MVNOs may simply want the business more. For most MNOs, IoT is only one division and it must compete for resources and attention with other (much larger) parts of the organisation. For companies such as Aeris, Cubic, Globetouch and Sierra Wireless, IoT is their primary business, and resources will be focused on winning these contracts, from the CEO down.

Suppliers need to be clear on their differentiators and address any perceived weaknesses

Any provider hoping to compete for connectivity contracts needs to have a clear understanding of its potential differentiators. Differentiators could include the following aspects.

- Financial solidity. Many IoT MVNOs are funded by venture capital and are, we presume, loss making. For any potential customer, such as an automotive original equipment manufacturer (OEM), aiming to sign a medium- or long-term contract, the provider's financial position will be an important consideration.

- Reliance on multiple customers. Smaller players will have fewer customers and their reliance on each will be greater; a contract loss could result in financial difficulties.

- Long-term commitment to IoT. Most major MNOs have had IoT (and, before that, M2M) teams for almost a decade and can demonstrate a long-term commitment to the sector. This contrasts with some of the other firms chasing IoT contracts (both MVNOs and divisions of other telecoms firms) for which IoT is a more-recent activity (although some MVNOs have been in business for over a decade).

- Connectivity coverage and quality. Many IoT MVNOs can claim to offer connectivity in over 100 countries, but these often do not include 4G and many IoT MVNOs do not offer connectivity in major markets such as Brazil, India and Russia. NB-IoT, LTE-M and even LoRa will play an increasingly important role in regional and global deals, which should benefit established operators.

Other differentiators that suppliers should explore include security capabilities, existing customer relationships, brand and the ability to provide other IoT capabilities (such as hardware or software platforms).

However, each of these differentiators could instead be perceived by potential partners as a weakness and any connectivity supplier needs strategies to address these problems. For example, IoT MVNOs can point to the size and sources of their funding to assuage concerns about financial stability.

Smaller connectivity providers should not be ignored

The types of contracts being won by MVNOs means that they cannot be ignored by other connectivity providers. MVNOs are winning these contracts partly because they are paying more attention to customers and are more-flexible about meeting their needs. Any operator – MNO or MVNO – needs to be clear about its differentiators and mitigate against any weaknesses; connectivity providers should understand their customers' priorities and consider how they perform against these factors.