5G enables Gulf-based operators to deliver faster speeds and experiment with new pricing models

Mobile operators in the Gulf region received low scores for customer satisfaction in our latest Connected Consumer Survey compared to those in other regions. The results also revealed that satisfaction with network speeds was the best predictor of customers’ willingness to promote an operator.

Operators’ 5G launches across most of the region in 2019 should help them to address customers’ desire for higher speeds and could potentially improve customer satisfaction. Operators should be open to exploring different data pricing models, including volume-based models, to effectively monetise 5G use cases.

This comment shares some results from our survey that underscore the importance of delivering superior network performance, primarily by improving current 4G networks, but also by expanding 5G coverage and using a variety of pricing models.

Network speed is a strong service differentiator and a major predictor of NPS in the Gulf region

Analysys Mason conducted an on-device survey of 4500 smartphone users across Kuwait, Oman, Qatar, Saudi Arabia and the UAE between August and September 2019. Respondents were asked to rate how likely they were to recommend their mobile operator on a scale of 0 (not at all likely) to 10 (definitely); this data was then aggregated to derive the Net Promoter Score (NPS).1 The results show that all of the operators in the five countries had a negative NPS, and most of them received a lower score than operators in Europe, emerging Asia–Pacific and Sub-Saharan Africa.

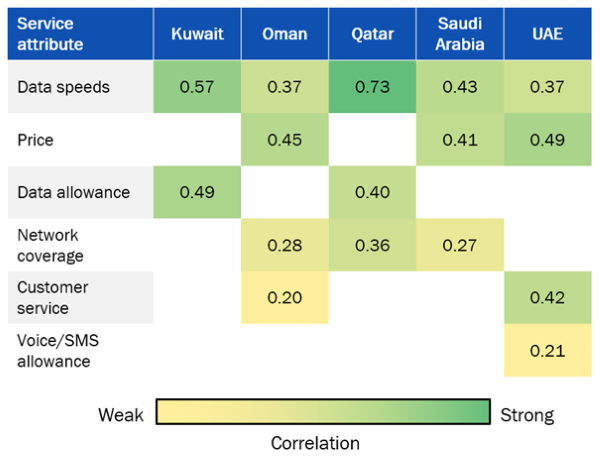

Regression analysis also revealed that network speed has the highest impact on NPS, more so than pricing or data allowances. Figure 1 shows the effect of a 1-point improvement in an individual’s satisfaction rating with various aspects of mobile services on the overall willingness to promote. On average, a 1-point improvement in satisfaction with data speeds (for example, from ‘neutral’ to ‘satisfied’) correlates with an average increase in willingness to recommend of 0.5. This could potentially lead to an increase in NPS of 10 points or more. This suggests that most operators could significantly boost their customer satisfaction metrics if they can provide better network performance.

Figure 1: Impact of a 1-point increase in satisfaction with specific aspects of mobile services on willingness to recommend, by country, Middle East, 2019

Source: Analysys Mason, 2020

Most users are primarily interested in 5G services that take advantage of the enhanced network performance

All network operators in Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE had launched a 5G service by March 2020, except Mobily in Saudi Arabia, Ooredoo in Oman and Zain in Bahrain. This has helped to increase the awareness of 5G among smartphone users. 78% of respondents in our survey were either familiar with 5G or had heard about it but did not know what it was, up from 64% in 2018.

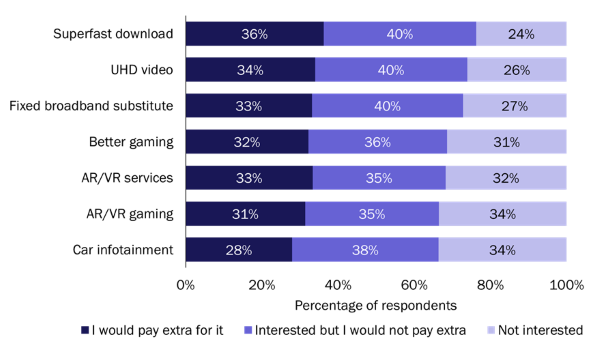

Most respondents were also interested in the higher speeds enabled by 5G. A third of respondents stated that they were willing to pay extra for 5G, and that they were more interested in using 5G to experience faster downloads and consume high-resolution video than to make use of more-innovative services such as AR/VR applications (Figure 2). This suggests that operators have the opportunity to monetise a better quality of experience for familiar use cases such as video streaming , in the short term. In the longer term, operators will need to offer emerging services such as gaming and AR-enabled applications to drive the demand for increased network performance. Many respondents in the region are aware of these services, but their development is still at a very early stage.

Figure 2: Self-reported interest in 5G-enabled mobile services, by application, Middle East, 2019

Source: Analysys Mason, 2020

Operators should add capacity to their 4G networks and consider new pricing models for 5G services

Operators should work to improve the performance of their 4G networks and add capacity to serve the mass market in order to drive customer satisfaction and data usage. This is important because probably only a minority of mobile subscribers will upgrade to 5G in the next 12 months due to the lack of affordable devices and the limited number of applications that can take advantage of 5G’s improved network performance.

Operators should consider complementing their current volume-based pricing models and price premiums with new approaches in order to monetise 5G more efficiently in anticipation of the wider adoption of 5G devices. The two following approaches are emerging as key strategies.

- Speed-tiering. Operators are increasingly using speed-tiering to showcase the speed benefits of 5G. However, significant network investments will be required to ensure that the advertised speeds are available and stable for most subscribers. This approach has been adopted by the likes of Elisa and Vodafone UK.

- Content-based pricing. The bundling of new value-added services, such as video enriched with analytic overlays, will cultivate new service usage patterns. Not all 5G operators are expected to be active in this area, but most of them should establish partnerships with content producers to enable the new 5G use cases. This approach has been adopted by EE, operators in South Korea and Telecom Italia.

Each approach comes with its own challenges. Operators in the Gulf region should assess their ability to provide good 5G coverage and deliver the advertised speeds, and should seek the right partners to implement their desired use cases. These operators lag behind the leading 5G players in Europe, Asia and the USA in terms of exclusive 5G content bundling and pricing innovation. This lag could limit the appeal of 5G in the Gulf region, but also offers an opportunity to implement best practices and avoid pitfalls. Ultimately, local operators will have to consider a combination of approaches and select a few concrete use cases to mitigate these risks.

1 The Net Promoter Score (NPS) is calculated by subtracting the percentage of subscribers that rated the operator 6 or below from the percentage that rated it 9 or 10.