RAN forecast: 5G and virtualised-RAN will be the dominant drivers of MNO spending growth

Listen to or download the associated podcast

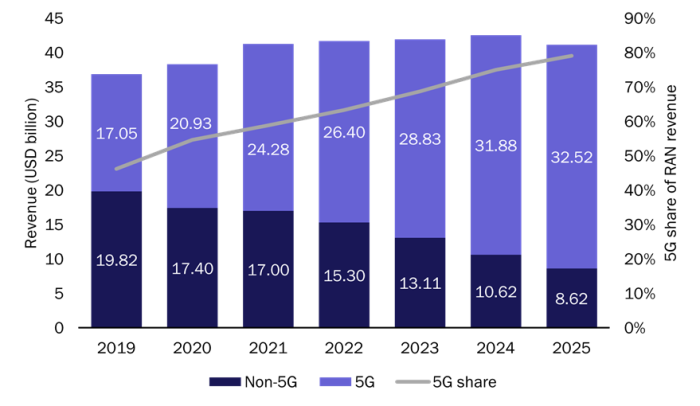

Mobile network operators’ (MNOs’) spending on 5G will increase by more than 91% between 2019 and 2025, and will deliver growth in an otherwise flat sector. Spending on the radio access network (RAN) and related services will grow at a CAGR of 0.1% between 2019 and 2025, from USD51.5 billion to USD55.8 billion. 5G and virtualised-RAN (vRAN) will be the biggest drivers of this growth; spending on 5G will grow at a CAGR of 11.4% from USD17.0 billion to USD32.5 billion during the same period. These forecasts are reported in detail in our report, Radio access networks: worldwide forecast 2020–2025, which also includes forecasts for spending on 5G and non-5G RAN products for all major site categories (macro, micro and mini-macro), as well as the professional services (PS) component for each. Forecasts for spending on massive multi-input multi-output (MIMO) and passive antennas are also available.

In this article, we summarise some of the key findings from our RAN forecast report.

MNOs will invest in the 5G RAN to add network capacity and improve the customer experience

5G new radio (5G NR) will account for approximately 79% of MNOs’ RAN investments in 2025 (Figure 1). Over 140 MNOs had started to deploy 5G non-standalone (NSA) using the 4G core with 5G NR by 4Q 2020. Many of these MNOs started with capacity upgrades in targeted locations, such as dense urban areas, in order to improve customer experience, and will move to the second phase and focus on nationwide deployments during the forecast period.

Figure 1: RAN vendor product revenue, split by 5G and non-5G, plus the 5G share of RAN revenue, worldwide, 2019–2025

Source: Analysys Mason, 2021

Nationwide deployments are a key next step for MNOs ahead of the migration to standalone (SA) core architecture. Some fast-moving MNOs, such as China Mobile, Korea Telecom and T-Mobile USA, have already started 5G SA deployments. As MNOs plan their migration strategies, they must ensure that 5G coverage is wide enough to avoid continual handovers between 5G and 4G, which can result in a poor customer experience.

MNOs most commonly use spectrum in the C-band (3.4–3.8GHz) together with massive MIMO antennas to provide 5G services. This delivers a good quality of experience in terms of download speeds. 5G RAN roll-outs were much faster than non-5G roll-outs in 2020, despite ongoing capacity upgrades in non-5G networks in some countries.

vRAN is an important segment for MNO spending and it will pave the way for open RAN

MNOs will need to make significant changes to their network architecture when migrating to the vRAN in order to deploy baseband functions on cloud infrastructure, away from the antenna mast. For this reason, they will start their vRAN journeys by deploying solutions in their secondary networks, such as enterprise and private networks, before they move to macro networks. The macro deployments are far more challenging due to the high fronthaul bandwidth requirements, which will require MNOs to invest in additional fibre. vRAN will therefore account for a growing share of MNOs’ RAN spending throughout the forecast period.

Many MNOs are considering taking the emerging open RAN approach to vRAN. vRAN, when implemented as a single-vendor solution, is a less-complex proposition than open RAN given that the latter by definition depends on open interfaces, which will facilitate a multi-vendor ecosystem. For this reason, we forecast that spending on vRAN will grow at a faster pace than that on open RAN. Open RAN solutions for complex scenarios (such as urban environments with high traffic density and massive MIMO use cases) are less mature than those using vRAN, and may still be 2–3 years away from being ready to deploy. However, the existing open RAN solutions will enable MNOs to deliver coverage to rural and suburban environments, thereby creating opportunities for new vendors to enter the market and create innovative solutions. This in turn will ensure that incumbent vendors will continue to innovate.

Massive MIMO antennas will be essential to deliver high bandwidth and increased spectral efficiency

The deployment of MIMO antenna arrays plays a critical role in increasing the performance of 5G networks. Vendors are continuing to improve their massive MIMO products as 5G deployments begin in a growing number of countries. However, massive MIMO antennas are significantly more expensive than the traditional passive antennas used for non-5G mobile networks because they use beamforming technologies and deliver a higher spectral efficiency, thereby enabling higher network capacity. In addition, the radio units are incorporated within the antenna panel in massive MIMO antennas.

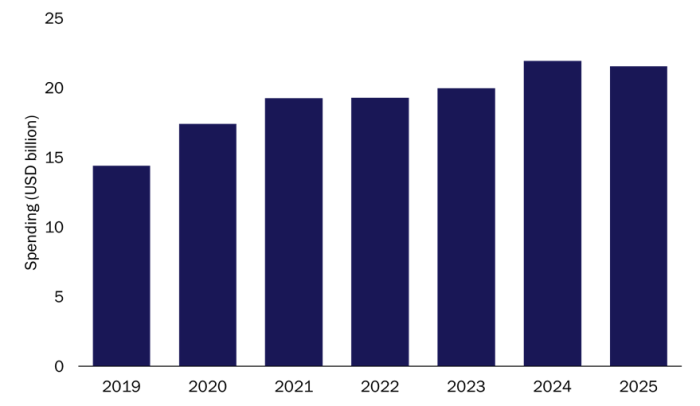

Most MNOs have deployed either 32T3R or 64T64R massive MIMO antennas to date, but they are now turning to other less expensive alternatives (such as 8T8R) until network traffic growth demands the higher-order equipment. For this reason, we forecast that spending on massive MIMO antennas will be flat at USD20 billion until 2023 (Figure 2), but it will then grow as more MNOs commence 5G deployments.

Figure 2: Spending on massive MIMO antennas, worldwide, 2019–2025

Source: Analysys Mason, 2021

Article (PDF)

DownloadRelated items

MWC 2024: the Open RAN market has entered a new phase, led by a clique of large vendors and operators

Article

Sub-Saharan Africa led 5G network launches in 2023, but 5G SA slowed despite growth in Western Europe

Article

5G deployment tracker 2H 2023