COVID-19 will lead telecoms revenue to decline by 3.4% in developed markets in 2020

15 April 2020 | Research

Report | PDF (7 pages) | IoT Services| Fixed Broadband Services| Mobile Services| Operator Investment Strategies| European Core Forecasts| SME Services| Cloud Infrastructure Strategies| Next-Generation Wireless Networks| Video, Gaming and Entertainment| Enterprise Services

Listen to or download the associated podcast

We expect the impact of COVID-19 to correspond with a year-on-year decline in telecoms revenue of 3.4% in 2020 across developed markets.1 This is in contrast to our pre-COVID-19 forecast of an increase of 0.7%. Telecoms is a relatively resilient sector and will perform ahead of general GDP trends. As a result, we expect telecoms (and paid-for TV/video services) to account for 2.0% of GDP on average across developed markets, an increase from 1.9% in 2019.

The industry will return to growth in 2021, with a year-on-year revenue increase of 0.8% driven by pent-up demand in consumer broadband. This is a less pronounced rebound than for overall GDP. The sector will be 4% behind where we had previously expected it to be in 2021. Profits will be hit, but we do not expect the average EBITDA margin to fall by more than 2 percentage points. Operators will be able to manage their costs by deferring some capex, and scaling down opex where possible.

- The consumer telecoms market is relatively resilient in an economic downturn. Consumer services, which account for the majority (68%) of telecoms revenue, tend to be more resilient than business telecoms services during economic downturns. The restrictions of movement in place in many countries and the emphasis on home working and entertainment means that fixed broadband services perform relatively well.

- Business telecoms will be hit by the slowing economy. Large increases in unemployment, business closures and the overall decrease in economic activity will cause a sharp decline in business services revenue. Business mobile revenue, in particular, will struggle in 2020.

- Capex will rebound quickly in 2021. Lockdowns will reduce capex and opex in 2020. Generally, capex will rebound quickly, but 5G capex recovery will be slower in Europe than elsewhere. The pandemic will reinforce and accelerate existing opex trends rather than introduce new ones. Profits will fall, but we do not expect EBITDA margins to fall by more than 2 percentage points.

Our impact assessment used an aggregate of data from 32 developed economies. The impact on telecoms markets will of course vary by country, as will the scale of the health and economic crisis. This document is an initial response from the Analysys Mason Research team. We are working on a more complete set of revisions to our market forecasts. At the time of writing, it is too early to make assumptions about the impact of the pandemic on emerging economies.

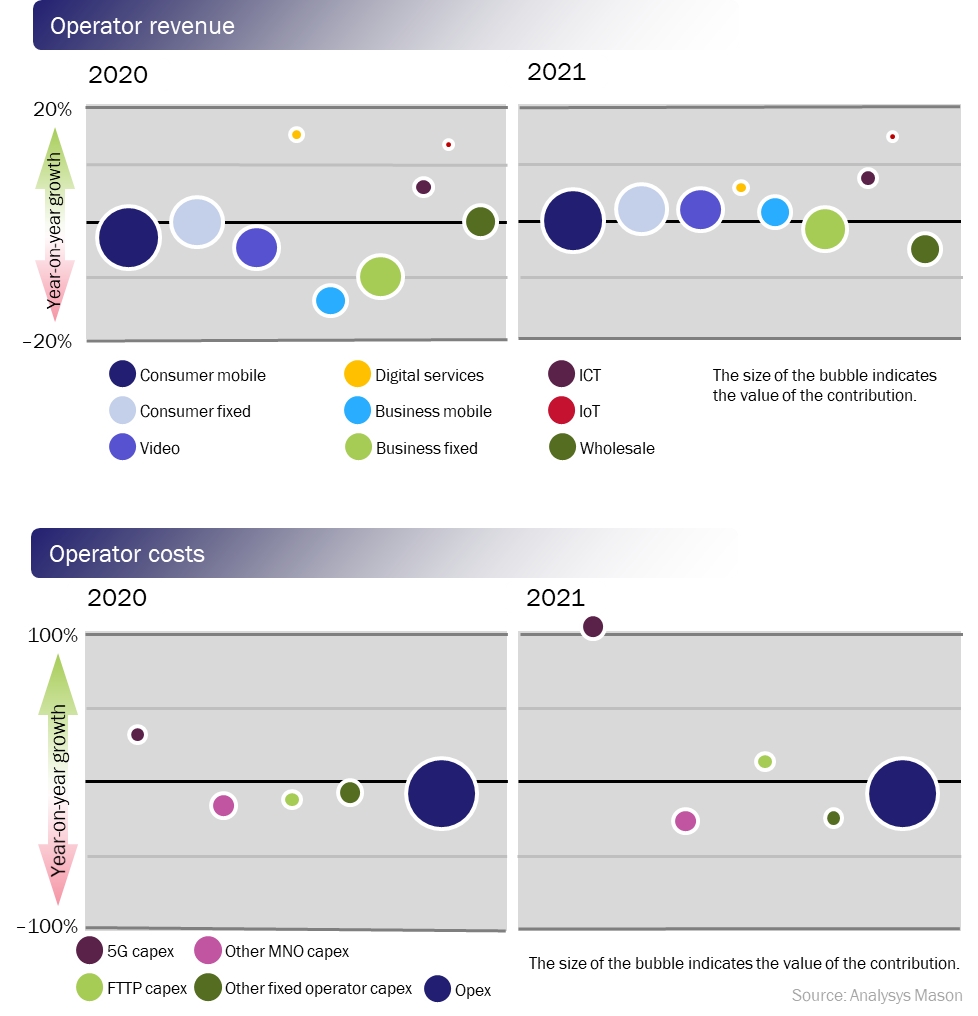

We have assessed the impact of COVID-19 on the major contributors of revenue and cost for telecoms operators (see Figure 1). On the revenue side, we have provided estimates of the impact for nine revenue lines across consumer, business and wholesale segments. For costs, we have broken out opex and capex, with capex split into fixed and mobile elements.

Figure 1: Impact of COVID-19 on telecoms revenue and costs in 2020 and 2021

We have assumed that GDP in developed markets will decline by 6% year-on-year in 2020

Assessments of the economic impact of COVID-19 are highly variable and subject to change as the pandemic progresses. The macroeconomic scenario underpinning this impact statement is based on a range of third-party GDP forecasts published between 23 March and 9 April 2020.

We assume that the most badly affected quarter in terms of economic output will be 2Q 2020, when we expect GDP to decline by 11% (37% on an annualised basis). We assume that output in these markets will start to rise in 3Q 2020 and will have returned to where it was in 4Q 2019 by the end of 2021, having fallen 6.1% for the whole of 2020 and rising 4.6% for the whole of 2021. In effect, this represents '2 wasted years'. We assume that economic inactivity (unemployment + furloughed workers) will rise to 25% in 2Q 2020, fall to 15.5% by the end of 2020 and pick up during 2021 to reach similar levels to those of 4Q 2019. We make no assumptions about the longer-term knock-on impact of intense fiscal stimulus, or the impact of political resistance to stimulus.

Revenue impact

Overall revenue declines are expected to amount to 3.4% in 2020 (against a previous forecast of an increase of 0.7%) with a modest rebound of 0.8% in 2021. Consumer services, which account for the majority (68%) of telecoms revenue, have a demonstrable level of resilience during economic downturns. The restrictions of movement in place in many countries and the emphasis on home working and entertainment means that fixed services perform relatively well. However, business telecoms will be badly hit. Increased unemployment, business closures and the overall decline in activity mean that spend by businesses on telecoms will fall sharply.

Consumer revenue

Consumer mobile services

The consumer mobile market has proven relatively resilient in past economic downturns. However, the current lockdown period is different in that mobility is restricted for large parts of the population. Mobile data usage may continue to increase in some countries (as reported by operators in Italy and Spain, for example) but will decrease as a proportion of total data traffic as many people rely more heavily on their fixed connections.

Given this context and the pressures on consumer spending power, operators are likely to have difficulty upselling customers to larger packages and we therefore expect further ARPU erosion. Many of the current promotions (such as Movistar's additional data allocation of 30GB per month and provision of additional free content via the Movistar Lite + app) are an attempt to anticipate this difficulty. New device purchases will also fall, which will hinder the migration to 5G. Prepaid spend will be worse hit than postpaid in 2020.

Outside the EU, roaming out revenue will plummet. In contrast to many other revenue lines, mobile is unlikely to have much of a bounce back in 2021; losses are hard to recover. We expect a reduction of 2.6% in retail revenue in 2020 with a year-on-year increase of 0.2% in 2021.

Consumer fixed services

The consumer fixed segment will not be dramatically affected by the coronavirus pandemic. Fixed broadband subscriber growth will be lower than we previously forecast in 2020, but will still occur. Some churn will happen due to income constraints but with many people spending more time at home, fixed broadband connections will demonstrate their value. Growth in the number of new subscribers will also be affected by constraints on engineer visits.

In 2021, net additions will be higher than we previously forecast as the economy recovers somewhat but many people continue to spend much time at home. We predict that broadband ASPU will be broadly flat. Operators will struggle to justify price rises during a recession and while, on one hand, some customers will be likely to upgrade to higher-speed offers, on the other hand, many upgrading customers will experience delays for new fibre connections. We expect revenue to decline by just 0.4% in 2020 and increase by 2.1% in 2021.

Pay-TV and video services

Consumers will retain traditional pay-TV services (satellite, cable and IPTV) throughout the pandemic due to the growing importance of in-home entertainment. The number of customers that pay for multiple subscription packages (service stacking) will increase in the short term as will the number who use ad-hoc on-demand content (TVoD). New direct-to-consumer services such as Disney+ are already benefiting. However, operators are more exposed to the disruption to live sports, which will have a marked negative impact on retail revenue in 2020, affecting both the traditional pay-TV segment and operator OTT services. Revenue will decline by 4.7% overall in 2020, but will increase by 1.5% in 2021.

Digital services

Digital services only represent a small proportion of operators' total revenue (under 5% for most of them, often much less) and so will not have a major impact on the overall outlook. However, we expect the impact to be positive as consumers use more, and sometimes adopt new, digital services. We expect some of the new behaviours to persist beyond the crisis. Operator revenue from mobile financial services and contactless payments are, for example, expected to increase alongside online commerce and consumption of new types of content. We expect an increase of 15% in 2020, 6 percentage points higher than we were previously expecting.

Business revenue

Business fixed services

Fixed voice and broadband revenue will fall in 2020 as branch sites (especially those in retail and hospitality) are forced to close and a significant number of small businesses cease trading. This will return to near-normal levels by the end of 2022 in line with predictions for recovering levels of employment. We expect spending on corporate data services to remain more robust, with major infrastructure changes likely to be postponed until at least 2021. Some large firms will face serious financial difficulties, but others will place increased emphasis on data connectivity to support increased use of cloud services. We expect revenue to decline by 10% in 2020 but only by 1% in 2021.

Business mobile services

In the short term, a drop in business travel will reduce mobile business revenue, but this will be partially offset by an increased provision of mobile phones for employees working from home. Rising unemployment will cause a more significant decline in mobile business revenue in both 2020 and 2021, although some key verticals for the mobile sector such as logistics and supply-chain will be shielded from the worst impact. Overall, we expect mobile business services revenue to experience a significant fall in 2021, with a recovery close to pre-crisis levels by the end of 2022. Revenue will decline by 12% in 2020 recovering slightly in 2021 with a 2% year-on-year increase.

Operator ICT services

Key ICT services offered to businesses by operators include colocation and hosting, security, unified communications and hosted voice. Business demand for these services has increased rapidly since the crisis began, and we expect this accelerated take-up to persist throughout 2021 and beyond as businesses become accustomed to new models of working and plan for improved business continuity in future. The impact of rising unemployment will result in lower-than-expected growth in ICT services revenue in 2020, but by 2022 we expect it to have risen to levels higher than pre-crisis predictions. We expect growth of 6% in 2020 (instead of 8%) and 8% in 2021 (in line with previous forecasts).

IoT connectivity services

IoT accounts for only a small share of telecoms operators' overall revenue, typically less than 0.5%. COVID-19 will have an impact on demand (many IoT projects are likely to be put on hold, or cancelled) and will cause supply-side disruptions. The pandemic has already affected the large IoT verticals such as automotive. For example, the ACEA estimates that over 1.4 million units of production have been lost in Europe since shutdown began. The decline in automotive sales will probably have the largest impact on IoT in 2020 and 2021. However, the installed base of IoT connections that are already active will be subject to contract terms and will continue to generate revenue. IoT revenue will increase, albeit more slowly than previous expected, at 13% in 2020 (instead of 16% previously forecasted).

Wholesale revenue

The wholesale market has largely discrete components that are subject to a variety of market dynamics. Overall, we expect 3% growth in 2020 and flat in 2021, compared with the 2% decline that we previously forecast for both years. International roaming will decline by over 80% during lockdowns, and will not fully recover in 2021 because of a prolonged slump in international travel. Voice traffic is up by around 50% during lockdowns, and we expect interconnect revenue to rise by 15% in 2020 and to return to normal in 2021.

Backbone capacity wholesalers will see growth; an ever-growing share of their revenue comes from 'OTTs' and these are experiencing a supernormal rise in demand. This crisis shows the weakness of over-reliance on a just-in-time model for capacity, and some OTTs might be pushed into more self-supply. Wholesale access and B2B services will follow the direction of their retail equivalents.

Costs impact

The pandemic reinforces the status of telecoms/ICT as essential infrastructure. Telecoms should show some of the strongest post-crisis investment in part because the industry has more resilient cashflow than most sectors, and because some governments will emphasise 5G and fibre in stimulus packages. We expect capex and capital intensity (capex/revenue) to take a short enforced hit in 2020, and to accelerate strongly in 2021. In the short term, operators will make some enforced reductions in opex, but they will have limited room for manoeuvre. In the longer term, the crisis will probably amplify and accelerate existing opex optimisation efforts through digitalisation, automation and simplification.

Capex

Operator capex is likely to fall in 2020 because of constraints in the ability to build and because of disruption to supply chains. We revise our previous forecast of +0.3% growth to –3.7% for the year but expect strong rebounds in 2021.

Infrastructure/FTTP

Fibre-to-the-premises (FTTP) capex will fall in 2020 because lockdowns constrain network build. Supply-chain disruption will be a much smaller factor than work restrictions. We expect a strong rebound by the end of 2020 and into 2021, with capex accelerating as operators benefit from the low cost of capital and some stimulus, and redouble on 'safer' long-term investment. In 2021, we expect FTTP spend to be 12% ahead of what we had previously forecast, in part catching up on time lost in 2020. Heavy expenditure on fixed telecoms infrastructure in a downturn was a strategy that several operators adopted during the 2008 financial crisis. Infrastructure funds will be reassured by the huge traffic demand on residential fibre networks, and more than ever will treat fibre as a safe haven.

Mobile/5G

Mobile capex will inevitably be curtailed in 2Q 2020 and probably into 3Q, but should rebound into 2021. There will be greater supply-chain disruption for 5G build than on the fibre side, and underlying geopolitical trends towards fragmentation and on-shoring of supply chain will be accelerated. After the lockdowns, North America and Europe will follow different paths. Verizon has already indicated accelerated investment in 5G, and the US government will probably put stimulus into 5G. On the whole, Europe will follow a somewhat different trend: 5G is seen as less urgent and remaining auctions are likely to be delayed (for example, in Austria, France, Portugal and Spain). We forecast that 5G spend in developed markets in 2021 will be 8% ahead of what we had previously forecast, but by less than this in Europe. Network cloud investments will be put on hold in part because of uncertainties about future enterprise spend, but they will also follow the distinct regional trends of 5G.

Discretionary investments by operators will fall. In an economic downturn, operators will tend to focus on lower-risk infrastructure than riskier growth areas, except where those investments have a direct bearing on reducing the impact of the global health crisis.

Opex

The pandemic reinforces existing opex trends rather than introducing many new factors.

Employment and employment costs

The ability of telecoms operators rapidly to scale down the staffing of their businesses in the face of revenue challenges, while retaining the ability to scale back up, is limited, and will depend on employment laws and governments' willingness to bail out furloughed staff. Automation initiatives were already trimming workforces, and operators will double down on these efforts. However, even if national furlough schemes do not exist, operators will find it politically difficult to lay off lower-paid staff, especially if the telecoms industry proves more resilient to the crisis than most other verticals. For example, Telstra stopped previously announced redundancies, in part for political reasons. Senior management salaries and bonuses will be cut.

Retail

It is unlikely that the footprint of bricks-and-mortar telecoms retail in 2021 will be the same as if the pandemic had not happened. The crisis is an opportunity to accelerate and stress-test digitalisation programmes. Even so, it has always been easy to exaggerate the impact of digitalisation initiatives such as these: even if half of all stores do not reopen, and half of staff cannot be reallocated, it is difficult to see how more than 2% could be shaved off opex. In practice, this will make little difference in 2020 but retail transformation is likely to be accelerated in 2021.

External services

External spend on IT and professional services will fall by about 7% (as opposed to the 13% growth that we previously expected) during the lockdowns because it will not be possible for about half of contractors to work remotely. However, growth should rapidly return to expected levels in 2021.

Network sharing

The trend towards network sharing will be accelerated. Regulators may take a more relaxed view of mobile network sharing agreements, shifting some of their scrutiny from competition to robustness and the economic health of the whole ICT sector.

Property and overheads

Reducing property portfolios is already a trend. One possible lasting consequence of this crisis as opposed to other economic shocks, is that it may demonstrate that large businesses, including telecoms operators can manage quite well with a higher proportion of staff working from home. More-distributed working could save on overheads, although the next 2 years at least will not be a good time to release value from excess property.

Implications for profitability

Telecoms should stay healthier than almost any industry in this crisis. Falls in absolute EBITDA are inevitable for 2020 and 2021 as the revenue base shrinks, but because opex will decline by an accelerated degree, average EBITDA margin should not fall by more than 2 percentage points. Free cash flow as a proportion of revenue ((EBITDA-capex)/revenue) will fluctuate as phasing of revenue declines and cost declines will be different. Some enforced reductions in capex will help to stem any fall in free cash flow. Additionally, it is already clear that like many large businesses, established telecoms operators will cut dividends to preserve cashflow for major infrastructure projects (mainly fibre and 5G).

1 Our impact assessment used an aggregate of data from 32 developed economies: Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Latvia, Lithuania, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Turkey, UK and USA.

Download

Report (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Authors