Operators should act quickly to secure a key position in the cloud-gaming value chain

20 May 2020 | Research

Article | PDF (3 pages) | Fixed Broadband Services| Mobile Services| Video, Gaming and Entertainment

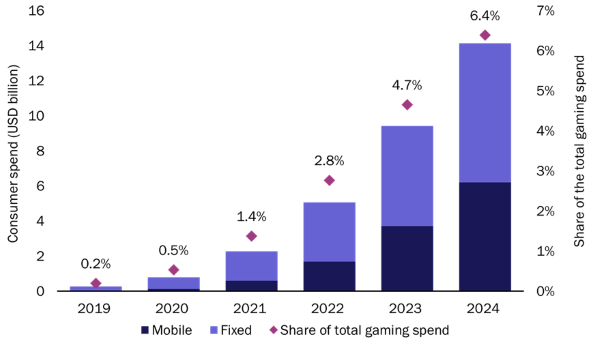

Cloud gaming (otherwise known as game streaming) is growing out of its niche: we expect that the consumer spend on such services worldwide will grow from USD265 million in 2019 to USD14.5 billion in 2024. Operators are key enablers of cloud gaming, but they must consider how best to position themselves in the market to secure the most value. This comment is based on our recent report; it highlights the role of operators in the cloud-gaming value chain and identifies the partnerships that they should form with cloud-gaming service providers.

Cloud gaming may become the main method for the delivery and consumption of video games, but there are five key barriers to overcome

Cloud-gaming services have the potential to open the door to digital gaming for new segments of users that were previously inhibited by high costs and a lack of technical knowledge, in both emerging and developed countries. It also has the potential to improve the user experience for all gamers. As such, the largest companies in the digital gaming industry and those adjacent to it (such as Amazon1) are entering the cloud-gaming space with the aim of attracting a significant share of the new (and current) gamers. Figure 1 shows that cloud gaming currently serves a small niche of the digital-gaming market (which totalled USD265 million worldwide in 2019), but the consumer spend on such services will double every year until 2024.

Figure 1: Consumer spend on cloud-gaming services and cloud-gaming spend as a percentage of the total spend on digital gaming, worldwide, 2019–2024

Source: Analysys Mason, 2020

However, the revenue growth potential within the cloud-gaming market is still limited by several barriers. These restrict the geographical reach of cloud-gaming services and affect operators’ ability to offer content at competitive prices.

- High-performance connectivity coverage. The addressable market is limited by the availability and adoption of high-speed fixed broadband and the mobile 5G network footprint.

- Server infrastructure coverage. Game-streaming platforms rely on scalable and flexible cloud server infrastructure to accommodate user base growth. The nodes must be close enough to the end users to ensure the expected quality of service.

- Cost of delivering high-quality content. The technology that powers game streaming is currently too expensive to deliver high-end content to the consumer at a competitive price.

- Content availability. Most publishers and game developers are reluctant to release new and premium content to nascent cloud-gaming platforms.

- Consumer education. Consumers must be taught the value of cloud gaming and must understand how it differs from using traditional methods of consumption.

Operators can help to lower some of these barriers, and are therefore potentially key partners for cloud-gaming platform providers. Operators can use their relationships with their existing customers to market cloud-gaming services and to educate them about the value of cloud gaming. Those with edge cloud capabilities can also offer the necessary server coverage.

Operators are natural sales channel partners for cloud-gaming platform providers

Cloud gaming requires consistent latency and speeds, and these requirements increase with the quality of the streamed content. Bundling cloud-gaming services with high-speed broadband benefits both components: the quality of the gaming experience is assured by the latter, which in turn demonstrates the value of premium broadband to the consumer. Operators’ operational size and knowledge of their home market allows them to ensure that cloud-gaming services are marketed directly to those consumers that would get the most out of the game-streaming experience, and also enables them to design appropriate marketing communications to generate awareness. Value-added services such as cloud gaming are likely to increase customer satisfaction, potentially decrease churn and offer new monetisation opportunities to operators.

Operators have a wide range of go-to-market options with varying levels of commitment, and they can use different types of cloud-gaming services to address different consumer segments. However, the three main options capitalise on the role of connectivity in differentiating the game-streaming user experience.

- Pay-TV and broadband service providers that deliver internet and content through a single set-top box (STB) can bundle cloud-gaming services in order to enhance the value proposition of the STB.

- Fixed broadband providers can bundle fixed cloud-gaming services with their best broadband plans in order to encourage users on lower-value contracts to upgrade and to differentiate their offer.

- Mobile network operators can bundle mobile cloud-gaming services with 5G contracts to demonstrate to consumers how much 5G can upgrade their digital experience.

Operators with edge cloud capabilities can become infrastructure-as-a-service (IaaS) providers

Game-streaming technology requires elements that add extra latency, such as video encoding, decoding and rendering. As such, minimising network latency (which accounts for the majority of the total latency) is crucial, thereby building demand for edge cloud services that operators can address using co-location and edge computing services. The business case for edge does not solely rely on cloud gaming, but this use case is likely to be the first large-scale application that offers sizeable monetisation potential. Telefónica (Spain), Telekom Deutschland (Germany) and SK Telecom (South Korea) are examples of operators that are planning on, or are already, deploying edge computing to support their own or third-party cloud-gaming services.

Operators that enter the cloud-gaming value chain early on will be able to accelerate the development of the cloud-gaming market and secure a larger share of the value in the long term. Operators with own-branded game-streaming services and those that support a third-party service can use their consumer and edge cloud platforms to take on the role of cloud-gaming service aggregators. However, operators should move quickly to avoid being overtaken by public cloud and data centre companies, and to make the most of their advantage in marketing cloud-gaming services before the cloud-gaming market matures.

1 New York Times (2020), Amazon Pushes Into Making Video Games, Not Just Streaming Their Play. Available at: https://www.nytimes.com/2020/04/02/technology/amazon-making-video-games.html.