Chinese operators are dominating the worldwide IoT market, benefiting from a supportive government

Listen to or download the associated podcast

IoT is a natural experiment for the role of government in technology. The Chinese government has played an instrumental role in supporting the development of technology and new markets for IoT. The IoT units of Chinese operators are thriving. In Europe and the USA, a decade of austerity has limited government/municipal budgets for IoT. This may have limited the performance of operators (and other players) in these region, where growth in the IoT market is less impressive than in China.

Governments in some countries are changing their approach to austerity; Portugal, in particular, is increasing spending and other countries, including the UK, may follow.

Government-related IoT projects in Europe and the USA have had limited impact

In her book, the Entrepreneurial State, Mariana Mazzucato shows how many of the technologies used by iPhones were developed by, or with the support of, the state (for example, the internet, GPS, touchscreens and the search algorithm in Google). She argues more generally that governments play a large and often ignored role in many technologies, especially at an early stage, and this role helps to create new markets that otherwise would not exist (for example, ride-hailing services such as Uber would not be possible without government-funded GPS).

She also argues that the Chinese are learning lessons about the role of the state, at a time when the Americans are 'unlearning' them.

It is perhaps the misfortune of IoT to have emerged in the past decade when governments in Europe and the USA have been more focused on austerity than investment. Government influence on the IoT markets of these regions has mostly been based on regulation rather than investment; for example, the European Union's decisions on eCall and smart metering.

Some funding has been available for projects, such as smart metering in the USA, and through bodies such as IoTUK, but these initiatives have typically been designed to solve a single problem without attempting to create a bigger market. For example, networks have been built to connect street lights (a case that has a clear financial return) but these often use proprietary or closed technologies that do not help to develop the broader IoT market. This narrow focus means that the benefits of these projects (for example, for the environment, public safety and productivity) are often not fully exploited.

Governments in Europe and the USA have also preferred to remain neutral on technology, for example leaving it up to the market to decide which type of connectivity to use for smart metering projects.

IoT in China has benefited from state intervention

The government in China has taken a different approach. It has mandated the use of NB-IoT technology for some projects. In part, this was because of its industrial policy to promote Chinese vendors, especially Huawei, which were likely to benefit from demand for NB-IoT, in China and beyond, but the approach has also helped to avoid uncertainty. Elsewhere in the world, developers were unclear whether to develop for NB-IoT or other technologies, such as LoRa and LTE-M. The selection of NB-IoT in China is comparable to the decision in Europe to select GSM technology in the 1980s.

The Chinese government has also invested in ambitious smart city projects. The country has an estimated 500 projects and reportedly has 200 million connected surveillance cameras.

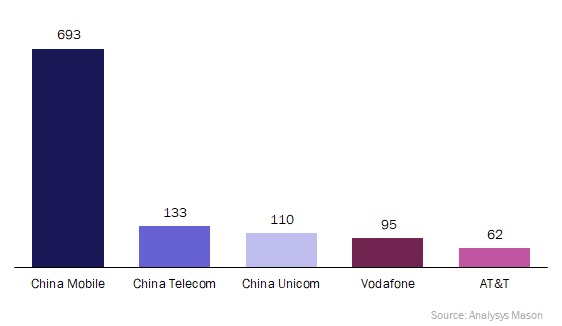

The impact of these initiatives on the Chinese mobile operators is startling. Each of the three has over 100 million IoT connections, more than any non-Chinese operator (see Figure 1). China Mobile alone has more IoT connections than the largest 20 non-Chinese operators combined.

Figure 1: IoT connections, by operator1

The Chinese operators are expecting to maintain this rapid growth in connection numbers. China Mobile is targeting an extra 300 million devices in 2019, while China Telecom expects to add 80–100 million connections. For both, this would imply a doubling of IoT connections in around 18–24 months.

The revenue per connection in China is far lower than in other parts of the world. China Mobile reports an average revenue per connection for IoT of USD0.17 per month, compared to around USD1 for most Western operators. Despite this, as a percentage of total revenue, China Mobile earns more from IoT than any other operator that reports revenue (2.5% of total revenue in 1H 2019). Vodafone, the next closest, generates around 1.8% of total revenue from IoT. All of the Chinese operators reported that IoT revenue grew by over 40% year on year in 1H 2019. Vodafone's IoT revenue increased by 5.4% in 3Q 2019.

Changing attitudes to austerity could open opportunities

Governments in the rest of the world may have lessons to learn from China relating to IoT. As attitudes towards austerity change, telecoms operators (and other players in the IoT value chain) need to make the case for IoT-related projects, including the positive impact on the local IoT sector. If they do not, IoT may take longer to develop and, when it does, Chinese rivals will be better placed to benefit.

1 1H 2019 data for China Mobile and China Telecom, 3Q data for Vodafone and AT&T, FY 2018 data for China Unicom.

Downloads

Article (PDF)Authors