Telecoms operators rated Fortinet as the best security vendor for the SMB market

29 October 2020 | Research

Article | PDF (4 pages) | SME Services| Enterprise Services| Cyber Security

Listen to or download the associated podcast

Telecoms operators rated Fortinet as the best security supplier for the small and medium-sized business (SMB) market (organisations with up to 1000 employees) in Analysys Mason’s survey. Other large vendors with a strong heritage in network security (Palo Alto Networks, Cisco and Check Point) also scored highly, as did F-Secure, Sophos and Microsoft.

Telecoms operators are looking to increase their presence in the security market. The ‘big four’ network security players look best-placed to help them given their popularity. F-Secure, Sophos and Microsoft are also well-positioned. Other vendors will need to increase operators’ awareness of their brands and products if they are to compete more effectively for operators’ business and for access to their existing large SMB customer bases.

We asked 34 operators for their opinions about security suppliers

We surveyed 34 telecoms operators during July–October 2020 to find out more about their security strategies for the SMB market. Respondents ranged from some of the world’s largest telecoms operators to small specialists that focus on the business market. The survey was carried out worldwide: we received input from operators in the Americas, the Middle East, Asia–Pacific and across Europe.

We asked respondents for their views of security solution providers and for suggestions on how these providers could improve. We also asked about the operators’ own security products and plans. The results are captured in our report Cyber security in the SMB market: survey of telecoms operators.

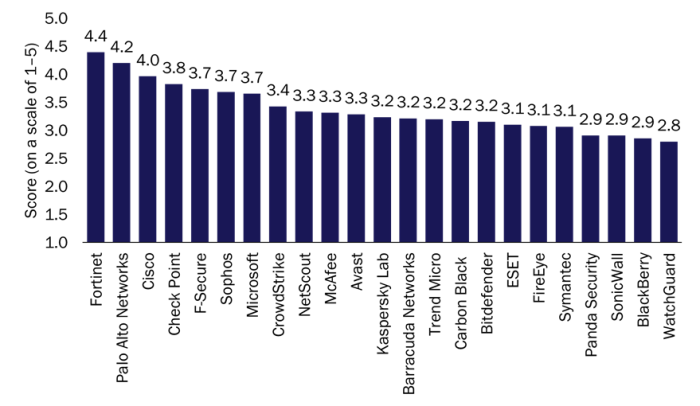

Telecoms operators’ overall impressions of security vendors were clear: the largest four vendors with a background in network security (Fortinet, Palo Alto Networks, Cisco and Check Point) received the highest scores (Figure 1). The high scores earned by these players are based on direct experience; many of the operators surveyed already work with them. For example, Fortinet provides SMB security products to 26 operators in our panel, and Cisco works with 24. The vendors’ focus on network security is also likely to have played a role in their strong performance. Indeed, products such as firewalls have been offered by telecoms operators for a long time and often form the base of operators’ security portfolios.

Figure 1: Telecoms operators’ ratings of security vendors in terms of overall impression, 20201

Source: Analysys Mason, 2020

Fortinet scored highly in all areas of assessment

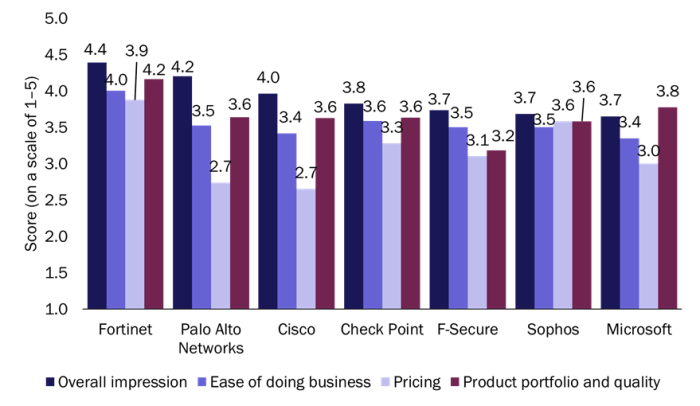

Figure 2 shows the scores for overall impression, ease of doing business, pricing and portfolio and product quality for the seven leading security suppliers in Figure 1. The portfolios of these seven, though often overlapping, are different and so the scores will reflect a range of factors. For example, we did not ask operators to compare individual product lines from vendors. Some caution is therefore needed when reviewing the results.

Figure 2: Telecoms operators’ ratings of the best-performing security vendors, 20202

Source: Analysys Mason, 2020

Source: Analysys Mason, 2020

- Fortinet received higher scores than any other vendor in all areas of assessment. The consistency of Fortinet’s results stands out: out of over 100 ratings, it received a single score of 2 (for pricing) and nothing lower. More than 80% of its scores were a 4 or a 5.

- Palo Alto Networks’s overall score was almost as good as Fortinet’s, but it received a number of lower ratings in other areas, particularly for pricing (though the correlation between pricing and overall impression is weak at best). The perception of being expensive may be costing it business; only 5 operators named it as their primary SMB network security provider, compared to 13 for Fortinet.

- Cisco’s results mimic those for Palo Alto Networks, though it is seen as slightly harder to do business with, and it received a slightly lower score for pricing.

- In contrast, Check Point did better on pricing than Cisco and Palo Alto Networks, and is slightly easier to do business with, but these factors were not enough to lift its overall score.

- F-Secure is a relatively small company. It is easily the smallest of the top-seven providers; its 2019 revenue was USD244 million, only around half of which came from business customers. However, it has several operator customers (seven of the panel sell F-Secure’s solutions to SMBs) and is well-regarded by them. More than a third of its ratings were a 4 or 5; it only received a 2 twice, and never received a 1.

- Sophos, like Fortinet, received a very consistent set of results. It received a single rating of 2 (for pricing), and nothing lower. Just over half of its ratings were a 4 or a 5.

- Microsoft only outscored Sophos in one area: product portfolio and quality. However, even here there is potential for improvement because it only received a single score of 5 in this category. Overall, Microsoft is liked but not loved by operators; it received more than five times more scores of 4 than of 5.

The leading seven vendors are well-placed to do business with operators; others have work to do

Operators have ambitious plans for security. Major operators such as AT&T, Orange and Telefónica have established separate security divisions, often supported by large acquisitions. Orange is targeting EUR1 billion in annual security revenue by 2022 (from around EUR700 million today) and it is not alone in having ambitious revenue growth targets.

The leading seven vendors look well-placed to support operators in realising their SMB security plans. Other suppliers have work to do. Many endpoint security providers struggle to differentiate themselves or their offers. They failed to generate strong feelings (either positive or negative) from our operator panel. Smaller vendors also often failed to create a profound impression on the operator community, though it is possible for them to break into the operator market, as the example of F-Secure shows.

1 Question: “Thinking only about security solutions for SMBs, please score vendors on the following: overall impression”; n = 34. Scores were given on a scale of 1–5, where 1 was the worst/among the worst and 5 was market leading/among the leaders. Vendors with fewer than 9 responses are excluded.

2 Question: “Please score vendors on the following: overall impression, ease of doing business, pricing, product portfolio and quality”; n = 34. Note that each vendor has under 34 responses; respondents did not enter a score if they did not have an impression of the vendor. Scores were given on a scale of 1–5, where 1 was the worst/among the worst and 5 was market leading/among the leaders. F-Secure only received 8 responses for ‘ease of doing businesses’.

Article (PDF)

DownloadCyber security in the SMB market: survey of telecoms operators

Click here to read the associated report