Huawei’s ‘ultra-simplified’ 5G RAN solutions could help MNOs to address the needs of consumers and businesses

Mobile network operators (MNOs) must plan and deploy 5G mobile technology infrastructure in order to meet growing demands from customers for a higher-quality network experience, but also to ensure that their networks are capable of addressing other revenue-generating use cases, such as those from businesses. MNOs also need to work with vendor partners to deploy their next-generation networks to deliver on their go-to-market KPIs, such that they remain competitive.

One of the challenges in achieving these goals is that MNOs’ radio sites are already crowded with non-5G hardware.

Huawei held its Mobile Broadband Forum (MBBF) 2020 event online in November 2020. During this event, it announced its 5G portfolio of solutions that the company describes as being designed for building ultra-simplified “1+N” 5G networks.

MNOs face challenging business scenarios, but they must proceed with 5G roll-outs to meet customer expectations

MNOs understand that the perception of network performance plays a major role in customer satisfaction and is one of the main factors in customer churn and long-term business success. ARPU has been flat or declining in many countries during the last 5 years, but MNOs must continue to upgrade their 4G networks and deploy 5G networks to remain competitive.

This is a challenge to MNOs’ finances given that consumers are generally unwilling to pay higher prices for a faster connection. In order to boost ARPU, MNOs have attempted to bundle value-added services, such as streaming music and video, with their mobile contract propositions, but most of those have met with limited success. Fortunately, 5G will deliver new monetisable features and network capabilities, such as the ability to connect a large number of devices per square kilometre, ultra-low latency communications for a much faster network response and significantly higher network reliability, compared to previous technology generations.

These capabilities will enable MNOs to improve their portfolios of services, targeting consumers and enterprises with use cases, such as high-quality augmented reality/virtual reality (AR/VR) gaming and ultra-low-latency-driven robotic arms used in smart factories.

MNOs must build their next-generation networks to deliver on the promise of these use cases and derive new revenue, but they must make sure the deployments are cost effective. Analysys Mason conducted a survey of 60 MNOs, including those in Tier 1 and 2, and found that over half the respondents placed total cost of ownership (TCO) reduction in their top-two objectives for next-generation network deployments (see Figure 1). Other important drivers were supporting new revenue-generating services from consumers and enterprises.

Figure 1: MNOs’ most important high-level commercial goals for 5G networks1

Question: “What are the most important business drivers for your next generation network deployment? (please select the top 2).”

MNOs’ site architecture is already complex yet 5G will require additional hardware

The three MNOs in South Korea were among the first to launch 5G services in 2Q 2019. Around 150 MNOs in 59 countries have launched 5G services since these first launches. We forecast that 5G coverage will reach 2.8 billion consumers worldwide by 2025 , with coverage in regions such as developed Asia–Pacific (DVAP), the Middle East and North Africa (MENA) and Western Europe (WE) reaching 194 million, 126 million and 262 million, respectively. This indicates that MNOs need fast roll-out processes in place.

There are many challenges in reducing TCO. The introduction of 5G services will create additional mobile data traffic that MNOs will need to carry on their networks. We forecast that annual cellular data traffic will reach 2490 exabytes by 2025, of which 5G handset data traffic will be 1000 exabytes. 5G handset traffic in Saudi Arabia, South Korea and Spain will reach 12.6 exabytes, 25.5 exabytes and 5.8 exabytes, respectively.

MNOs will need to address the increasing volume of network traffic by acquiring spectrum in bands such as 5G’s 3.5GHz and 28GHz. This will require MNOs to install new radio unit (RU) hardware and antenna elements at radio access network (RAN) sites. However, most RAN sites in the DVAP, MENA and WE already contain the hardware to deliver other radio access technologies (RATs), such as 2G, 3G and 4G networks. Space is limited at these sites and the architecture is already quite complex. There is limited space at the foot of the towers where much of the electronic equipment, such as air conditioning units, batteries and power supplies are stored, and at the top of the towers, where the radios and antennas are installed.

Another challenge to MNOs’ business case is growing opex costs, which, if unchecked, would put operators’ margins at risk, especially because 5G will require additional network equipment at the sites to serve the new spectrum bands. Furthermore, regulatory requirements in many countries will force MNOs to deploy new legacy RAT sites in areas where coverage is poor.

To meet their deployment goals, MNOs will need efficient site design and automation, and a significantly simplified site architecture.

Huawei’s ultra-simplified solutions could help to address MNOs’ challenges, but parties must collaborate to deliver results quickly

Huawei was the top vendor in the 5G RAN market in 2019 when it accounted for 26% of product revenue. During MBBF 2020, Huawei announced its new 5G solutions that are designed for building simplified 5G networks. The vendor understands that MNOs will require “1” layer of ubiquitous high-performance and high-capacity network that delivers connectivity to consumers and IoT devices. Connecting people requires a contiguous high-bandwidth network to provide a premium experience at reduced per-bit costs. Connecting things also requires ubiquitous coverage to support the massive connectivity of IoT terminals. However, MNOs will find it difficult to address enterprise requirements because they will not be able to deploy all the 5G capabilities required ubiquitously and in a cost-effective manner. For this, they must build the “N” number of capabilities more selectively, delivering the use case requirements where needed.

One of the main challenges that MNOs face is maintaining all the legacy network services while adding the necessary RUs, antennas and other power supply equipment required for 5G networks. MNOs in most regions can own up to 10 separate spectrum blocks in the sub-3GHz bands, which service 4G (as well as 3G and 2G) networks. Many still use legacy single band RU hardware and single port antennas, where the combined set delivers a service on a single radio band in a single sector. To create efficiencies and reduce the required space on the site towers, MNOs should upgrade each sector’s hardware to multi-band RUs, combining a larger number of spectrum bands in a single box. This together with multi-port antennas reduces the number of boxes installed. Huawei’s Blade Pro Ultra-Wideband RU combines all the sub-3GHz bands in a single RU hardware, significantly reducing not just the hardware and the installation time required, but also the opex per sector.

MNOs should, where possible, ensure that they use the newest technologies, such as the BladeAAU Pro, as they plan their network migration strategies. This combined active (64T64R or 32T32R) and passive antenna serves both 5G and non-5G RATs, respectively, further improving site TCO. Furthermore, those MNOs that want to address the enterprise B2B market can benefit from solutions such as the Super Uplink.

Scaled deployment worldwide has shown that time division duplex (TDD) high-bandwidth massive MIMI (M-MIMO) antennas are recognised across the industry. TDD IF M-MIMO used with 3.5GHz spectrum achieves the same level of coverage as 1.8 GHz, delivering a tenfold improvement in user experience compared to that of 4G. The performance of the same hardware can vary considerably with different algorithms. As the cornerstone of M-MIMO performance, algorithms greatly affect the performance of commercial networks.

Huawei continues to work with its MNO customers, such as LG U+ in South Korea and Sunrise in Switzerland, as they plan and roll out their 5G networks. Huawei provides RAN equipment to many MNOs, but provides Sunrise with an end-to-end network.

RootMetrics, an independent network KPI benchmarking company, delivers its reports on a bi-annual basis. For the analysis of network results, it is important to bear in mind that RAN hardware and the amount of spectrum availability play an important role in delivering good KPIs, but other network domains, such as the core, play important roles also.

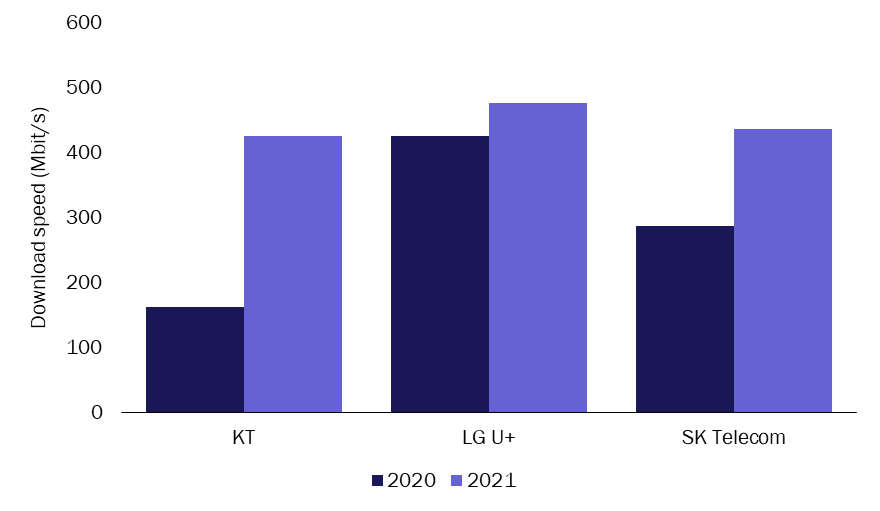

RootMetrics conducted tests for the three MNOs in South Korea in 2H 2020. Both KT and SK Telecom (SKT) obtained 100MHz of spectrum in the 3.5GHz band, while the challenger LG U+ obtained 80MHz during the 2019 spectrum auctions. Nevertheless, LG U+ outperformed its rivals on both speed and latency tests in Seoul, delivering 476.5Mbit/s median downlink throughput compared to SKT’s 436.2Mbit/s. LG U+, despite its limited spectrum holdings, delivered 430.8Mbit/s overall median downlink throughput in Incheon, the country’s third-largest city, compared to KT’s 431.1Mbit/s in speed tests and first position in latency tests.

Figure 2: 5G median download speeds by operator, Seoul, South Korea, 2020 and 2021 [Source: RootMetrics]

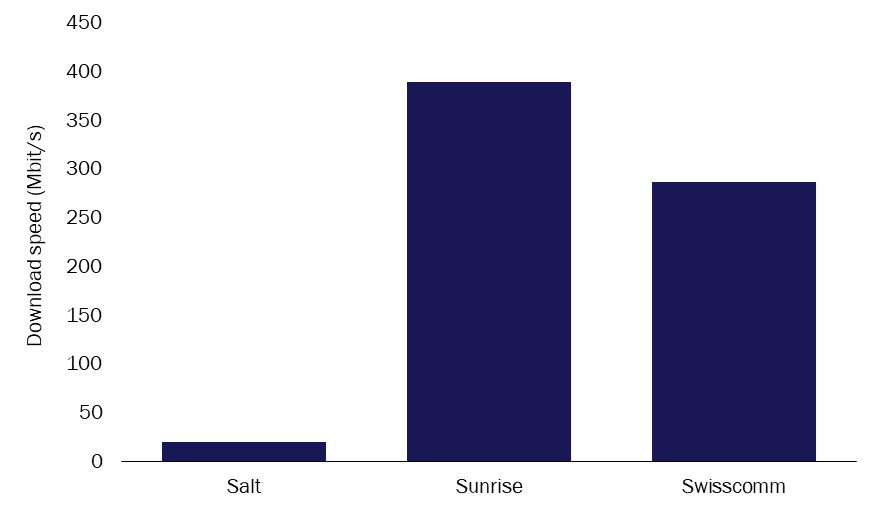

During the 5G spectrum auction that was finalised in in Switzerland in February 2019, Swisscom, the incumbent, obtained 120MHz in the 3.5GHz band, while Sunrise and Salt obtained 100MHz and 80MHz, respectively. RootMetrics’ 2H 2020 results indicated that Sunrise led the median download speed and latency 5G tests in Geneva with 389.2Mbit/s and 30.3ms compared to Swisscom’s 286.4Mbit/s and 33.8ms.

Figure 3: 5G median download speeds by operator, Geneva, Switzerland, 2H 2020 [Source: RootMetrics]

Pioneering algorithms will enable MNOs to significantly improve user experience and the cell capacity of 5G networks. Huawei’s adaptive high resolution (AHR) algorithm aims to help MNOs to expand network capacity in scenarios with a high density of users and strong interference.

MNOs that want to plan their next-generation 5G networks, should work with their vendor partners to use the forthcoming upgrade cycle and plan their site simplification strategies to ensure that they streamline their existing networks and deliver the use cases that will address the requirements of their consumer and enterprise customers.

This article was commissioned by Huawei. Analysys Mason does not endorse any of the vendor’s products or services.

1 Respondents first provided a free-form list of goals. They were then asked to select the two most important goals from the six that were most commonly cited.

Huawei’s ‘ultra simplified’ 5G RAN solutions could help MNOs to address the needs of consumers and businesses

DownloadRelated items

MWC 2024: the Open RAN market has entered a new phase, led by a clique of large vendors and operators

Article

Sub-Saharan Africa led 5G network launches in 2023, but 5G SA slowed despite growth in Western Europe

Article

5G deployment tracker 2H 2023