CSP spending on SaaS will exceed USD10 billion in 2023, and spending on OSS will grow rapidly

17 March 2020 | Research

Article | PDF (3 pages) | Telecoms Strategy and Forecast

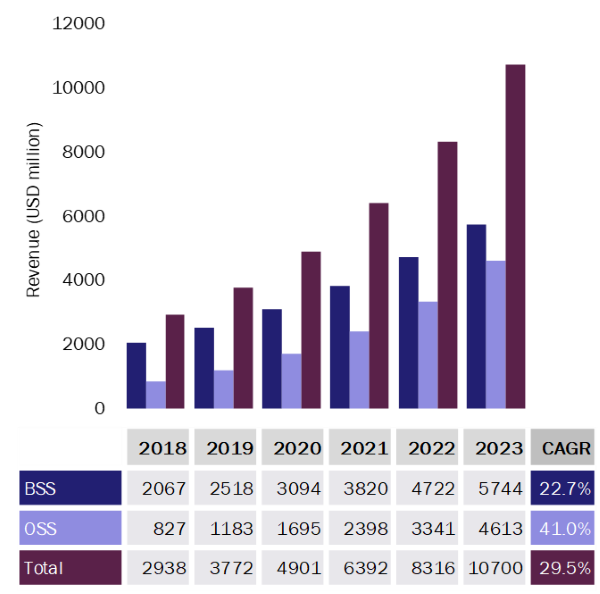

Analysys Mason forecasts that SaaS-related revenue will grow to USD10.7 billion worldwide by 2023. This growth will be driven primarily by spending on BSS, which, due to their IT-centric nature, will more-easily adapt to the SaaS delivery model. This comment highlights the findings of our report, SaaS: worldwide forecast 2019–2023, and includes details on SaaS spending in the OSS and BSS markets and on the key market drivers.

SaaS-related revenue will grow to USD10.7 billion worldwide in 2023, led by CSPs’ spending on new, 5G-enabled services

SaaS-related revenue will grow from USD2.9 billion in 2018 at a CAGR of 29.5% during the 5-year forecast period. SaaS-based delivery will become more-attractive to CSPs that are under increasing pressure to reduce their costs and improve their business agility.

The adoption of cloud-based SaaS allows CSPs to limit their upfront investment and time to deploy solutions, and to scale more-flexibly in line with demand. SaaS delivery can be especially pertinent to CSPs whose investment demands are high, and where investment risk and demand are unclear, such as with 5G network roll-outs and related services.

As a result, 5G will be a key driver of SaaS-related spending during the forecast period because it will encourage CSPs to invest in new services and in assessing new ways of controlling operational costs.

SaaS will account for 16% of the overall BSS spending in 2023, and 12% of the total OSS spending

The adoption of SaaS delivery is proceeding more quickly in BSS applications, which are customer-facing, than in OSS applications, which are network-facing and are more-directly linked to network performance and security. Analysys Mason expects that this will continue to be the case throughout the forecast period.

Figure 1: SaaS in telecoms software revenue, worldwide, 2018–2023

Source: Analysys Mason, 2020

SaaS spending in the BSS market will be driven by spending in business analytics, customer engagement (CE) and revenue assurance. SaaS is expected to account for 27%, 22% and 21% of the overall revenue in each of these three sub-segments, respectively, in 2023.

CE functions are IT-centric and non-mission-critical, so CSPs have started to adopt the SaaS model in this sub-segment. As a result, SaaS spending in the CE market accounted for more than 50% of the total estimated SaaS-spending across all segments covered by our forecast in 2019, led by Salesforce.com. CE-related SaaS spending will continue to grow, driven by CSPs’ ability to cost-effectively experiment with multiple business cases and engagement models.

SaaS-related spending in the monetisation platforms (MP) sub-segment will also grow steadily during the forecast period, driven by the popularity of cloud-based deployment models in other verticals and by the reduction in the total cost of ownership that SaaS enables. However, we forecast that SaaS will only account for 8.6% of the total spending in the MP sub-segment in 2023. The slow adoption of SaaS in this sub-segment is due to the cautious approach from CSPs that lack confidence about the security and customisability of the model and have heavily invested in legacy systems that are still functional and in use.

Within the OSS market, we expect that the benefits of the SaaS model will slowly win over CSPs that are not currently comfortable with network domain off-premises software applications. SaaS spending in the OSS market will grow at a CAGR of 41%, but the growth rates in each of the four OSS sub-segments will vary widely. Specifically, SaaS-related revenue in the OSS market will be driven by CSPs’ spending on network automation orchestration (NAO) and business analytics (CAGR of 111% and 63%, respectively, during the forecast period), while SaaS adoption in the service design and orchestration (SDO) and automated assurance (AA) sub-segments will be more-limited.

Few CSPs in the NAO sub-segment have yet to commit to the SaaS model because of concerns such as a lack of control over network performance and data ownership. However, cost benefits and the growing number of vendors that are offering SaaS-based products will drive SaaS revenue to account for nearly16% of NAO spending by 2023. The first cloud-based SaaS applications will focus on analytics, SD-WAN management and orchestration and control plane VNF orchestration. The adoption of SaaS-based delivery will proceed quickly in the network analytics sub-segment because the SaaS model is suitable for training AI-based solutions that require large volumes of data without requiring CSPs to build associated infrastructure.

11% of the total spending in the AA sub-segment will come from SaaS in 2023; this will be driven by IT-centric assurance functions, such as workforce automation, because SaaS spending on network-centric assurance functions will be limited. We expect that SaaS will account for just 6% of the total SDO spending in 2023.

Greater product availability and increased confidence in the cloud will encourage CSPs to adopt the SaaS model

CSPs are increasingly accepting the SaaS model due to the cost and agility benefits that it delivers. CSPs that want to explore the benefits of the SaaS model should adopt it gradually, and should start by using SaaS for non-critical use cases in order to minimise risks. The initial wave of deployments for limited use cases that we have seen to date will be followed by wider adoption to include more mission-critical network-facing applications once the approach has been proven at a small scale and CSPs have become more comfortable with the quality and security of cloud infrastructure.

The growth in SaaS-related spending will be driven by CSPs’ concerns about the potential size and speed of 5G investment growth. Vendors may benefit greatly from the shift towards SaaS because it will improve the efficiency of product delivery and will lead to a more stable revenue stream. As such, many are likely to offer an increasing number of SaaS-based applications, which in turn will lead to further growth in SaaS-related spending by CSPs.

Downloads

Article (PDF)Author

Michela Venturelli

Senior AnalystRelated items

Vendors must improve the power efficiency of their products to tackle Scope 3 emissions

Article

Public cloud providers are tackling soaring emissions despite being leading purchasers of renewable energy

Article

Environmental KPI tracker: network equipment vendors 2H 2022