IoT connectivity disruptors’ platform strategies present a challenge for MNOs

1NCE and Eseye, two IoT connectivity disruptors, announced the addition of device and data management functions to their connectivity platforms during 3Q 2020.1,2 They aim to use these solutions to simplify the integration between their connectivity offers and AWS’s suite of data processing tools.

Connectivity disruptors are using AWS to develop platform capabilities that augment and differentiate their core offerings

The position of the disruptors in the connectivity market is based on their origins, their technical capabilities and their ambitions for targeting the IoT opportunity, as discussed in our report IoT connectivity disruptors: case studies and analysis (Volume IV).

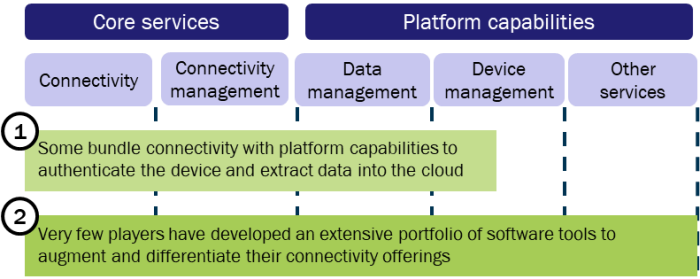

Connectivity disruptors have adopted the following two main approaches to extend their horizontal capabilities, in addition to offering connectivity and connectivity management services (Figure 1).

- Offer connectivity with basic platform features. For example, 1NCE, EMnify and Eseye have used hyperscalers’ infrastructure and software tools to incrementally develop and deploy new IoT platform features that are closely tied to core connectivity.

- Offer connectivity with advanced platform features. A small number of players (such as Soracom and floLIVE) have internally developed modular solutions and developer tools to offer more-sophisticated platform capabilities and support different cloud providers.

Figure 1: Connectivity disruptors’ approaches to extending their horizontal capabilities

Source: Analysys Mason, 2020

There are pros and cons for each of these approaches (Figure 2). Offering connectivity with basic platform features means that providers can give their customers more than just connectivity quickly and with minimal development costs. This has been possible because players have developed their connectivity infrastructure on AWS, meaning that they can build on existing frameworks, such as AWS IoT Core, to facilitate the exchange of data between devices and the cloud.

Figure 2: Pros and cons of connectivity disruptors’ approaches to extending their horizontal capabilities

| Approach | Pros | Cons |

|---|---|---|

| Connectivity with basic platform features |

|

|

| Connectivity with advanced platform features |

|

|

Source: Analysys Mason, 2020

1NCE and Eseye have used AWS to augment their connectivity management platforms

1NCE and Eseye both developed their core networks and IoT connectivity management platforms using AWS. 1NCE has been successful in commercialising low-cost global IoT connectivity, bundled with its ‘Connectivity Suite’ platform. Eseye offers a connectivity-as-a-service proposition that includes connectivity and a connectivity management platform, plus optional hardware and cloud integration modules.

The two disruptors have recently added new capabilities to their connectivity platforms, but they have contrasting platform strategies.

- 1NCE added a new module that automates device onboarding and data acquisition and transfer. It uses the SIM to uniquely identify the connected device. It also converts standard protocols such as MQTT to power-saving protocols such as CoAP and UDP, which reduce power and data consumption. The company’s primary objective is to complement its connectivity service, while maintaining a simple pricing model (the new capabilities are included in the base tariff for free). 1NCE has no intention of developing advanced device management capabilities.

- Eseye added device management to its AnyNet Cellular Connectivity platform based on its device design and certification expertise. It introduced a new desktop application that allows users to set up and configure devices in AWS, track device metrics for anomalies and security risks and set up notifications for critical actions and updates. Eseye has expressed an ambition to diversify its revenue streams and enhance its standing with operators. However, it will need to invest significantly to develop a distinctive platform proposition, and that could be challenging given its current resources, although its fundraising plans may help.

The tight integration of connectivity disruptors’ offerings with AWS raises questions on how MNOs should react

1NCE and Eseye have tied their connectivity platforms to AWS because many of their existing and target customers already use the cloud service. It may become more challenging for 1NCE and Eseye to differentiate their platform features if more connectivity providers integrate their solutions tightly with AWS (or with other hyperscalers). Customers will have fewer incentives to stay with the same connectivity provider, which may lead to further price competition.

MNOs face a greater challenge. They risk losing connectivity market share if they do not offer similar integration with hyperscalers’ platforms. MNOs that have invested in developing their own platforms (such as Vodafone and Telefónica) could decide to use APIs to better integrate certain parts with AWS. For example, Verizon offers multi-sensor devices and an IoT development kit that are pre-integrated with AWS’s application hosting, storage and analytics services, but that uses the device management features of Verizon’s IoT platform, ThingSpace.

MNOs may be reluctant to relinquish value to hyperscalers’ IoT platforms; they would prefer customers to use their own IoT platforms (for example, for device management, analytics and application enablement). MNOs need to balance the benefits of promoting their own platforms against the threat of losing customers to smaller, but more innovative, players.

1 1NCE (2020), 1NCE simplifies IoT device management for customers on Amazon Web Services. Available at: https://1nce.com/en/news/1nce-iot-connectivity-suite-on-aws-pressrelease/.

2 Eseye (2020), Eseye Revolutionises Global IoT Device Deployment with Next Generation AWS Integration. Available at: https://www.eseye.com/eseye-revolutionises-global-iot-device-deployment-with-next-generation-aws-integration/.

Article (PDF)

DownloadRelated items

International IoT connectivity: challenges and solutions for providers

Strategy report

UK wireless IoT market: trends and forecasts 2022–2032

Forecast report

IoT connectivity disruptors: case studies and analysis (volume VII)