Growth in the IoT market will be sizeable, but challenges remain for operators

The total number of IoT connections worldwide will grow sevenfold between 2018 and 2028 to reach 5.3 billion. This represents a CAGR of 22%, which is significantly higher than the growth rate for the number of smartphones (the total number of handsets worldwide is predicted to grow at a CAGR of just 2% between 2018 and 20241). However, only a handful of operators are pursuing the IoT revenue growth opportunity by investing in developing new services to serve new sectors that match their IoT ambitions. Those that are acknowledge that IoT is a long-term initiative. Our recent forecast update reflects some of the challenges that IoT network operators encounter regarding LPWA network deployment, the role of 5G in supporting IoT applications and the increasing erosion of connectivity revenue. This article examines these trends and explains their impact on the IoT landscape.

Growth in the number of LPWA connections will be solid, but slower than anticipated

LPWA connections (that is, NB-IoT, LTE-M and ‘other LPWA’ connections) will account for 61% of all IoT connections by 2028 (that is, 3.2 billion connections). NB-IoT will form the largest share of LPWA connections, and there will be 1.75 billion NB-IoT connections by 2028. The number of LTE-M and ‘other LPWA’ connections will increase to approximately 920 million and 570 million, respectively, by 2028.

The number of traditional cellular connections has grown, as previously predicted. However, growth in the number of LPWA connections has been hampered by a number of factors including:

- slow and fragmented network deployments

- a lack of demand-side awareness of the benefits of LPWA technology, resulting in the need for trials, PoCs and long lead times

- relatively high prices for modules (and connectivity)

- a lack of relevant hardware.

Operators also face significant challenges regarding channel strategy, funding and cultural factors (such as resistance to the adoption of new technologies) when targeting sectors such as agriculture, smart buildings and smart cities.

This is slowly changing. There have been a few large contract announcements for LPWA connectivity such as Orange’s contract with Veolia to connect 3 million meters over a 10-year period and Telia’s announcement to deploy NB-IoT and/or LTE-M for its smart meter contract in Sweden.

5G will provide good opportunities to support IoT use cases, but these will emerge only gradually over time

5G IoT connections will emerge in 2020 and their number will grow to around 150 million by 2028 (it should be noted that our 5G forecast does not include NB-IoT and LTE-M, even though they are sometimes classed as 5G technologies). Operators in China will deploy the largest share of connections (53%), followed by those in Western Europe and North America (14% and 11%, respectively). In the early years of 5G deployments, operators will develop and market 5G services to enhance the customer experience for mass-market smartphone users (the eMBB use case) with a fallback to LTE. Analysys Mason forecasts that the number of smartphone and broadband 5G connections will grow to 1.9 billion in 2024. This represents a stark contrast to the 28 million 5G IoT connections that we forecast for 2024.

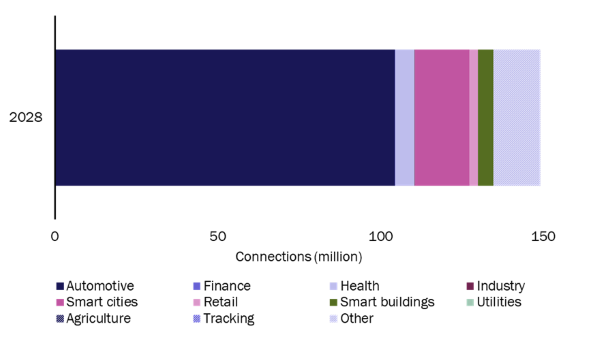

The adoption of 5G IoT networks will initially be slow due to limited coverage and high device costs. Automotive use cases will require good geographic coverage and other use cases will not support the higher cost of providing a fallback to LTE. However, the automotive sector will generate the largest share of 5G IoT connections during the forecast period (Figure 1).

Figure 1: Total 5G IoT connections by sector, worldwide, 2028

Source: Analysys Mason, 2020

Connectivity ARPC has declined and this trend will continue due to competition and a lack of differentiation

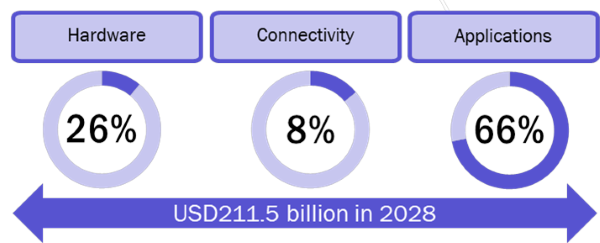

The connectivity revenue generated from traditional cellular and LPWA technologies worldwide will increase from USD4.9 billion in 2018 to USD16 billion in 2028, at a CAGR of 13%. Traditional cellular technology will account for 75% of the total connectivity revenue, despite the greater number of LPWA connections. The connectivity ARPC for traditional cellular connections will decline from USD0.66 per month in 2018 to USD0.51 per month by 2028. The LPWA ARPC, in contrast, will remain reasonably flat over the forecast period, and will only decline slightly from USD0.12 to USD0.11. Overall, connectivity revenue will account for just 8% of the total value chain (TVC) revenue as shown in Figure 2.

Figure 2: Percentage of TVC revenue from each component for traditional cellular and LPWA networks, worldwide, 2028

Source: Analysys Mason, 2020

Connectivity ARPC erosion is attributed to:

- increased competition from both existing and new-entrant MVNOs that are attracted by the IoT opportunity, as well as challenger operators that are selling wholesale connectivity for IoT

- intense competition for high-volume, lucrative automotive and utility contracts, especially in Europe

- a lack of differentiation in the connectivity offerings meaning that operators struggle to compete on factors other than price.

Increasing pressure on connectivity revenue has serious implications for IoT operators, many of whom already struggle to provide higher-value services along the value chain.

Operators are building solutions to address the challenges

Operators with dedicated IoT business units are developing strategies to address many of these challenges directly. Operators working in the LPWA sector are focused on high-volume segments (such as smart metering) in order to support millions of connections and generate meaningful revenue. Some are also building new services with a view to target some of the longer-term 5G opportunities such as industrial IoT. These opportunities involve new business models and ecosystem partnerships, and IoT will be one component of a broader solutions portfolio including 5G, cloud, edge and AI. The forecast illustrates that the IoT revenue opportunity for operators is sizeable, but that there are still barriers to overcome.

1 For more information, see Analysys Mason’s DataHub.