Operators in MEA should enhance the self-care app experience to drive customer satisfaction KPIs

Most operators in the Middle East and Africa (MEA) have launched their own self-care apps to reduce the cost of sales and customer care operations. However, the results of our Connected Consumer Survey from August and September 2020 show that the use of operators’ self-care apps remains low.

Operators need to increase customers’ engagement with their self-care apps in order to both reduce the cost of call centre operations and improve the customer experience. Survey results show that an increase in the adoption of, and satisfaction with, self-care apps can support an increase in Net Promoter Score (NPS)1 and satisfaction with customer care.

The adoption of operator self-care apps did not increase between 2019 and 2020 in most of the countries surveyed, despite COVID-19-related restrictions

We conducted a survey of smartphone users in eight countries in the Middle East and Africa between August and September 2020.2 We asked a minimum of 750 respondents per country questions regarding their usage behaviour, preferences and plans.

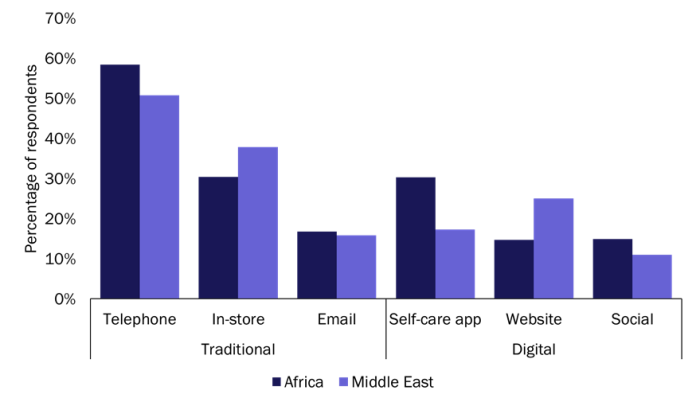

We asked respondents which channels they use to interact with their mobile operator. We then grouped their responses into two categories: traditional channels (telephone calls, emails and retail store visits) and digital channels (websites, self-care apps and social media). More than half of all respondents in MEA stated that they contact their mobile service provider using a telephone; this is the most-used channel for both customer support and to make a purchase (for example, adding a new service or topping up prepaid credit) across the region (Figure 1). In-store visits are the second-most-used channel.

Figure 1: Use of various channels to communicate with a mobile service provider for sales and customer support, Africa and the Middle East, 2020

Source: Analysys Mason, 2021

Our survey results show that store closures and movement restrictions due to the COVID-19 pandemic led to an increase in the use of self-care apps in 2020 in regions such as Europe and Asia. The Middle East is the exception; all operators had lower levels of self-care app penetration in 2020 than in 2019 (apart from du in the UAE, which retained the same penetration level).3 The use of self-care apps for customer support and sales in Sub-Saharan Africa only increased marginally between 2019 and 2020, but was still higher, on average, than that in the Middle East (30% and 17%, respectively). MTN (Nigeria), Safaricom, Vodacom, Ooredoo (Oman), stc (Saudi Arabia) and du have the highest levels of self-care app penetration in MEA (around 40%), while operators in Kuwait, Egypt and Saudi Arabia (excluding stc) have the lowest adoption rates.

The limited impact of the pandemic on the use of operators’ digital channels in MEA could be linked to the change in the types of customer enquiries, which may have rendered mobile apps less effective. For example, traditional channels are more suitable for downgrading a phone plan or asking for a delay to bill payments than digital channels. The features and capabilities of the self-care apps provided by operators in MEA also lag behind those implemented by their peers in Europe and Asia.

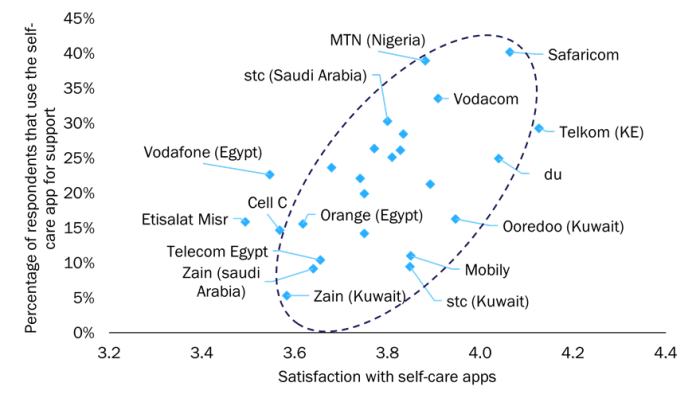

The level of satisfaction with self-care apps generally correlates with both their adoption level and customer service satisfaction

We asked respondents that use self-care apps to rate their satisfaction with them. We found that the level of satisfaction with self-care apps in MEA correlates with the penetration of self-care apps (Figure 2). Furthermore, customers that are satisfied with using self-care apps for support tend to also have high levels of overall customer service satisfaction. For example, du, Safaricom and Telkom (Kenya) have some of the highest customer satisfaction ratings for both their apps and their overall customer service. Operators with more limited app traction (such as Cell C, Zain (Kuwait and Saudi Arabia) and those in Egypt) have the lowest satisfaction scores.

However, there are also a few outliers. For example, Mobily, Ooredoo (Kuwait) and stc (Kuwait) have relatively high satisfaction scores for their self-care apps, despite the low levels of penetration.

Figure 2: Satisfaction with and use of self-care apps for customer support, by operator, Middle East and Africa, 2020

Source: Analysys Mason, 2021

Operators should ensure that their self-care apps are well-designed and feature-rich to drive adoption and satisfaction

Evidence that demonstrates the potential benefits of operators’ investments in self-care apps is starting to emerge in MEA. Operators with high self-care app penetration tend to have higher satisfaction ratings with different aspects of their mobile services, as well as higher NPSs. In fact, regression analysis shows that respondents that use digital channels (such as self-care apps) are more likely to recommend their operator than those that do not, all other things being equal. This means that there is likely to be an improvement to the overall satisfaction with customer service if an operator manages to increase customers’ satisfaction with its self-care app.

Leading operators’ apps offer good usability and utility, which contributes to their high rankings on app stores. New features such as loyalty programmes are regularly added to increase engagement (for example, Ooredoo’s Nojoom, stc’s Qitaf and Vodacom’s VodaBucks), and artificial intelligence and machine learning (for example, MTN’s Zigi and Safaricom’s Abbybot chatbots) can be added to complement basic account management features, balance transfers, online shops and customer support.

Operators in MEA that lag behind in terms of self-care app satisfaction and adoption have the potential to improve the quality of their digital channels and address issues that may discourage customers from migrating from traditional channels. Adopting best practices from leading operators in the region and worldwide may result in enhanced customer satisfaction and deeper engagement.

1 The Net Promoter Score (NPS) is calculated by subtracting the percentage of subscribers that rated the operator 6 or below from the percentage that rated it 9 or 10.

2 The countries included were Kuwait, Oman, Saudi Arabi and the UAE in the Middle East and Egypt, Kenya, Nigeria and South Africa in Africa.

3 Note that Egypt was only included in the 2020 edition of the survey.

Article (PDF)

Download