Wholesale inputs may be key as service providers look to SD-WAN and off-net services to gain market share

The importance of wholesale inputs is growing as service providers look to SD-WAN and off-net services to gain an increased share of the business connectivity market. Businesses’ reliance on cloud services has led to increased expectations for reliable, secure connectivity that can be adapted in response to changing needs. Service providers must secure the right wholesale inputs to support these expectations. At the same time, they must also invest in improving their own processes to raise customer satisfaction levels.

This article discusses the requirements of retail service providers for improved automation and service integration from their wholesale partners. These and other important aspects of wholesale business connectivity services are discussed in more detail in our recent report, Delivering business connectivity off-net: securing the right wholesale inputs.

The changing requirements for business connectivity services place new demands on wholesale inputs

Many challenger operators in the business connectivity market are seeking to gain market share and are taking advantage of the disruption to relationships with legacy network providers that is caused by SD-WAN and enterprise cloud migration. SD-WAN enables operators to deliver more-effective optimisation across the underlying connectivity networks from multiple different suppliers. As a consequence, the use of off-net services looks set to grow in importance. However, wholesale inputs must adequately address changing business needs if service providers are to compete effectively off-net.

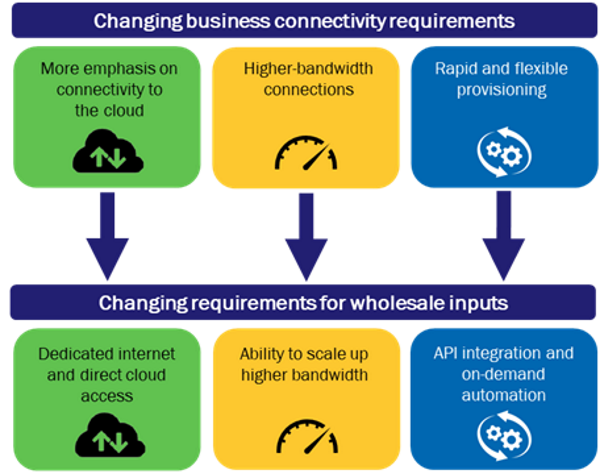

New demands for wholesale inputs may include the provision of services such as dedicated internet and direct cloud access. There is an increased emphasis on the availability of high-bandwidth services and the ability to scale this up as the use of cloud services increases. More integration and automation is also required to facilitate rapid provisioning and upgrades at the retail level. This is illustrated in Figure 1.

Figure 1: Key trends in business connectivity requirements and the implication of these for service providers’ wholesale inputs

Source: Analysys Mason, 2019

Customer service for end users can be improved with increased automation and integration from wholesale partners

Customer service is an important means of differentiation in the fixed connectivity market. SLAs will become critical points of comparison between suppliers as enterprises’ reliance on the cloud and associated connectivity increases. The expectations for rapid provisioning of new or upgraded services will also rise. Service providers should look to their wholesale partners to facilitate streamlined ordering and provisioning processes and improved fault response times at the retail level.

The levels of automation used for provisioning vary widely between wholesale providers. Some small domestic providers rely heavily on manual procedures, although their small scale means that this can be a relatively efficient process. Some, such as 1&1 Versatel in Germany, offer a single point of contact throughout the ordering and provisioning process. Many larger providers either already have, or are developing, an online portal through which service providers may access information about network availability. Orders are also placed through the portal, and this can significantly reduce provisioning times if it is linked with an automated system for delivery.

Real-time delivery is not possible for new connections to enterprise sites, but some wholesale providers are facilitating more-automated changes to the provisioned bandwidth. Some service providers currently opt to deliver lower-bandwidth services on a 1Gbit/s bearer to ensure a rapid upgrade path for end customers in cases where prices for 1Gbit/s circuits have converged towards those of 100Mbit/s circuits. However, some wholesale providers such as Openreach now offer remote upgrades in order to provide low-cost migration to higher-bandwidth services without the requirement for an engineer visit. Other providers such as Colt are using network automation to develop on-demand changes to bandwidth for wholesale customers.

Most large wholesale providers offer API-integration on a custom basis, primarily to Tier 1 service providers. This allows service providers to access information and ordering systems across multiple wholesale partners, thereby streamlining the provisioning process. In June 2019, AT&T and Colt announced the implementation of industry APIs that enable them to automate Ethernet service provisioning across each other’s networks using a programmable API–API interface.1 Similar announcements are expected from Orange and Verizon later in 2019.

At the retail level, service providers are coming under increasing pressure from businesses to improve fault response times. For off-net services, this means that service providers must interact with wholesale partners effectively, and must work to develop enhanced systems for fault response. Some wholesale providers offer a single point of contact for fault response, while others are working on improvements based on automation.

A drive to improve customer satisfaction should permeate all aspects of service delivery, both on-net and off-net

Securing the right wholesale inputs is an essential part of improving customer satisfaction, but will only be effective as part of a much broader emphasis on customer service across the whole ordering, provisioning and delivery cycle.

Many retail service providers now track NPS and have reported significant improvements in recent years. B2B specialists Macquarie Telecom (in Australia) and Colt Technology Services have had particular success in raising their NPS levels well above the industry average by making significant investments in customer service. Both companies recognise the importance of wholesale inputs in this achievement, and have worked with wholesale partners and regulatory bodies (where relevant) to push for improved service.

It is unusual for wholesale providers to monitor NPS, but Openreach in the UK has recently started to do so. It may be relevant for other wholesale specialists to follow similar practices as off-net services increase in importance.

A wide range of service providers, including domestic challengers such as Comcast and global players such as PCCW Global, have identified customer satisfaction as an important means of differentiation as they look to use SD-WAN to gain market share by delivering off-net services. Service providers will need to bring together internal initiatives with support from technology providers and wholesale suppliers alike to achieve such differentiation.

For more information on this topic, see our report Delivering business connectivity off-net: securing the right wholesale inputs.

1 MEF's Lifecycle Service Orchestration (LSO) Sonata Application Programming Interfaces (APIs).

Downloads

Article (PDF)Authors