COVID-19: the pandemic will accelerate CSPs’ investments into self-service functions

The social distancing and work-from-home norms that COVID-19 has brought about will accelerate communications service providers’ (CSPs’) adoption of automation and self-service capabilities, especially those that are related to customer service functions. Many CSPs were working towards increasing their engagement with digital channels, even before the pandemic, in order to both reduce the cost of operations and improve the customer experience by giving end users greater control over their interactions. However, CSPs worldwide are perceived to be considerably behind the leading digital-native companies in terms of providing advanced self-service capabilities and adopting leading-edge customer engagement technologies. This is becoming an increasingly important issue because customers’ preferences and expectations are rapidly changing based on their digital engagement experiences with digital-native companies, and CSPs are under pressure to provide a comparable digital experience.

COVID-19 will expedite CSPs’ initiatives to remove the key barriers to providing digital engagement capabilities

The three main pain-points that CSPs are expected to address to improve their digital engagement over the course of the next decade are as follows.

- Insufficient self-service capabilities. The majority of CSPs have invested in basic self-care functionalities, but these are far from being self-contained and are insufficient to drive deeper engagement with customers. The customer journey on CSPs’ digital channels is often incoherent with several points of friction, which can lead to high customer drop-off rates. In addition, there is no consistency between the different digital channels (the website, the app and virtual assistants), which can be confusing for customers.

- High support costs. Most CSPs have large call centre operations (either outsourced or directly owned) that are responsible for capturing and responding to customer queries and complaints. The cost of these operations is quite high, especially when compared to those of OTT service providers that operate at a comparable scale.

- Complex architecture frameworks. The presence of complex, disparate systems is often cited as a key reason for poor customer experience. These systems are mostly large monoliths, with a limited ability to support modern functionalities. They often require expensive customisations before new support services can be launched, which can limit CSPs’ competitiveness. Legacy silos are also often one of the key reasons for order fallouts, which is an important factor in poor customer experience.

CSPs will take a three-pronged approach to transforming their digital engagement capabilities

The interest and investment in CSPs’ initiatives to overcome these issues will grow rapidly thanks to the disruption caused by COVID-19; the pandemic has increased the visibility and importance of service providers’ self-service capabilities. Most CSPs’ investments in improving digital engagement capabilities will focus on three key themes in the next decade.

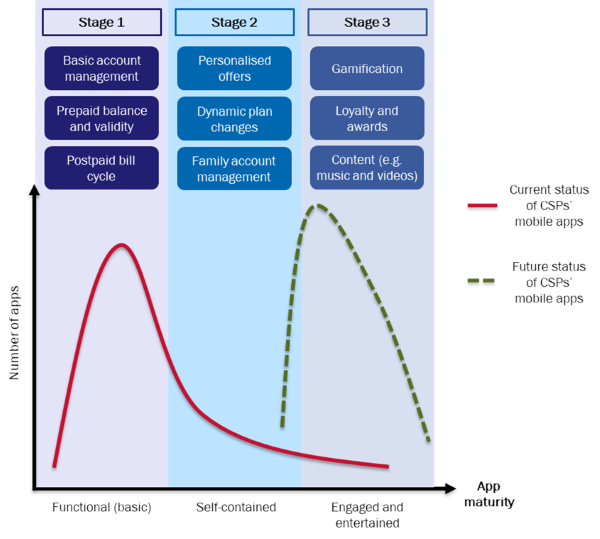

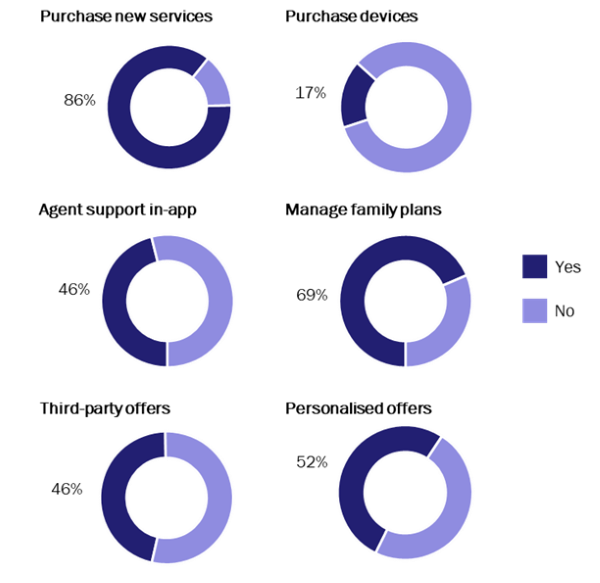

- The mobile app will emerge as the gateway for customer interaction. Most CSPs have their own apps, but the ability of these apps to effectively engage with customers is generally poor. CSPs have historically been focused on app penetration (that is, the number of app downloads) as the key indicator of engagement. However, mobile app engagement will become the primary metric to measure how effectively CSPs are engaging with customers in the coming decade. CSPs will invest to move from stage 1 to stage 3 of mobile app engagement (Figure 1). This will understandably involve significant changes to the capabilities and design of CSPs’ mobile apps, especially since a number of CSPs do not currently provide even basic functions on their mobile apps (Figure 2).

Figure 1: The three stages of mobile app maturity and an indication of the current and future status of CSPs’ mobile apps

Source: Analysys Mason, 2020

Figure 2: Percentage of CSPs that support various functions on their mobile apps, worldwide, 20191

Source: Analysys Mason, 2020

- Automation will be central to new products, processes and services. New initiatives will not only reduce the number of manual interventions required in back-office processing jobs, but will also use artificial intelligence and machine learning to reduce the number of call centre resources required. Chat and voice bots will be at the forefront of this revolution.

- Cloud-delivery models will be commonplace. SaaS (on public or private cloud) will be the dominant application delivery model in the medium term. SaaS offers CSPs greater freedom to experiment with different engagement models, as well as reducing complexity and total cost of ownership.

CSPs’ accelerated shift towards digital customer engagement will affect various players in the telecoms industry

These trends are expected to have a wide and varied impact on all players in the telecoms industry.

- CSPs. The shift towards a self-care- and automation-centred approach to serving customers will have the biggest impact on CSPs. This includes the adoption of AI-based technologies such as voice and chat bots and process automation systems. Organisational and cultural change, and not technology transformation, is likely to be the biggest challenge for most CSPs.

- Solution vendors. The widespread adoption of SaaS delivery models will have a significant impact on vendors, especially those with large on-premises deployments of customer engagement solutions. SaaS will force vendors to make changes in application design and delivery, pricing models and support services. SaaS delivery models will reduce the overall spend by CSPs in the long term thanks lower support and maintenance costs and fewer customisation requests.

- Other service providers. There will be a decline in the number of traditional system integrator roles as SaaS delivery models become widespread. However, CSPs will continue to engage with service providers that have experience in strategy and organisation change. The demand for lower level (L1 and L2) call centre support services will fall, and some CSPs may even bring call centre services in-house and reduce offshoring.

Self-service functions are set to have a transformative effect on CSPs’ operations over the next decade. The long-tail effect of the COVID-19 pandemic and the likely impact that it will have on the future of workplaces will encourage CSPs to accelerate their plans to transform digital engagement.

1 n=103. For more information, see Analysys Mason’s Engagement with CSPs’ digital channels worldwide.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Related items

GenAI will help communications service providers to upgrade CPQ systems for B2B services

Article

CSPs will need to invest in next-generation CPQ systems to compete effectively

Article

CPQ systems: worldwide forecast 2023–2028