FMC penetration continues to increase in many countries, aided by improving fixed wholesale rates

Fixed–mobile convergence (FMC) is a common feature in many European markets and is becoming more prevalent in regions such as emerging Asia–Pacific (EMAP). The penetration of FMC has increased in almost every market since its inception, although its prevalence and the form that it takes is dictated by the level of market competition and the operator infrastructure. Operators must consider the effect that FMC may have on the markets in which they operate and should adjust their strategies accordingly. This comment presents some of the analysis provided in Analysys Mason’s latest FMC forecast, which models 15 countries individually and isolates the trends that operators should bear in mind when launching or competing against convergence offers.

FMC is present in differing levels around the world and is a key dynamic in several European markets

In Europe, we can classify markets into the following four distinct groups based on the FMC landscape.

- Markets in which FMC adoption has been driven by upselling fibre (France, Portugal and Spain). These markets have the highest levels of FMC penetration in Europe and are characterised by operators across the board offering FMC bundles.

- Low-competition markets in which operators have used conservative discounts to consolidate their fixed–mobile user bases (Belgium and the Netherlands). These two markets have the highest ARPA in Europe. Small discounts and convergence bonuses have been used to minimise premium consumers’ potential to churn. Competition in both markets has increased recently and it is likely that the overall market value will fall slightly, but FMC will retain a strong presence and will slow the progress of any challengers.

- Markets in which FMC penetration remains limited by operator infrastructure (Italy, Germany, Poland and the UK). MNOs’ share of the fixed market remains low in these countries, so operator margins are more constrained when offering FMC deals. However, improving wholesale conditions and potential mergers will lead to an increase in the take-up of FMC during the forecast period.

- Markets where convergence remains niche despite favourable infrastructure conditions (Romania and Turkey). The market structure in Romania and Turkey is ideal for FMC, but a lack of appetite for FMC on the supply side (Romania) and the demand side (Turkey) is limiting take-up.

Broadband penetration is still growing strongly in many countries in EMAP, so there is a strong opportunity for mobile operators to build a base in the fixed market. AIS (Thailand) and China Mobile (China) are examples of operators that have established a strong fixed base using FMC, and FMC has a strong presence in both of the countries in which these operators are active. FMC is still nascent in the three other countries included in our forecast (Australia, Malaysia and the Philippines), but we expect that the take-up will grow strongly during the forecast period.

Several key drivers will affect the take-up of FMC and how products are marketed in the future

Increasing competition and wholesale fibre access will enable mobile operators to be much more nimble in how they approach FMC. Until recently, mobile operators that were planning to offer a strong FMC offer were reliant on their own converged infrastructure or M&A. However, wholesale fibre providers are increasingly emerging in markets with low fixed network competition, thereby enabling mobile operators to offer competitive retail fibre rates. Salt in Switzerland is an example of an operator that has taken advantage of such rates. Operators in established fibre markets such as Spain are increasingly opening up their networks to competitors, and many networks now overlap or have sharing agreements. MásMóvil has taken advantage of the wholesale situation in Spain to launch a highly competitive FMC offer.

Another changing dynamic is how premium pay-TV content will be offered within FMC bundles. Pay TV has historically been used to upsell customers to FMC bundles, and several operators have built a premium FMC strategy around pay-TV content. However, the strong emergence of OTT players means that operators are beginning to alter their approach to pay TV. We have already noted a shift away from pay-TV content in many operators’ FMC portfolios, and operators that are offering FMC without a pay-TV component at all have already had success, because consumers are increasingly purchasing pay-TV content through OTT players. The shift in pay-TV dynamics is likely to affect mid-market operators the most, and they will be pushed towards either the premium or budget end of the market as a result.

The take-up of FMC is likely to grow in most countries as operators increasingly look to consolidate their user bases

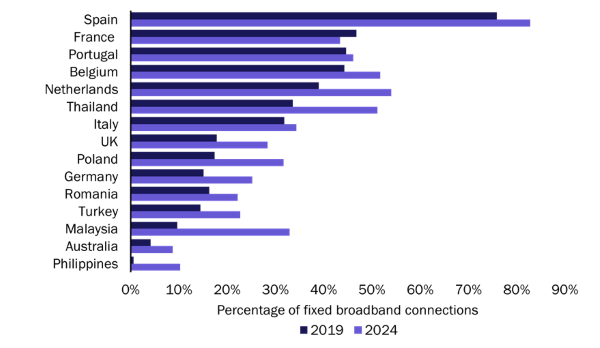

We expect that the number of FMC accounts will grow in most countries in Europe as established operators increasingly attempt to defend their market share using FMC strategies and challenger operators are forced to adopt FMC to compete (see Figure 1). Wholesale broadband and 5G fixed-wireless access (FWA) will enable mobile operators to offer FMC propositions. The most-mature FMC markets (in France, Portugal and Spain) give us a glimpse of how FMC can develop once it has reached maturity (the number of FMC accounts as a percentage of the number of fixed broadband connections is at least 45% in each of these countries). France is an interesting case study, because the number of FMC accounts as a percentage of the number of fixed broadband connections is declining due to stronger price competition in non-bundled offers. FMC will be used to build broadband market share in EMAP, primarily by mobile-centric operators, through the use of wholesale agreements, network roll-outs and partnerships. It will become increasingly difficult to operate in countries such as Malaysia and Thailand as a standalone mobile or broadband operator during the forecast period.

Figure 1: FMC accounts as a percentage of the number of fixed broadband connections, selected countries, 2019 and 2024

Source: Analysys Mason, 2020

Download

Article (PDF)Related items

FMC will be increasingly important for Belgian MNOs in light of Digi Belgium’s market entry

Article

Digital initiatives in new verticals 1Q 2024: trends and analysis

Report

Fixed–mobile converged bundles pricing: trends and analysis 1Q 2024