The COVID-19 pandemic will accelerate businesses’ move to the cloud

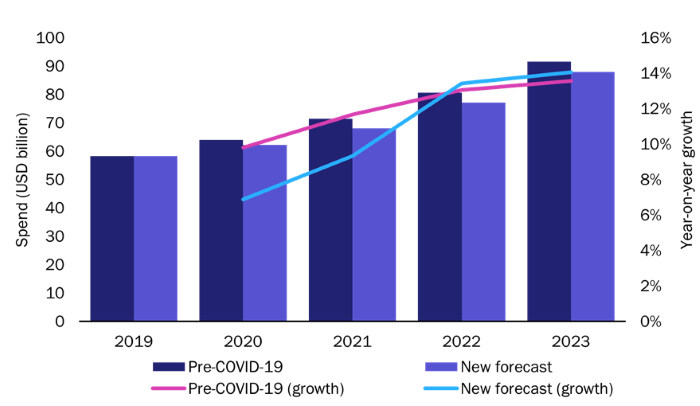

Spending on IaaS servers, co-location services and on-premises servers (which we collectively refer to as ‘servers’) by small and medium-sized businesses (SMBs) worldwide will grow by 7% year-on-year in 2020. This rate of growth is faster than that for the overall IT solutions market, but is slightly lower than we had previously forecast due to suppressed economic activity and a lower-than-expected demand from enterprises. However, if the COVID-19 outbreak peaks in 2020 and economic activity returns by the end of 2021, we forecast that the server market will grow by 10% in 2021, and that it will return to a pre-COVID-19 growth trajectory by 2022 (Figure 1).

Figure 1: SMB spending on servers and year-on-year growth, before and after COVID-19 revisions, worldwide, 2019–2023

Source: Analysys Mason, 2020

Spending on IaaS servers will drive the overall growth in the SMB server market. The pandemic will accelerate the fall in spending for on-premises server, but the impact of COVID-19 on IaaS server spending will be minimal. Indeed, SMB spending on IaaS servers will grow at a CAGR of 24% between 2020 and 2025, driven by an increased demand for servers to accommodate the migration of applications to the cloud and the deployment of next-generation technologies that require specific computing capacity.

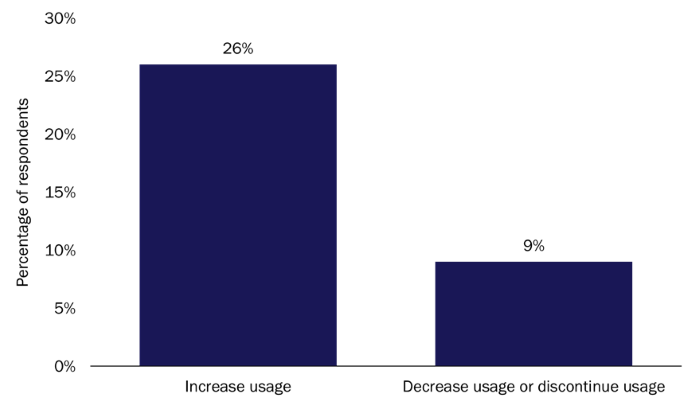

Analysys Mason carried out a survey of over 400 SMBs in the USA in April and May 2020 to assess the impact of the COVID-19 pandemic. The survey revealed that 6% of SMBs started to use cloud infrastructure solutions in response to the pandemic, and more than a quarter of respondents intend to increase their use of cloud infrastructure once restrictions have been relaxed. (Figure 2).

Figure 2: SMBs’ planned use of cloud infrastructure solutions once COVID-19 restrictions have been relaxed, USA, 1Q 2020

Source: Analysys Mason, 2020

SMB spending on servers will continue to grow more quickly in Asia–Pacific than in any other region

SMB spending on servers in the Americas is expected to grow by just 6% year-on-year in 2020; it will then return to 11% growth in 2022. Most of this spending will come from the USA, where the economic downturn will have a significant impact on server demand. SMB spending on servers in Europe will grow by 5% year-on-year in 2020, and the growth rate is expected to reach 11% in 2022 (exceeding the pre-COVID-19 forecast).

Spending on servers among SMBs in Asia–Pacific will grow by 11% in 2020; this is 3 percentage points less than the pre-COVID-19 forecast. The SMB cloud server market in China and India will grow at a CAGR of 36% and 40%, respectively, between 2020 and 2025, supported by government-led digital transformation initiatives and improved digital infrastructure. Emerging Asia–Pacific will have the second-highest level of SMB server spending (23%) after North America (31%) by 2025.

The long-term outlook for the SMB server market is strong

We recommend that vendors take the following actions to make the most of the strong outlook for the SMB server market.

- Help clients to adapt to new modes of working by providing solutions that enable secure and productive operations. Many enterprises’ operations have been disrupted by lockdown measures, and employers are trying to find new ways to support remote working. Vendors should offer packaged solutions that are tailored to clients’ immediate needs, including work-from-home solutions and SMB solutions. Vendors should also consider offering remote working consulting services to help clients to transition to new ways of working faster and for less money.

- Support clients’ short-term cash flow issues. Many businesses are facing short-term cash flow issues due to the unprecedented scale and speed of the economic slowdown. Several vendors have already launched financial support programmes to ensure that their customers can provide essential technology services. For example, Dell established a USD9 billion fund to offer financing to business customers, including 0% interest rates and payment deferrals of up to 180 days. HP launched a USD2 billion fund with similar goals. Some server vendors are also providing financial support for their channel partners. For example, Dell is providing special financing plans for its partners, including 24 months of 0% interest financing for servers. Huawei also announced a 10% rebate programme for channel partners whose sales exceed USD100 000. It is hoping that this strategy of helping customers to get through the crisis will foster long-term relationships.

- Maintain a long-term focus. The effects of the COVID-19 crisis on the global economy will diminish growth in the server market in 2020 and 2021, but several key segments of the market show good growth potential for vendors in the long term. The SMB segment of the market will grow the fastest, at a CAGR of 14% between 2020 and 2025. The manufacturing sector also has significant growth potential, despite the considerable impact that the virus will have on this vertical in the short term. Indeed, spending by SMBs in the manufacturing sector will grow at a CAGR of 17% between 2020 and 2025. Vendors should continue to engage with these segments, and should tailor their solutions to industry-specific challenges.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Receive the latest news and research on SMB IT buying behaviour and forecasts

Author

Youngeun Shin

Senior AnalystRelated items

SMB IT spending forecast report: a new beginning

Report

SMBs in manufacturing and professional service industries are making big investments in CRM solutions

Article

Security vendors’ financial and operational metrics: trends and analysis