Operators should bundle ICT and connectivity services to both defend and generate revenue from SMEs

Enterprise revenue is declining for most large telecoms operators in high-income countries, and interest in ICT services is rising due to its potential as a new and growing source of revenue. Operators are well-positioned to bundle ICT services with traditional connectivity services, but they typically lack the capabilities required to be ICT providers and have had limited success so far – only 5% of operators’ revenue from SMEs worldwide came from ICT services in 2017.

Bundling ICT and connectivity services is a significant opportunity for operators, but they will need to:

- carefully select which ICT opportunities to pursue and ensure that they align with operators’ core strategies

- gain the necessary capabilities through acquisitions and partnerships

- reform sales and support structures through comprehensive training schemes and the acquisition of experienced ICT sales and support personnel.

This article is based on our recently published strategy report: SME bundling strategies for operators: building an ICT portfolio for SMEs.

ICT services present operators with the opportunity to offset declining legacy revenue with new and growing forms of revenue, but there are challenges

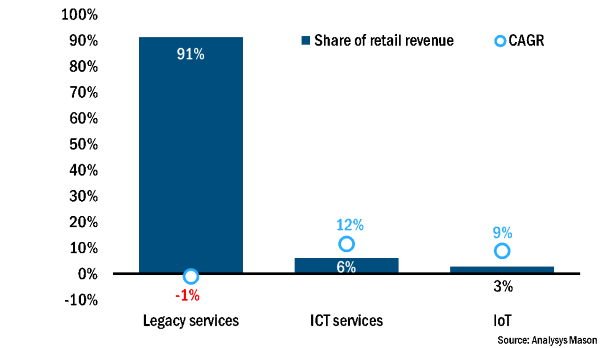

Figure 1: Breakdown of operators’ revenue from SMEs in terms of the share of the total revenue, 2017, and CAGR, 2017–2022, Western Europe

Operators have struggled to gain ground in ICT services; connectivity still accounts for over 90% of operators’ revenue from SMEs in Western Europe. The diminishing returns from legacy services place a greater importance on operators to diversify their ICT portfolios and benefit from new and growing sources of revenue – we expect ICT services to grow by 12% on average each year between 2017 and 2022 in Western Europe.

However, operators often lack the skills, experience and capabilities to be major ICT providers. Sales teams, in particular, do not have the incentives or the knowledge to sell ICT services. The market for ICT services is also relatively mature in most high-income countries, leaving little room for operators to enter organically. Widespread dissatisfaction with operators’ basic services also acts as a significant barrier. Operators must improve the quality of traditional connectivity services in order to be successful in the ICT market; SMEs that are dissatisfied with their core connectivity services will be unlikely to purchase additional services from their operator.

Operators should carefully select opportunities and ensure that they align with their core strategies

Margins for basic ICT services, such as Office 365 or antivirus, tend to be lower than those for connectivity services which is likely to deter operators from investing. However, margins on ICT services should be considered in accordance with operators’ overall strategies; basic ICT services will be more attractive to operators who are using ICT services to differentiate connectivity, whereas operators seeking new business with independent revenue streams will need to consider high-value ICT services, such as managed cloud and security services. These have the potential to be of high value but will require a greater commitment from operators to bolster their capabilities.

Operators should be clear about what their strategy is and measure its effectiveness accordingly. Operators using ICT services as a tactic will measure their success in terms of new customers and churn reduction, whereas operators using ICT services as a strategy will need to consider margins and revenue.

Operators will need to gain the necessary capabilities through acquisitions and partnerships

Partnering with ICT providers gives operators access to the products used by SMEs, such as cloud, security, UC and basic SaaS services, like Office 365. Acquisitions can provide a direct route into the ICT market with specialist technology and sales and support teams. Acquiring ICT providers can be an effective means of gaining specialised personnel to develop and augment ICT solutions in-house, as opposed to merely reselling vendors’ solutions. It is also a direct means of obtaining personnel with experience in selling or supporting ICT services, which is the fundamental barrier operators face in the ICT market.

Many operators, including CenturyLink, KPN, Orange, TDC, Telia and Telstra, acquired ICT providers between 2015 and 2017 to enhance their capabilities. Ultimately, operators should build towards an ecosystem of partnerships and acquisitions to maximise their potential in the ICT market.

Operators should address the difficulties in sales and support and tailor their strategies to each segment

Selling and supporting ICT services will probably be the greatest challenge for operators in the ICT market. Operators should implement several sales initiatives and tailor their ICT services around existing structures for each SME segment. Simplicity should be a fundamental facet of an SME proposition for both connectivity and ICT services.

The value and margins of ICT services are likely to be low relative to those of connectivity, which can limit the incentives for sales personnel to sell them. Operators should adjust incentive schemes for both direct sales staff and third-party networks in favour of ICT services to ensure that they are adequately motivated. All sales staff should receive training to ensure that they acquire the necessary product knowledge.

Bundling ICT and connectivity services is a significant opportunity for operators, but they will need to be clear on what their strategy is and commit with adequate resources

Bundling is a significant opportunity for operators to advance their SME portfolios and differentiate themselves; this is of even more importance in saturated markets where enterprise revenue is under pressure. Operators are uniquely positioned to bundle ICT and connectivity services, but they will need to invest in gaining the necessary capabilities and address the challenges in sales and support to capitalise on this considerable opportunity. ICT services should align with operators’ core strategies and their purpose should be clear to staff and sales teams.

Operators should not look to ICT services for margins, but rather to bolster connectivity. Operators should view ICT services within the scope of their overall package and focus on selling the simpler ICT services, like Office 365, before becoming a more complete ICT service provider.