Opportunities exist for smaller IoT platform vendors, despite the activities of large players such as AWS

IoT platform providers are demonstrating their technical capabilities and geographical reach through their IoT use cases and customers. The details of more than 200 use case announcements are included in Analysys Mason’s recently published IoT platform use case tracker 4Q 2018.

This article discusses the key observations drawn from our analysis of five of the main IoT platforms providers, namely Amazon Web Services (AWS), Cisco Jasper, Ericsson, PTC and Software AG. These observations are as follows.

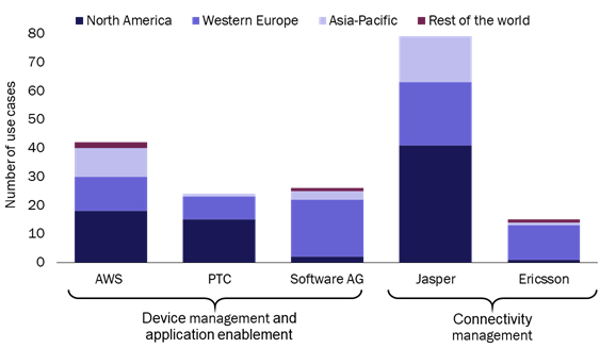

- Established vendors are strongly focused on North America and Western Europe, and 81% of all customers are based in these regions. This is not surprising, but the low number of deals in China, Japan and South Korea is notable.

- The market is highly fragmented and IoT use cases are being adopted across many different verticals.

- The majority of IoT customers are using platforms to lower costs by optimising their existing operations, rather than to generate new revenue. Other customer objectives include transforming service delivery models and monetising data by selling applications and services.

All of the data used in our analysis is based on the public use cases of the selected vendors. Our analysis will therefore not be a perfect reflection of the vendors’ businesses, as certain sectors or geographies may be underrepresented because some deals are under non-disclosure agreements, for example. However, we think that there is a reasonable representation of the sectors and geographies in which customers are active.

The level of competition varies across regions because established vendors have a stronger presence in specific, developed regions

The relatively high adoption of IoT platforms in North America and Western Europe has attracted different players and has created a highly competitive market. Prominent IoT vendors have strong relationships with local enterprise communities in their respective markets. For example, American players AWS, PTC and Jasper have higher numbers of customers in the USA, while Software AG and Ericsson operate largely in the German and Swedish markets, respectively (Figure 1). This shows that, although many IoT vendors aim to build a global presence, they are still heavily reliant on their local markets.

The absence of large players in many regions creates opportunities for smaller players and new entrants to integrate with the local ecosystem and secure a position in the market. For example, Ayla Networks is an American platform vendor that targets the Chinese market; its customers include China Telecom and China Unicom. Other examples include providers such as Nexign in Russia and Eastern Europe and IoT.Nxt in Africa.

Figure 1: Number of IoT use cases, by region and vendor

Source: Analysys Mason, 2018

Vendors promote horizontal platforms but tend to have significantly higher activity in certain verticals

The industrial sector is one of the fastest growing IoT verticals. Most vendors are demonstrating expertise in this sector and are aligning their solutions to meet the growing demand. Application enablement providers have the strongest focus and are providing additional dedicated solutions such as ThingWorx Navigate (PTC) and AWS IoT SiteWise (AWS).1 Connectivity management platform providers such as Cisco Jasper and Ericsson have a bigger influence in verticals in which operators are active such as tracking, automotive and smart cities (Figure 2).

To expand their market reach, many vendors are promoting a horizontal platform that can be reused across verticals. However, customers from different verticals have different challenges and drivers, and they require various levels of support. For example, in healthcare systems, connecting equipment and sharing data might require specific legacy and proprietary protocol support and is also subject to strict data regulation requirements. Building and promoting a clear vertical-specific ecosystem, along with the necessary expertise, can be a way to differentiate for those vendors that are struggling to compete in the crowded horizontal platform market.

Figure 2: Number of use cases by vertical and vendor

| Vertical | AWS | PTC | Software AG | Cisco Jasper | Ericsson | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Industrial and manufacturing |

|

10 |

|

14 |

|

12 |

|

10 |

|

0 |

|

46 |

|

Tracking and logistics |

|

1 |

|

1 |

|

5 |

|

17 |

|

0 |

|

24 |

|

Automotive, transportation and fleet management |

|

0 |

|

2 |

|

1 |

|

15 |

|

4 |

|

22 |

|

Retail and payment |

|

2 |

|

0 |

|

3 |

|

14 |

|

0 |

|

19 |

|

Smart cities |

|

3 |

|

2 |

|

2 |

|

3 |

|

6 |

|

16 |

|

Utilities and energy |

|

8 |

|

0 |

|

1 |

|

5 |

|

1 |

|

15 |

|

Consumer and smart home |

|

9 |

|

0 |

|

0 |

|

5 |

|

0 |

|

14 |

|

Healthcare |

|

2 |

|

2 |

|

2 |

|

5 |

|

2 |

|

13 |

|

Agriculture |

|

3 |

|

1 |

|

0 |

|

4 |

|

2 |

|

10 |

|

Other |

|

4 |

|

2 |

|

0 |

|

1 |

|

0 |

|

7 |

Source: Analysys Mason, 2018

Most enterprise customers are using IoT platforms to improve operational efficiency and save costs

Enterprise customers use IoT platforms to achieve one or more of the following objectives.

- Operation optimisation and cost reduction, by tracking and adjusting energy consumption, for example. This accounts for 74% of the use cases tracked.

- Revenue growth from offering additional services or new product delivery models to existing customers. For example, vendors could offer real-time support for connected devices (8% of the tracked use cases).

- End-to-end service provisioning to new customers (18% of the tracked use cases). For example, vendors may offer complete crop monitoring solutions and services to farmers.

When the majority of IoT customers start using IoT platforms, their main objective is to improve the efficiency of their operations and to reduce costs. However, as the adoption of IoT grows, the need to monetise data will increase in importance for both new and existing customers across different verticals such as agriculture, healthcare and smart home. Vendors should demonstrate their platform’s ability to support monetisation and the creation of new revenue models.

1 For more information, see https://aws.amazon.com/about-aws/whats-new/2018/11/announcing-aws-iot-sitewise-now-available-in-preview/