COVID-19 will have a long-term positive effect on SMB cloud collaboration solution usage and spending

The COVID-19 pandemic has forced businesses to adapt to new methods of working including continuing operations while many employees work remotely. The use of cloud-based collaboration tools has eased this transition by enabling employees to stay connected.

This comment highlights insights from the SMB Technology Forecaster and our recent survey of small and medium-sized businesses (SMBs) in the USA, which show how the COVID-19 pandemic will affect SMB spending on collaboration solutions.

The COVID-19 pandemic will lead to strong growth in SMB spending on collaboration solutions in 2021 and beyond

The use of collaboration solutions has been significantly affected by the pandemic; many businesses are adopting collaboration software for the first time. Indeed, 28% of US SMBs adopted collaboration tools for the first time due to COVID-19 according to our study of 404 SMBs in the USA in 2Q 2020. Many other businesses have added seats to their existing SaaS collaboration subscriptions. 46% of the firms that participated in our study reported that they were using collaboration tools prior to office closures, but that their usage had increased in response to the pandemic in order to ensure that employees working from home could stay connected. It appears that the trend towards high collaboration solution usage is here to stay: 43% of businesses plan to maintain higher levels of collaboration software usage once lockdown restrictions have been relaxed, while only 21% plan to reduce or discontinue usage.

Our forecast is further supported by recent figures provided by some of the leading players in the collaboration space. The use of cloud-based software for video meetings, chat and file sharing and editing (for example, Microsoft Teams, Slack, Webex Teams and Zoom) has increased rapidly. For example, Microsoft announced in its 3Q 2020 earnings call on 29 April 2020 that the maximum number of Teams users in a single day had reached 200 million, and that the number of daily active users had grown from 44 million in March 2020 to more than 75 million a month later.1 Similarly, Zoom reported surpassing 300 million daily meeting participants (not to be confused with daily active users because meeting participants can be counted multiple times) in a single day in April 2020.2

However, the overall spending on collaboration solutions by SMBs worldwide in 2020 will be around USD1 billion less than previously forecast (USD34 billion compared to USD35 billion; see Figure 1), despite the strong growth in usage of cloud collaboration solutions.

Figure 1: SMB spending on collaboration solutions, before and after COVID-19 revisions, worldwide, 2019–2023

Source: Analysys Mason, 2020

Source: Analysys Mason, 2020

We now forecast that SMB spending on collaboration solutions in 2020 will be lower than previously expected because:

- overall business activity is lower and many companies have closed or reduced their number of staff

- the increase in use of new tools such as Zoom will not initially offset the decline in spending on on-premises collaboration/legacy hosted voice solutions

- many customers are using free or discounted introductory offers.

The combination of these factors mean that spending will be 3 percentage points lower than in our previous estimates (but still growing). We expect much stronger growth in 2021: spending is forecast to increase by nearly 13% year-on-year. This growth will be driven by the continued increase in demand for cloud-based tools, businesses rehiring furloughed employees and more businesses opting for paid versions of collaboration solutions. Spending will surpass our pre-COVID-19 forecast in 2022 and will reach USD43.2 billion, USD300 million above our earlier forecast.

Spending on collaboration solutions in the Americas will decline only slightly in 2020, and year-on-year growth will remain at roughly 8%

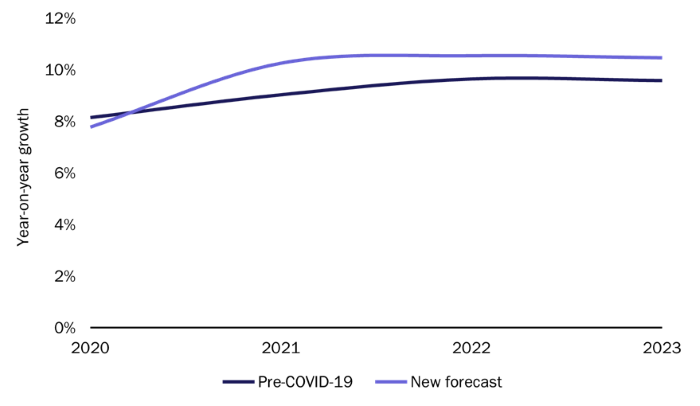

SMB spending on collaboration solution in North America in 2020 will remain fairly stable compared to that in other regions. The loss of revenue due to business and office space closures will be largely offset by the adoption of SaaS collaboration tools, particularly in the USA. The strong demand for such solutions will result in 10% year-on-year growth in SMB spending in 2021 and nearly 11% in 2022 (Figure 2).

Figure 2: Year-on-year growth in SMB spending on collaboration solutions, before and after COVID-19 revisions, Americas, 2020–2023

Source: Analysys Mason, 2020

SMB spending on collaboration solutions will grow much more slowly in Europe, the Middle East and Africa (EMEA) and Asia–Pacific (APAC) in 2020 compared to our previous projections, but strong growth will return in 2021. Spending in EMEA will be dominated by SMBs in Western Europe; those in Eastern Europe and Africa will reduce their spending the most because they face the greatest hurdles in coping with the pandemic. Spending growth in EMEA as a whole will be just 4% in 2020, but will increase to 10% by 2021.

We now expect that year-on-year spending growth in APAC will be just 7.1% in 2020 (compared to our previous forecast of 11.9%), but decisive responses to the pandemic will result in a strong comeback in spending by 4Q 2020, and year-on-year spending in 2021 will reach 15.9%.

Vendors of collaboration solutions should work to convert free users to paying customers

There is a strong revenue opportunity for vendors thanks to the growing number of businesses using collaboration solutions for the first time and the plans of many businesses to increase their usage even after their employees begin to return to central workspaces. Collaboration tools have become essential not just to enable remote employees to remain connected to one another, but also for remote sales and customer service. In the longer term, businesses will see the benefits of saving on travel costs and may be willing to invest these savings in new technology. Indeed, our survey showed that 24% of small businesses and 38% of medium-sized businesses had reduced or reallocated travel budgets in response to the pandemic.

Businesses will continue to be price-sensitive until the crisis and resulting economic volatility stabilises. Vendors will need focus on converting users of free services into paying customers. Many vendors have supported businesses while gaining market share by offering free and discounted collaboration solutions. They should work to convert these users into paying customers by providing strong customer support, reducing downtime/outages and bundling collaboration solutions with additional services such as security or productivity solutions. Focusing on product differentiators will be the key to fighting off new entrants for incumbent players.

1 Microsoft (2020), Earnings Release FY20 Q3. Available at: https://www.microsoft.com/en-us/Investor/earnings/FY-2020-Q3/press-release-webcast.

2 Zoom (2020), 90-Day Security Plan Progress Report: April 22. Available at: https://blog.zoom.us/90-day-security-plan-progress-report-april-22/.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Receive the latest news and research on SMB IT buying behaviour and forecasts

Related items

SMB IT spending forecast report: a new beginning

Report

SMBs in manufacturing and professional service industries are making big investments in CRM solutions

Article

Security vendors’ financial and operational metrics: trends and analysis