Bundling OTT voice services could help operators in the Middle East protect some of their core revenue

The high proportion of immigrants and the great cost of international calls in the Middle East and North Africa (MENA) have driven the adoption of over-the-top (OTT) voice services. Most operators in the region have attempted to neutralise the effect of such services by disrupting or banning them, often with the support of regulators.

At a time when some regulators have begun to soften their stand on OTT services, and more consumers resort to workarounds to overcome usage restrictions, operators should look for new ways to address the OTT threat while monetising their growing popularity. In this comment, we will share some primary data on OTT usage in the region and discuss recent examples of bundling OTT voice services in the UAE.

Communication OTT applications remain popular despite attempts to block them in MENA

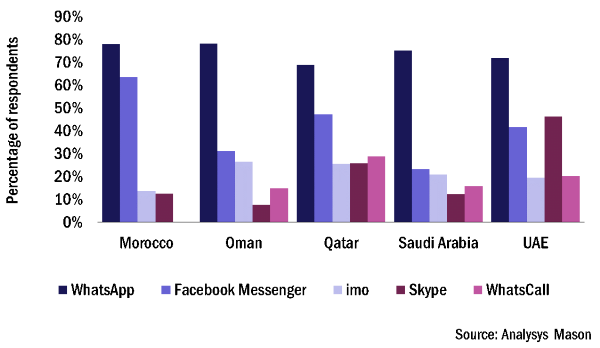

The use of OTT communications services in MENA is widespread and increasingly fragmented, according to a survey of 4500 smartphone users in Morocco, Oman, Qatar, Saudi Arabia and the UAE during the summer of 2017. WhatsApp remains the dominant application, with penetration ranging from 69% in Qatar to 78% in Morocco, but there is a range of other applications gaining traction, reflecting the diversity of the population (Figure 1).1

- Facebook Messenger is a strong challenger to WhatsApp, especially in Morocco, Qatar and the UAE.

- Skype remains very popular, especially in the UAE; 46% of respondents said that they use the service (although the country blocked all use of Skype as of January 2018). It is less used in Oman where the service is completely blocked.

Figure 1: Penetration of the top five OTT communications apps among smartphone users by country, MENA, 2017

Most regulators and operators block or disrupt OTT voice services, but their position is slowly changing

Mobile operators in the Middle East have generally adopted a strong defensive stance against OTT players by blocking their services, either partially or completely, to limit the erosion of revenue from voice, especially from international traffic.2 Operators have relied on regulators to impose restrictions and to filter out OTT-related traffic (Figure 2).

Figure 2: Status of regulators’ approach to permitting or blocking OTT services, MENA, January 2018

| Regulator position | Operator approach | Notes | |

| Morocco | ✔ | ✔ | The ban on Skype, Viber and WhatsApp calling was lifted in November 2016. |

| Oman | ✗ | ✗ | Ooredoo launched its own OTT voice service in July 2016. |

| Qatar | ✔ | ✔ | |

| Saudi Arabia | ✔ | ✗ | In November 2017, the regulator announced the liberalisation of some applications. |

| UAE | ✗ | ✗ | Operators maintain a block on most third-party OTT VoIP services. |

Key: ✔ = allowed ✗ = blocked

Source: Analysys Mason, 2018

However, there is a growing trend towards a softening of the regulators’ stance on some OTT voice applications, prompting operators to adopt a more proactive approach by offering legal alternatives such as the following.

- In Morocco, the regulator, ANRT, withdrew the ban on mobile VoIP in November 2016.

- In Oman, one of the most restrictive markets, Ooredoo launched its own OTT application, OoredooTalk, to target the expatriate population with lower international call rates.

- In Saudi Arabia, the regulator, CITC, announced the lifting of the ban on some OTT voice services in November 2017. We understand that the operators are in discussion with CITC regarding the monetisation of VoIP usage.

- In the UAE, du and Etisalat announced new VoIP packages.

Operators in the UAE are experimenting with new partnership models for OTT voice services

Historically, mobile operators in the region considered marketing partnerships with OTT messaging providers in order to capitalise on the growing popularity of OTT services and to assist with the branding of their applications to drive the adoption of data tariffs. However, this model did not extend to the voice features of those applications due to the threat of the further substitution of international calls.

At the beginning of 2018, du and Etisalat launched a new legal VoIP service a few days after Skype was blocked in the country.3 The service offers unlimited app-to-app voice and video calling, but is restricted to two authorised third-party applications (BOTIM and C'Me).

The following two tariffs are currently offered by both operators.

- AED50 (USD13.6) per month to use the application with a smart device connected to the operator’s mobile network. Mobile data usage will be charged from one’s data allowance. du allows business customers to activate the service, while Etisalat appears to restrict it to non-business (that is, non-SME or enterprise) consumers.

- AED100 (USD27.2) per month for multi-device usage through the home Wi-Fi network.

While the practice of bundling OTT services is quite common, especially for social media and messaging applications, offering voice as a stand-alone service is new for the region. Analysys Mason believes that du and Etisalat can achieve a much higher return per megabyte compared to the standard price for mobile data, while the cost to the operator and to the OTT service provider would be minimal. However, restricting usage to two less popular applications at a relatively high cost might reduce the appeal of their offerings to existing OTT users.

du and Etisalat can eventually consider adding new applications and can structure the offers around the type of application used or the destinations contacted. While such an approach will not completely compensate for the loss due to illegal applications, it will strengthen the operators’ position in the voice market, targeting mid-to-high value customers who have been frustrated by the unreliability of other OTT applications.

While it is unlikely that regulators in those Middle Eastern countries with a high proportion of expatriates, such as Saudi Arabia and the UAE, will fully liberalise OTT services, operators should consider introducing bundles to differentiate their services and appeal to consumers who have grown accustomed to using such OTT services. This novel approach in the region, if successful, could serve as a blueprint for other operators.

1 Further analysis will be included in an upcoming report from Analysys Mason titled Connected Consumer Survey 2017: OTT and digital economy services in the Middle East and North Africa.

2 For more information, see Analysys Mason’s Communication services in the Middle East and North Africa: trends and forecasts 2017–2022.

3 Skype was legally blocked prior to 2018 because of security concerns. However, it was still possible for users to use Skype by connecting their smartphones to a Wi-Fi network or by using a computer.