Operators in Western Europe must better their business connectivity offerings, despite stagnating revenue

Analysys Mason’s latest forecasts1 predict that operator business revenue in Western Europe will increase from EUR72.3 billion in 2018 to EUR74.5 billion in 2023, driven primarily by revenue growth from ICT services. Operators must ensure that their fixed connectivity offerings keep pace with the changing requirements of businesses, because connectivity represents the main building block that is needed to upsell a wide variety of ICT services, which in turn, can drive revenue growth.

This article draws on our recently updated forecasts to explore the main business connectivity trends in Western Europe.2

Operators need to focus on improving their fixed connectivity offerings to mitigate declines in business revenue

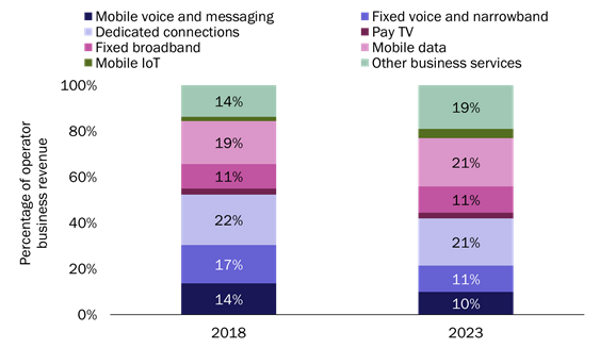

We expect that the decline in business revenue from fixed and mobile voice services in Western Europe will continue, as businesses increasingly adopt unified communications, OTT and lower-cost IP voice solutions. Business revenue from fixed connectivity services will stagnate between 2018 and 2023, while that from mobile data, mobile IoT connectivity and ICT services will grow (Figure 1). Operators must focus on improving their fixed connectivity offerings and making sure that these are suitable for businesses that are migrating their functions to the cloud. This is important for two reasons: it enables operators to upsell ICT services more easily, and also allows them to expand (in the case of challengers) or maintain (in the case of incumbents) their market share.

Figure 1: Operator business revenue, by service, Western Europe, 2018–2023

Source: Analysys Mason, 2019

Operators should clearly differentiate between business broadband and residential broadband

Operators can explore different approaches to differentiation that may increase revenue, even in a mature fixed connectivity market such as that for fixed broadband. Operators across Western Europe have radically different pricing strategies for business broadband. Prices are set only marginally above those for residential services (typically 10–20%) in some Western European countries such as Belgium, France and Spain. In these countries, we do not expect business broadband to be cannibalised by consumer products, even as the consumer products improve. Conversely, in Sweden for instance, the difference in both the price and the quality of service between business and consumer broadband services is substantial. As a result, micro and small businesses with simple requirements opt for cheaper consumer services.

The effect of these different pricing strategies can be seen in take-up of business broadband and in ARPU. The price premium for business broadband in Spain is low, and business broadband accounts for 19% of all broadband connections. However, in Sweden, where this premium is high, business broadband accounts for just 5% of all broadband connections. The business broadband ARPU in Spain is only slightly above that of consumer broadband, while in Sweden, it is more than three times higher. The pricing strategy of operators in Sweden is probably leading to a higher overall fixed broadband revenue, even if most businesses are taking a consumer package. Other operators should at least explore the Swedish model as a way of maximising revenue.

Operators can differentiate their higher-value business broadband solutions by offering wireless back-up, dedicated customer support, strong service-level agreements (SLAs), integrated security and support for multi-cloud deployments, as well as through bundling simple storage services, software licences, domain hosting and email solutions (primarily aimed at smaller businesses).

The difference in price between residential and business services should reflect the value that the latter add to businesses. For example, BT added wireless back-up to its premium business broadband service in the UK in April 2018. As a result, the proportion of small and medium-sized enterprise (SME)4 business broadband customers that take premium services has increased from 27% to 54%. BT charges GBP8 (or 33%) more per month for its premium service than its standard business broadband service.

Dedicated connections are crucial for larger businesses that are migrating their functions to the cloud

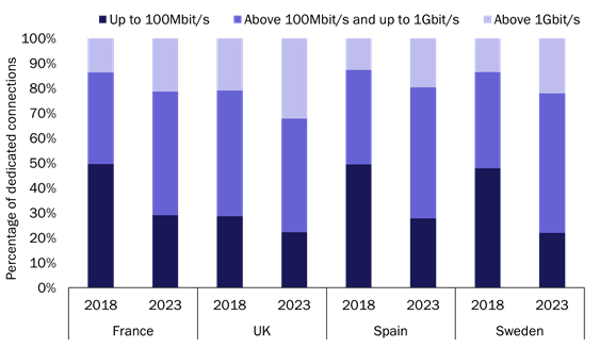

Medium-sized and large businesses are the main adopters of dedicated connectivity services such as MPLS and Ethernet. Fixed broadband often fails to meet their requirements and is typically used as a secondary back-up connection or to connect smaller sites, such as branch offices. Our research indicates that the adoption of dedicated connections of 100Mbit/s or above is rapidly increasing in many countries in Western Europe, as can be seen in Figure 2. The cost of delivering a 100Mbit/s Ethernet service is already very close to that of providing a 10Mbit/s service, and as prices converge, we expect that many businesses will adopt higher-bandwidth connections to support their migration to the cloud. We therefore expect that revenue from dedicated connections will remain broadly flat or decline in many countries across the region due to the falling prices of higher-bandwidth connections.

Figure 2: Dedicated connections, by bandwidth class, selected Western European countries, 2018 and 2023

Source: Analysys Mason, 2019

Operators in Western Europe are increasingly offering SD-WAN services, but we expect that this technology will only have a limited impact on the dedicated connections market in the region between 2018 and 2023. Businesses will gradually adopt SD-WAN, but this will not significantly affect the dedicated connections spend because most businesses will retain their dedicated connections, and gradually upgrade them. A key benefit of SD-WAN for many businesses is its ability to enable the active utilisation of secondary broadband connections, but this is likely to result in these businesses only slightly delaying their upgrade to higher-bandwidth dedicated connections.

A strong business fixed connectivity offer should form the basis of operators’ broader strategies

The business fixed connectivity market in Western Europe will stagnate between 2018 and 2023; operators will need to win customers from competitors in order to grow revenue. Operators need to ensure that their connectivity offering is up-to-date with the requirements of businesses (specifically in the areas of bandwidth, support and SLAs/back-up), because they can use these services as a springboard for growing new revenue streams in the ICT market. We expect that fixed voice and connectivity will continue to account for over 40% of operator business revenue in Western Europe at the end of 2023, while the contribution of ICT services revenue is expected to grow from 14% to 19% between 2018 and 2023. Those operators with the strongest connectivity offerings are likely to be best-placed to benefit from this growth.

1 For the full forecast data, please see Analysys Mason’s DataHub.

2 For more information please see Analysys Mason’s Operator business services forecasts 2018–2023 for France, Germany, Italy, Spain, Sweden and the UK.

3 Other business services include unified communications, SaaS, IaaS, PaaS, security, private cloud, co-location and hosting, enterprise mobility and desktop management.

4 BT defines SMEs as businesses that employ up to 100 people.