Operators in SSA should support the migration to 4G to address consumers’ desire for faster speeds

Mobile operators in Sub-Saharan Africa (SSA) received relatively high scores for customer satisfaction compared to those in other regions in our 2019 Connected Consumer Survey. Price continues to play an important role in customers’ choice of plans and their willingness to recommend an operator. However, data speed is also a strong differentiating factor.

This comment shares some of the results from our survey to emphasise the growing importance of network performance. It argues that operators should do more to encourage consumers to adopt 4G in order to improve data monetisation and address their desire for faster speeds.

Respondents in SSA were satisfied with most aspects of their mobile services, except for price and data allowances

We conducted our survey of mobile users in Kenya, Nigeria and South Africa between August and September 2019. There were 1000 respondents per country, and we asked questions regarding the behaviour, preferences and plans of smartphone users in these countries.

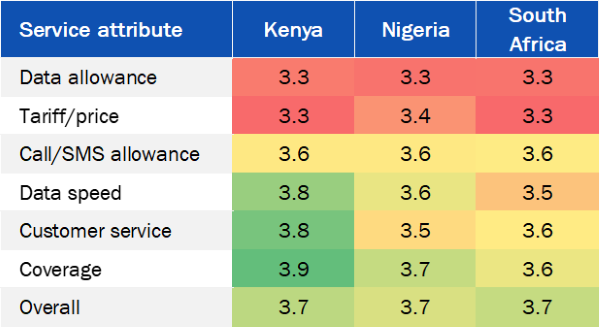

Respondents were asked to rate how satisfied they were with specific elements of their mobile services on a scale of 1 (very dissatisfied) to 5 (very satisfied). The elements included were price, call/SMS allowance, data allowance, data speeds, network coverage and customer service. We averaged the results across operators, as shown in Figure 1.

Figure 1: Average customer satisfaction scores for different elements of a mobile service, Kenya, Nigeria and South Africa, 2019

Source: Analysys Mason, 2020

However, these averages mask significant differences between operators. For example, Safaricom Kenya has a score of 3.2 for customer satisfaction with data allowances, while Airtel and Telkom Kenya have ratings of 3.7. In South Africa, Vodacom’s customers gave a score of 3.0 for price satisfaction, which contrasts with the 3.7 given by Telkom Mobile’s customers. All operator-level results are included in our recently published report.

The majority of customers (particularly those of Safaricom) were the most satisfied with data speeds, coverage and customer service, but they were the least happy with price-related factors including allowances. This suggests that most consumers feel that they are not getting sufficient value for money from their mobile tariffs.

Price satisfaction is also the strongest single predictor of consumers’ willingness to promote their operator (as measured by NPS). A 1-point improvement in satisfaction with prices (for example, from ‘neutral’ to ‘satisfied’) results in an average increase in willingness to recommend of roughly 0.4 in each country. This could potentially lead to a reasonably large increase in NPS, by 10 points or more. This highlights the price-sensitivity of most subscribers.

Price also plays a role in influencing consumers’ choice of next plan, but data speed is a strong differentiating factor

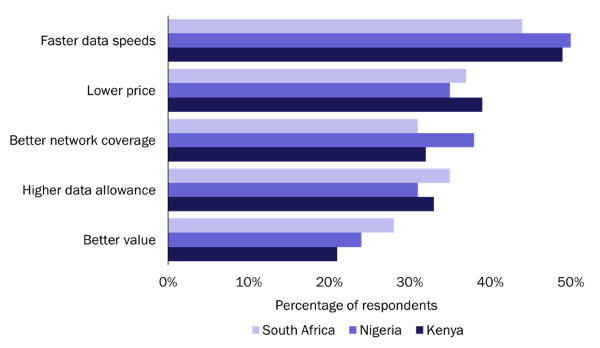

We asked respondents that were planning to change their plan or provider which factors they would look for in a new plan (Figure 2). Network-related factors were the most prominent, even though most users reported being relatively satisfied with the network-related aspects of their current plans. Faster data speeds were more frequently cited as a factor than lower prices in all countries surveyed in 2019.

Figure 2: Top five factors influencing respondents’ choice of their next plan, Kenya, Nigeria and South Africa, 2019

Source: Analysys Mason, 2020

Operators can do more to encourage the adoption of 4G in order to capitalise on consumers’ appetite for faster speeds

Respondents that reported using 3G were consistently more dissatisfied with all aspects of their mobile service than those using 4G. They were also more likely to look for faster data speeds in their next plan (51% of 3G respondents compared to 35% of 4G users). Data speed was also the most frequently cited factor influencing 3G subscribers’ choice for the next plan.

This suggests that there is a stronger demand for improved network performance from 3G users than from their 4G counterparts. Operators can address this by encouraging these users to migrate to 4G, but they must find the right balance between delivering superior network quality and ensuring that some 4G tariffs are affordable in order to appeal to this price-sensitive segment. 4G offers a number of other advantages over 3G for operators. 4G can deliver increased capacity at a lower cost per gigabyte of data than 3G, thereby making it more cost-efficient to offer larger data allowances. It also enables operators to offer tariffs that allow more customers to use popular services such as Instagram or YouTube without imposing very strict constraints in terms of data usage or time. Indeed, our survey results show that the migration to 4G is associated with an increase in data consumption and spending.

Operators should therefore do more to support the migration to 4G in order to address consumers’ desire for faster speeds and to increase spending through data usage growth. Examples of how this can be achieved are as follows.

- Facilitate the acquisition of 4G-enabled devices. Operators can use credit and financing schemes to lower the cost burden of acquiring new 4G handsets for consumers. For example, Safaricom leases phones to prepaid customers through a pay-as-you-go monthly scheme supported by its mobile money platform, M-Pesa.

- Offer more incentives to customers to encourage them to migrate to 4G. For example, operators could offer free bonus data for subscribers that switch to 4G (Airtel in Nigeria already offers such benefits), launch music or video streaming bundles to showcase 4G’s capabilities or introduce content bundles and zero-rated tariffs (such as Airtel Kenya’s ‘YouTube’ data pack) to improve the value for money of data tariffs.

Operators should grow their 4G subscriber bases and promote larger data allowances in order to better capitalise on enhanced network speeds and coverage. This will ultimately help them to maintain good returns on growing data consumption and potentially increase the level of customer satisfaction with mobile services.