Operators’ potential approaches to Alphabet’s expansion range from competition to collaboration

Alphabet, through the core products managed by its subsidiary, Google (including Search, Gmail and Android), enjoys extensive market reach, with seven products that each have over 1 billion monthly active users. However, Alphabet relies on Google for 99% of its revenue – 87% of which comes from digital advertising. Alphabet is aware that its dependence on advertising puts it at risk from changing consumer behaviour, increasing regulation and new competitors.

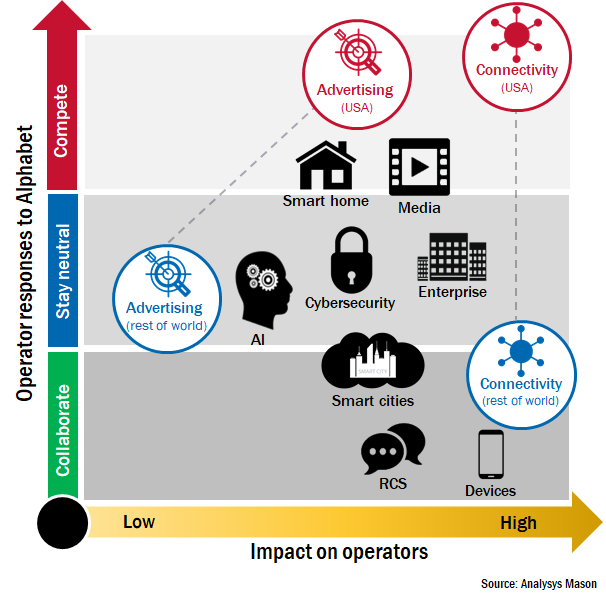

When Google reorganised as Alphabet in 2015, its core activities (advertising, cloud, YouTube and hardware) were isolated from its 'Other Bets' (other segments such as connectivity and smart homes), some of which have a direct impact on operators' activities. Operators have responded to the competitive pressures posed by Alphabet's activities by either competing, resisting or collaborating with Alphabet (see Figure 1). This article discusses potential operator responses to Alphabet and Google's activities in digital advertising, smart cities and Rich Communications Services (RCS).1

Figure 1: Potential responses by operators to Alphabet's activities

To compete against Google in digital advertising, operators should consider a similar high-investment strategy to that adopted by US operators

AT&T and Verizon are investing heavily to gain the adtech and inventory that will help them to compete against Facebook and Google, particularly in the contested video market. Changes in US regulation are also enabling operators to monetise their subscribers' data more effectively.2 For example, Verizon's Oath division posted USD2.2 billion in revenue in 4Q 2017, corresponding to 8% of service revenue for the period.3

Operators that are active outside of Google's (and Facebook's) main markets have a greater potential for success in filling the market gaps left by these players. Opportunities for operators lie primarily in emerging markets such as the Middle East and North Africa and emerging Asia–Pacific. Operators could also explore investing in technology and digital properties to provide digital advertising services on their own ad inventory.4

Nevertheless, more-stringent regulation related to the use of personal data may impair the ability of Internet giants and operators to monetise consumer data.5

Operators should explore filling the gaps in Alphabet's smart-city initiatives – either as partners or as competitors

Alphabet's efforts in the smart-cities vertical are still nascent, but trials are being planned. For example, Sidewalk Labs, Alphabet's smart-cities company, has deployed connected kiosks in New York City, and is involved in planning for a larger-scale trial of its smart-city technology in Toronto's formerly industrial Eastern Waterfront area. However, it remains unclear whether Alphabet is the most-adequate partner for public bodies and urban regeneration projects. In contrast, operators are already accustomed to negotiating with, and supporting, local governments. This could make them preferred partners for deploying and managing smart-city solutions, provided that they clearly address the issues of data privacy, security and ownership, and conduct the consultation and planning processes transparently.

Ultimately, Alphabet may lack the appetite to support smart cities – and possibly some smart-home activities – outside of the USA. Capabilities around customer support, including well-staffed call centres, or the willingness to deal with local authorities and planning processes represent areas in which operators have expertise. Operators can in turn consider becoming partners with Alphabet, or competing against it, if necessary.

Google's involvement with RCS aligns its interests with mobile operators, at least temporarily

Google's acquisition of Jibe Mobile in 2015 gave the GSMA's ailing RCS initiative a major ally with leverage in the device value chain. Google was able to channel operators' efforts into specifying a 'universal' RCS profile that gained acceptance with Android device original equipment manufacturers (OEMs). Handsets with embedded RCS capabilities are expected to be made available in 2018, and some operators consider RCS to be an opportunity to regain a competitive position in person-to-person (P2P) messaging.

The viability of this strategy will likely depend on the extent to which messaging apps such as WhatsApp have taken hold in an operator's domestic market. Ultimately, however, operators need to have a longer-term vision for RCS and how it will work to support their business needs, and they must offer a stronger collective vision if they are to shape the future of RCS because Google is currently setting the agenda.

1 This article accompanies our recently published strategy report Alphabet’s strategy: what it means for telecoms operators, where these topics are discussed in more detail.

2 For a more-detailed discussion about how regulation is shaping operators’ and Internet players’ ability to monetise private user data in the USA compared with Europe, see Analysys Mason’s Operators’ approaches to customer data monetisation in Europe and the USA are diverging due to regulation.

3 For more information, see Verizon’s 4Q 2017 earnings results. Available at: http://www.verizon.com/about/investors/quarterly-reports/4q-2017-quarter-earnings-conference-call-webcast.

4 Our forecasts of operators’ potential revenue from advertising and other digital activities in those regions can be found in the following reports: Digital service opportunities in the Middle East and North Africa: trends and forecasts 2017–2022 and Digital service opportunities in emerging Asia–Pacific: trends and forecasts 2017–2022.

5 For more information, see Analysys Mason’s Operators’ approaches to customer data monetisation in Europe and the USA are diverging due to regulation.