Microsoft places Teams at the forefront of its partner strategy for SMBs

The COVID-19 pandemic has pushed small and medium-sized businesses (SMBs) to speed up their digital transformations to better equip them to manage employees that are working away from centralised locations. Microsoft has focused on the modern workplace (remote and secure work) for several years and this focus is proving to be timely in the present climate. As such, Microsoft is well-placed to grow its share of the SMB market by working with partners to sell products based upon its collaboration solution, Teams.

Microsoft’s SMB partner strategy is focused on collaboration and productivity

SMBs have been strongly affected by the office closures and work restrictions caused the COVID-19 pandemic. This was clear in Microsoft’s FY2020 4Q financial report: it cited that a slow-down in SMB sales resulted in slower than expected revenue growth for office commercial products and cloud services.1 However, revenue from its SMB customers improved slightly in the first quarter of FY2021 (compared to that in the fourth quarter of FY2020) according to Amy Hood, Microsoft’s CFO. Nonetheless, uncertainty surrounding the COVID-19 pandemic remains.

Microsoft demonstrated its sustained push into the SMB space, despite the recent challenges, during its annual Inspire partner event in July 2020. Many of the sessions at Inspire were targeted towards partners serving SMBs. The importance of collaboration, which Microsoft enables through Microsoft Teams, was one of the underlying themes during these sessions.

Teams, alongside Microsoft’s well-established Office products, is a strong selling point for partners that are focused on SMBs and it is included by default with most Microsoft 365 offerings. Microsoft 365 Business Premium and Microsoft 365 Business Voice are Microsoft’s two primary SMB offerings.

- Microsoft 365 Business Premium customers get access to productivity, security, cloud storage and collaboration tools for USD20 per user per month. Introductory offers include a 1-month free trial. There are less expensive Microsoft 365 bundles, but Business Premium provides an added layer of security and PC and mobile device management for an additional USD7.50 per user per month (compared to Microsoft 365 Business Standard). Security and device management are at the top of mind of many SMBs that are continuing to do business in the COVID-19 climate because the high number of remote workers can increase the vulnerability to cyber attacks.

- Microsoft 365 Business Voice is another key offering that caters to SMBs. It is a cloud-based telephony solution for businesses with 300 or fewer employees and is built around the interface and functionality of Teams. This solution provides calling capabilities from any device to users that have a Microsoft 365 account that includes Teams. Customers can use Microsoft 365 Business Voice to add PSTN calling plans through Microsoft, or they can work with a Microsoft partner or reseller to co-ordinate with their existing telephone provider and migrate an existing calling plan.

Teams has become a focal point of Microsoft’s SMB sales strategy because remote collaboration has become increasingly important to many businesses during the last decade. According to Jon Orton, Director of Product Marketing – Microsoft 365 SMB, “Teams is so important because it is a great way to start customers in the cloud, particularly those that are replacing legacy servers.”

Analysys Mason expects that Microsoft’s addressable SMB market will grow strongly

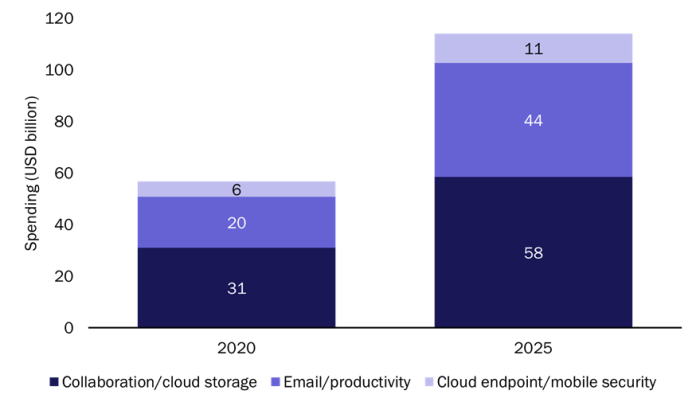

We forecast that SMB spending on SaaS/cloud solutions such as email/productivity, cloud storage, security and collaboration tools will grow from USD57 billion in 2020 to USD114 billion by 2025 at a combined 5-year CAGR of 15% (Figure 1).

Figure 1: SMB spending on collaboration/cloud storage, email/productivity and cloud endpoint/mobile security solutions, worldwide, 2020 and 2025

Source: Analysys Mason, 2020

Our 2020 business survey on the impact of COVID-19 showed that SaaS adoption is a priority for the next 12 months for 21% of small businesses (1–99 employees) and 35% of medium-sized businesses (100–999 employees). 43% of SMBs plan to increase their use of collaboration solutions (compared to pre-COVID-19 levels) once lockdown restrictions have been relaxed. This data suggests that there is strong potential for growth in the take-up of Microsoft’s offerings.

Microsoft’s work to grow the adoption of Teams will play a meaningful role in SMBs’ shift to the cloud and will help those already in the cloud to move additional workloads. SMBs have tended to initially move email and productivity workloads to the cloud. Staying connected has become even more important following the significant disruptions that businesses have experienced in the wake of the COVID-19 pandemic, and collaboration has become a key entry point to the cloud for SMBs. As such, SMB spending on cloud collaboration solutions is expected to grow significantly.

Partners need solutions that are simple to sell and implement in order to attract SMBs

SMBs typically lack the expertise or resources to manage their IT solutions in-house, which makes them an attractive customer base for partners that specialise in managing IT software and infrastructure. SMB decisions makers need providers that can make onboarding and maintenance simple and sustainable.

Microsoft is positioning itself as a vendor that offers products that are easy to sell and implement. The philosophy espoused during Inspire was that SMBs want to consolidate the number of partners and vendors that they work with, and Microsoft 365 and Teams can give SMBs more options in a single place. The idea is that the reduction in the number of dashboards to understand means that partners can provide less training and therefore can carry out more migrations while reducing the cost of their services. Microsoft wants to ensure that it is creating a package that is simple for partners to sell.

Microsoft offers a portfolio that is both well-established and straightforward to implement. It places itself in a strong position to remain a leader in the SMB space by continuously improving its collaboration solution. Security and reliability become increasingly relevant as businesses increase their numbers of employees and uncertainty prevails.

1 Microsoft (2020), Earnings Release FY20 Q4. Available at: https://www.microsoft.com/en-us/Investor/earnings/FY-2020-Q4/press-release-webcast.

Article (PDF)

Download

Receive the latest news and research on SMB IT buying behaviour and forecasts