COVID-19 will only have short-term impacts on telecoms software and services vendors

Listen to or download the associated podcast

Telecoms industry vendors will suffer short-term setbacks from COVID-19 as general shutdowns impede work and decision-making in 2Q 2020. However, the longer-term outlook for investment in the telecoms industry is positive, particularly in areas such as automation, virtualisation and cloud enablement. COVID-19 will not lead to any major changes in telecoms industry strategies; in fact, the pandemic amplifies the value of cloud-enabled, automated solutions, which the industry has already been pursuing.

We expect the impact of COVID-19 to correspond with a year-on-year decline in telecoms services revenue of 3.4% in 2020 across developed markets (for more details, see Analysys Mason's COVID-19 will lead telecoms revenue to decline by 3.4% in developed markets in 2020). This contrasts with our pre-COVID-19 forecast, which indicated an increase of 0.7%. Telecoms is a relatively resilient sector and will perform ahead of general GDP trends. As a result, we expect telecoms (and paid-for TV/video services) to account for an average of 2.0% of GDP across developed markets, an increase from 1.9% in 2019.

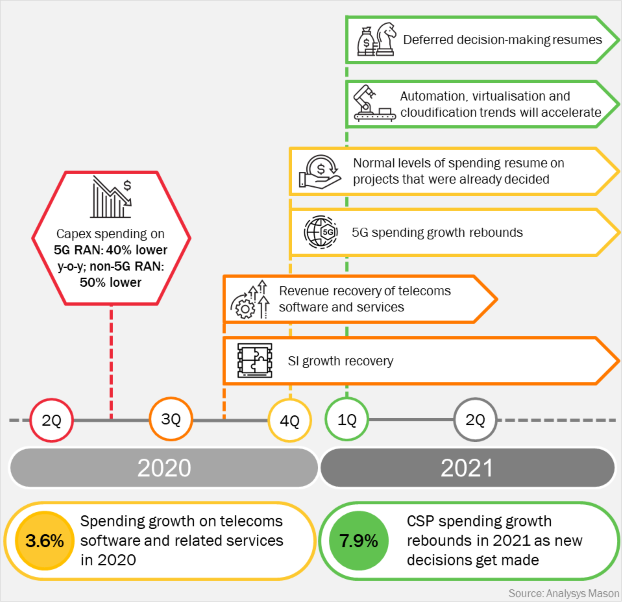

Figure 1: Key milestones in COVID-related telecoms software spending

Telecoms software and services spending: CSP customers will proceed with new investment decisions in 2021

Communications service provider (CSP) spending on telecoms software and related services will grow by 3.6% in 2020 as compared with our prior expectation of 6.7%. The global shutdown will have a severe impact in 2Q 2020 but we expect a recovery in 3Q 2020, with close-to-normal spending levels returning in 4Q 2020. We expect CSP software and services spending to rebound in 2021 to 7.9% growth. The telecoms industry will be more robust than almost any other industry during this crisis. In all industries, including telecoms, automation will be more valuable than ever, providing better user support and lowering operating costs. As a result, vendors should have confidence that their CSP customers will quickly resume suspended projects and proceed with new investment decisions in 2021.1

COVID-19 will delay existing work, including some systems integration (SI) work, because of work shutdowns in most markets, but this work is likely to resume in 3Q 2020. The pandemic will significantly delay decisions on new projects, probably until at least 4Q 2020. Digitalisation, particularly in customer engagement, will get a boost from COVID-19 and existing customer engagement digitalisation efforts will accelerate. However, we do not expect the rapid launch of many new digitalisation efforts in 2020 because CSPs will be focused on shoring up existing operations for most of the year.

We do not expect that COVID-19 will cause significant long-term shifts in business strategy. CSPs are already committed to the digitalisation of customer operations and networks. COVID-19 will reinforce the value of these efforts but not change their direction. The shift of IT to the cloud for CSPs themselves, for their enterprise customers and for the services that their retail users consume was also already well underway. COVID-19 reinforces the value of network connectivity and of the cloud-deployed services that amplify the value of the network.

Customer engagement

The new norms that have been introduced around social distancing and working from home will accelerate CSPs' adoption of self-service capabilities, with a specific emphasis on the mobile app. The mobile app will emerge as the gateway for customer interaction. Most CSPs have their own apps, but these apps generally offer poor functionality for engaging fully with customers. CSPs will therefore need to invest to increase engagement on the mobile app. This will involve significant changes to the capabilities and design of CSPs' mobile apps, especially because a number of CSPs do not currently provide even basic functions on their mobile apps.

In the long term, the shift towards a self-care- and automation-centred approach to serving customers will have a significant impact on CSP operations. This includes the adoption of AI-based technologies such as voice and chatbots to automate level 1 and 2 support functions, proactive and pre-emptive customer engagement, contextual and hyper-personalised customer offers and process automation. These activities will reduce the role of retail stores and particularly call centres. The outsourced call centre business will suffer in the long run from this improved automation.

5G

5G is subject to the same short-term disruptions, followed by relatively rapid normalisation, as is the case for other infrastructure. However, 5G is likely to be central to stimulus and recovery programmes in many developed economies (as it already is in China), which should intensify the expected bounce-back in telecoms capex towards the end of 2020 and into 2021.2

In a revision to our telecoms capex forecast,3 and more specifically in relation to the 5G RAN, we expect to see delays to planned 5G roll-outs in the period from March to September 2020 because of postponed auctions, economic uncertainty and reduced access to sites and labour. These effects will be reduced in 4Q 2020 and the effect will be further mitigated by stimulus funding, emergency spectrum release and other 5G-centric recovery measures in major markets.

In the worst-affected quarter, 2Q 2020, we expect capex spending on 5G RAN to be 40% lower than our pre-COVID-19 forecast, while in non-5G RAN it will be almost 50% lower than previously forecast. By contrast, 5G spending in 4Q 2020 will only be down by 1% compared with the forecast, and by 1H 2021 it will be up by almost 20%. This means that, for the calendar year 2020, we expect 5G RAN capex to be 13% lower than previously forecast, totalling USD10.09 billion, with the total RAN market capex down by 31%. For calendar year 2021, we expect 5G RAN capex to be 9% above forecast at USD23.8 billion, and equal to about 35% of total RAN capex. This is approximately as expected, indicating a swing towards 5G investment.

Network virtualisation

Network virtualisation is well underway globally, although the majority of deployments continue to be based on single-vendor stacks such as those provided by the network equipment providers (NEPs) for mobile core use cases. We expect that the number of virtual network function (VNF) deployments4 will continue to grow during the crisis; their superior scalability compared with non-virtual deployments have helped CSPs to stay ahead of any capacity crunches during the lockdown. New projects (particularly those that CSPs perceive as riskier and more complex, such as vRAN deployments) or those based on less-mature technology (such as cloud-native, containerised network functions) will be more vulnerable to investment delays than projects that feature proven use cases.

Prior to the COVID-19 pandemic, we expected software and professional services spending related to VNF deployments to grow by 64% in 2020, exceeding USD5.7 billion, and by 40% in 2021 to exceed USD8.0 billion. However, delays in decision-making, CSPs' risk aversion, changing priorities and challenges with deployments due to crew safety could all reduce growth to half of what we first expected (32% (USD4.6 billion) this year). A spending rebound at the end of 2020 and in 2021 should help to reset annualised growth to 53% to bring the VNF market to about USD7.1 billion, or USD2.2 billion down for 2020–2021 from what we expected prior to the global pandemic.

Anything that vendors can do to accelerate network virtualisation decision-making and to remove deployment challenges during and immediately post-lockdown (such as guiding pre-sales customers through solution integration, configuration and testing remotely using their own lab facilities, or supporting post-sales customers through highly-automated deployments at job sites, remotely if necessary) could mitigate impediments and strengthen the market rebound.

Network automation

COVID-19 will temporarily pause spend on new automation initiatives but this spending will accelerate from 2021. The expected decline in service revenue will put further pressure on CSPs to reduce costs, with network and operations automation providing some of these cost savings. Ongoing efforts for which spending decisions have already been made will continue – these include initiatives for existing operations such as NOC/SOC automation, predictive operations and integration with self-care customer engagement channels. Outcome-based managed services for operations automation will continue. Delays in 5G RAN roll-out will result in direct delays in decisions that relate to network planning software and professional services spending.

Implementation of network automation software for new virtual networks such as network function virtualisation (NFV) orchestration will continue but new procurement decisions will be delayed. CSPs will use this time to reassess their automation technology options in light of the upcoming 5G Standalone (SA) core. Software-defined networking (SDN) orchestration spend related to SD-WAN will be reassessed (in some cases delayed and in others accelerated) as enterprises reconsider their WAN strategy in light of the empty offices and the increasing number of employees working from home since the beginning of the COVID-19 outbreak. As economies begin to reopen and 5G spending rebounds, CSPs will also accelerate their spend on network automation to support new capabilities such as network slicing and 5G core with lower opex levels.

IT cloud

Growth in CSP spend on IT cloud infrastructure and data centre SDN will contract by 5 percentage points to reach USD6.4 billion in 2020 compared with our original, pre-COVD-19 forecast of USD6.7 billion as CSPs shed back office jobs and pause IT application migration programmes to focus investment on frontline activities. We expect a rebound in 2021, with an additional 3 percentage points of growth over our existing forecast to yield a spend of USD7.3 billion, as CSPs reactivate the cloud migration programmes that they anticipate will future-proof them against market shocks in the future by delivering efficiency and resilience benefits.

AI and analytics

CSPs have a significant role to play in terms of using their big data sets to tackle the COVID-19 crisis.5 This big data can be used to support the modelling of the disease, compliance with social distancing rules and tracing the contacts of people known to be infected with COVID-19. User data is already actively being used by governments in Austria, Belgium, France, Germany, Singapore, South Korea and the UK and others to model citizen movements and compliance with social isolation rules. This emphasis on data analytics and relaxation of privacy concerns will accelerate CSPs' use of cloud-based analytics and the development of their own analytics around customer data.

1 A data annex that quantifies the anticipated COVID-19-related spending changes (by software segment) for 2020 and 2021 is available to customers on request. Please contact us for further information.

2 For more information, see Analysys Mason’s COVID-19 will lead telecoms revenue to decline by 3.4% in developed markets in 2020.

3 For more information, see Analysys Mason’s Telecoms capex: worldwide trends and forecast 2017–2026.

4 This includes vEPC, vIMS, vCPE (residential and business) and a catch-all of ‘other’ use cases.

5 For more information, see Analysys Mason’s COVID-19: operators need to overcome privacy issues in order to help combat the coronavirus threat.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Related items

Vendors must improve the power efficiency of their products to tackle Scope 3 emissions

Article

Public cloud providers are tackling soaring emissions despite being leading purchasers of renewable energy

Article

Environmental KPI tracker: network equipment vendors 2H 2022