COVID-19: operators’ business revenue results from 1Q 2020 show that the crisis is starting to take effect

Listen to or download the associated podcast

Operators’ quarterly investor reports for 1Q 2020 were filled with warning signs about the impact of the COVID-19 crisis. A temporary end to business travel, financial difficulties, business closures, rising unemployment, an increase in bad debt and the implications of a recession were all mentioned as concerns.

The crisis comes after what was a reasonably successful 2019. Indeed, many operators reversed negative revenue trends. The weighted average for business revenue growth increased from –0.6% worldwide in 2018 to 1.2% in 2019.1 However, operators expect that business revenue will decline significantly in 2020.

Operators’ business revenue in 1Q 2020 was only slightly affected by COVID-19

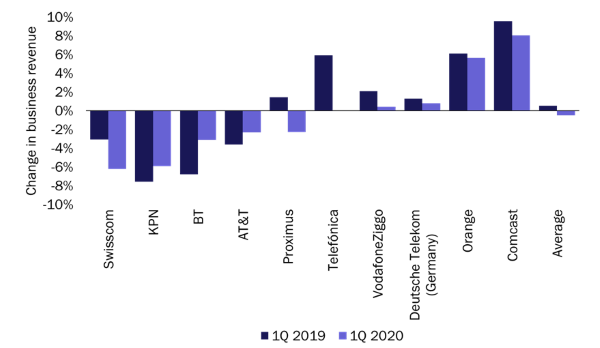

Figure 1: Year-on-year change in operator business revenue, 1Q 2019 and 1Q 2020

Source: operator reporting, 2020

The simple average business revenue growth rate for the sample declined from 0.5% year-on-year in 1Q 2019 to –0.5% year-on-year in 1Q 2020 (Figure 1) and some operators attributed this decline to the pandemic. However, most operators were only affected by the COVID-19 crisis in the last 2 or 3 weeks of the quarter. Proximus’s business revenue had been growing consistently at around 1% for several years, but this declined in 1Q 2020 due to “early signs of COVID-19 impacting fixed and mobile services”. Additional details about the impact of the pandemic were discussed in operators’ reports and are outlined below.

- Vodafone report that “the most immediate and direct impact on revenue has been from roaming.” The operator recorded a 65–75% decline in roaming revenue across its European operations during April 2020. Similarly, Deutsche Telekom reported that “retail roaming revenue decreased by 80%.”

- Rogers Canada reported that its 5% decrease in business revenue in 1Q 2020 was “largely driven by a 17% decrease in wireless equipment revenue, as a result of lower subscriber activity surrounding the COVID-19 pandemic.” Likewise, Swisscom’s business hardware sales grew by 11% in 2019, but declined by 27% in 1Q 2020.

- AT&T increased its bad debt estimates by USD250 million (equivalent to 0.7% of group revenue for the quarter) as a result of the pandemic. BT estimated that COVID-19 would cost its business division GBP51 million (USD62 million; 3.3% of business revenue), most of which was attributed to losses in account receivables. BT’s estimate for the cost of the crisis on its total operations was GBP95 million (USD115 million; 1.7% of group revenue in the quarter), which shows that business services account for 54% of the expected cost of the pandemic while only representing 27% of group revenue.

- Swisscom reported a 10% decrease in the number of orders from its business customers, and BT also reported “sharply reduced business activity and rising insolvencies, specifically among the small and medium-sized enterprise (SME) segment.” The pandemic-related slowdown is most noticeable in the SME segment, but it is also affecting large enterprises and multinational corporations. Indeed, Vodafone reported that it is “starting to see some signals of tension in [its] B2B business”, with “some delays in project spend from the big corporates.”

- Verizon reported a 3% decrease in churn for its SME customers and a 35% decrease in churn for its large enterprise and public sector customers. For Swisscom, a 24% decrease in churn was large enough to offset the 10% decrease in the number of orders.

- KPN reported that the pandemic is affecting some verticals more than others. Those affected the most include hospitality, leisure and travel, which represent around 10% of its group revenue.

Most operators have withdrawn revenue guidance amid such uncertainty, but some operators have attempted to provide rough guidelines for the impact. Comcast’s business revenue grew by 9% in 2019, but it estimates that this will drop to low single-digit growth in 2Q 2020. Verizon estimates that growth will be 3–5 percentage points lower than originally expected.

Operators’ small business divisions are likely to be the most heavily affected

AT&T reported that “the most disconcerting, troublesome area that we are seeing is what is happening down in small business.” Verizon provided more detail about the differences in how the COVID-19 crisis is affecting small and large businesses (Figure 2). Large enterprises have spent money to prepare for working from home, while small businesses have cut costs. Businesses of all sizes have postponed upgrades or have downgraded.

Figure 2: Verizon’s estimates of the early impacts of COVID-19 on business postpaid mobile service revenue, 15 March–15 April 2020 against a similar period in 2019

| SMEs (0–999 employees) | Large enterprises and public sector | |

|---|---|---|

| Gross additions | –24% | 163% |

| Upgrades | –45% | –19% |

| Device activations | –33% | 80% |

Source: Verizon, 2020

Rogers Canada reported that it is “starting to see the very early signs of potential broader economic impacts. Higher unemployment and difficulties in the enterprise side, in particular around small businesses, are going to lead to downgrade migrations.”

COVID-19 has boosted sales for VPNs, unified communications and security solutions

Many businesses have closed or reduced the scale of their operations, but others have had to quickly enable and connect remote workforces, thereby creating a spike in demand for ICT solutions. Verizon reported a 65% increase in VPN network usage and a 982% increase in the use of collaboration tools. AT&T reported high demand for VPN bandwidth and security solutions, and Telefónica spoke about the “need for speeding up digitalisation in the corporate world.”

Other operators have warned that this boost will only be temporary while businesses prepare for and adjust to lockdown conditions. Indeed, Swisscom reported a general slowdown in the orders and KPN stated that businesses “may delay IT projects.” Many of the additional ICT services currently being delivered to businesses are based on free trials or temporary extensions, and may have a limited impact on revenue. Rising unemployment will also counter an increase in the penetration rates for these services.

The long-term implications for operators’ ICT divisions are more positive

Major ICT projects may be delayed in 2020, but “long-term prospects remain intact” according to Telefónica. We expect that demand for improved business continuity will be sustained as operations resume, and that this will drive increased penetration for a wide range of SaaS and IaaS/PaaS services. Operators’ free trials and support to businesses during this crisis may translate into stronger relationships and the increased take-up of ICT services in the long term.

1 For further information, please see Analysys Mason’s Business revenue tracker.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges