COVID-19: operators should be concerned about the robustness of networks rather than capacity

The COVID-19 crisis will confine many more people than usual to their homes, including those who are planning to work and study from there. This comment discusses the effect that this will have on network traffic and the implications for operators.

It is already possible to see changes in patterns of network traffic:

- a shift from corporate to residential access

- a proportionate, or possibly absolute, shift of data traffic from mobile to fixed/Wi-Fi networks

- an increase in the volume of voice traffic

- an increase in the volume of streaming, gaming and video communication traffic.

Various communications service providers (CSPs) have provided early indicators of what they are expecting

Telecom Italia said on 12 March 2020 that traffic on its fixed network in Italy had surged 70%, and traffic on its mobile network had risen 10%, in the space of 2 weeks. To put this in context, 70% growth in fixed data is about what it would normally expect in 2 years. Downloading games was one of the main drivers, and created short-term spikes. Similarly, Italian fixed operator Fastweb registered an average of 3.2TB/s (sic) data traffic on 10 March compared with a pre-lockdown average of 2.3TB/s, but this has subsequently settled to 3TB/s. Fixed wholesaler Open Fiber recorded a huge 300% spike in upstream traffic in the same period.

The five largest operators in Spain reported a 40% increase in overall IP traffic, a 25% increase in mobile traffic and a 50% increase in mobile voice traffic since the start of the outbreak. As in Italy, this shows a proportionate, but not absolute, shift of data traffic from mobile to fixed networks. The operators have also reported a fivefold increase in the volume of instant messaging.

Verizon reported on 18 March 2020 that gaming traffic on its fixed network in the USA had increased by 75% within 1 week. AT&T reported a decline in mobile traffic in the cities that are most affected by the coronavirus outbreak. Whether this traffic simply shifts to indoors in the suburbs remains to be seen. Interestingly, the US regulator, the FCC, has granted T-Mobile an additional market average 31MHz of spectrum in the 600MHz band, 'borrowed' from Dish (which does not yet use it) and others, for a period of 60 days. 600MHz is generally thought of as wide-area coverage spectrum, but it is also the spectrum that is most-suited to reliable indoor coverage.

French operator industry group FFT asked end users to show civic responsibility by not overloading mobile networks and to divert mobile traffic to home Wi-Fi/fixed broadband where capacity is higher. Orange surmised that a day under lockdown would be very much like a rainy weekend day, and did not anticipate an insurmountable impact because the fixed network was already dimensioned to cope.

BT said on 18 March 2020 that mobile traffic in the UK was trending slightly down as people shifted to fixed broadband and Wi-Fi.

We are also expecting a massive spike in traffic generated by some types of transnational OTT apps: those that provide time-killing entertainment services in particular, but also those used for communication. Telia Carrier, the international IP carrier, reported that most video communication service providers have requested large bandwidth upgrades.

Several ISPs are adapting their offers during the crisis (for example by offering free access to usually paid-for content), and some mobile network operators (MNOs) are giving away additional data for free. For example, T-Mobile said it would suspend data caps for 60 days (a high proportion of its customers are already on unlimited plans), and that it would also grant all customers an additional 20GB per month of tethering data: the latter is interesting because it recognises shifting needs.

The COVID-19 crisis will test different types of home connectivity and expose pain points

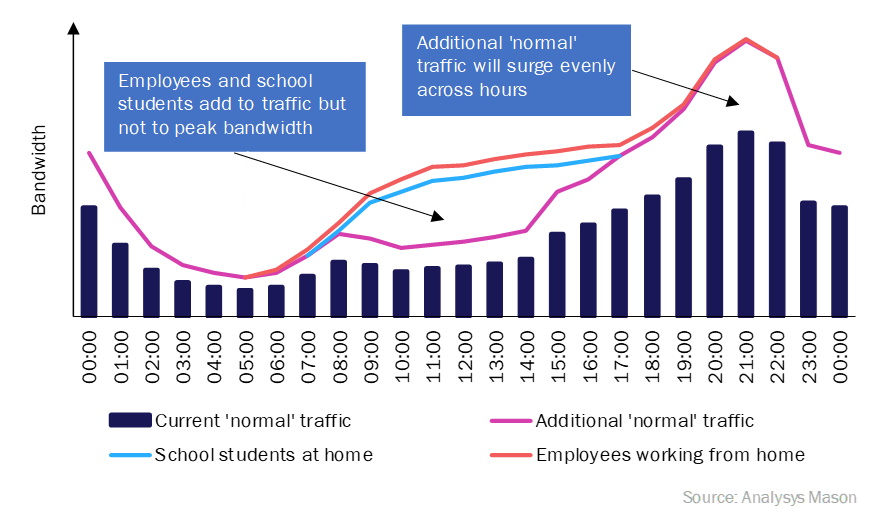

We expect fixed networks in Europe and the USA to cope in terms of capacity. Traffic generated by employees who are working from home will be a small part of the total; average business broadband usage per line is about half that of residential, and only 20%–40% of workers have the kinds of jobs where they can work from home. Average residential usage during school hours tends to be only be about a third of that during the busy hour, so we do not expect children and employees who are working from home to put additional pressure on networks that are dimensioned for the evening load. Figure 1 shows a typical residential fixed broadband traffic profile across 24 hours, with our own speculative view of the impact of the crisis.

Figure 1: Residential fixed connection diurnal bandwidth profile

However, there will be pain points. One will be uplink. B2B traffic is less asymmetric than B2C, and cloud-based working and videocomms require robust uplinks. Unlike on FTTP technologies, useable frequencies on coax and cable are a scarce resource, and they are allocated to uplink and downlink according to typical current traffic rather than to need.

Pressure on home Wi-Fi networks will be another pain point as more people try to share resources. This may expose the limitations of Wi-Fi4, but Wi-Fi5 and Wi-Fi6 should be able to cope in terms of capacity once installed. However, meshed Wi-Fi networks are generally self-install and, frankly, difficult to set up and configure, especially for the vulnerable. Many people may be self-isolating in a single room. Old telephone and cable-TV networks used to run to sockets in multiple rooms, yet this is rarely the case for FTTP, and all broadband generally relies on whole-house Wi-Fi.

For those who need to work from home but do not have fixed broadband, indoor FWA customer premises equipment (CPE), dongles, pucks or simple smartphone tethering will be faster to deliver than new fixed connections. The crisis will sorely test mobile networks with respect to:

- indoor coverage, especially if C-band 5G is involved

- the impact of more fixed-type traffic on performance

- the capabilities of small low-power CPE versus dedicated FWA CPE

- the ability of MNOs to reallocate network resources away from business areas and towards residential areas.

The number of households that rely entirely on mobile varies greatly around the world. In countries with limited fixed broadband access (such as India), the COVID-19 crisis could stimulate demand for new robust fixed broadband networks, and employers may pay for access to existing fixed broadband networks for those working from home.

Operators should be as concerned about the robustness of networks as they are about capacity

The COVID-19 crisis will expose weaknesses in the reliability of networks, fixed and mobile. Keeping networks operational is paramount. Telecoms/ICT stores in Italy are exempt from the lockdown. In the UK, communications workers ("including but not limited to network operations, field engineering, call centre staff, IT and data infrastructure, 999 and 111 critical services") have been defined as 'key workers', and therefore are exempt from some of the restrictions that are being imposed in the response to the crisis.

In the longer term, the experience will probably shift demand from 'good enough' connections, geared primarily to consumer entertainment on infrastructure meant for pre-internet connectivity, to robust and overprovisioned symmetrical fat pipes that can cope with all eventualities. Note that China already has 94% FTTP coverage and about 80% of Chinese homes take FTTP.

The crisis could also spur policy makers to firm up broadband objectives by:

- defining, where not already the case, fixed broadband as a basic necessity that should be covered by universal service obligations

- dropping technology-neutrality in state-aid guidelines and pushing only for the most robust solutions

- making not only FTTP but also fibre-to-the-room (FTTR) technology a required feature of new housing.

Downloads

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Authors