COVID-19 will lead to a temporary decrease in SMB spending on PaaS, but the long-term outlook is strong

Small and medium-sized businesses’ (SMBs’) spending on platforms-as-a-service (PaaS) will reach USD2.1 billion in 2020, up USD160 million from 2019. However, this spending will be USD170 million lower than previously forecast due to the COVID-19 pandemic and businesses’ plans to delay or limit their investments in PaaS.

SMBs’ spending on PaaS will grow by 10% between 2020 and 2021 because businesses will seek to improve operational efficiencies and reduce costs through the deployment of technology. Analysys Mason expects that growth in the PaaS market will resume its pre-COVID-19 trajectory in the long term, driven by continued investments in related technologies such as the public cloud. SMBs’ spending on PaaS will grow at a CAGR of 17% between 2020 and 2025.

Mitigating factors will prevent substantial long-term damage to the PaaS market

Analysys Mason has assessed the impact of the COVID-19 pandemic on businesses across 55 countries, 13 business sizes (in terms of the number of employees) and 19 vertical markets. The analysis considers factors such as the duration of lockdowns, the health security index, GDP growth and unemployment rates and purchasing managers’ index scores.

The PaaS market will be less affected by the COVID-19 outbreak than some other IT-related markets. The share of PaaS spending that comes from industries that have been severely disrupted by the pandemic such as retail, hospitality and transportation is quite small, thereby mitigating the overall impact on PaaS spending. Indeed, only 10% of SMB spending on PaaS comes from these industries (Figure 1).

Figure 1: Breakdown of SMB spending on PaaS by sector and change in spending compared to the pre-COVID-19 forecast, worldwide, 2020

Source: Analysys Mason, 2020

Our research indicates that 32% of medium-sized businesses (100–999 employees) and 6% of small businesses (1–99 employees) use PaaS solutions. The high rates of adoption of IaaS and SaaS solutions among medium-sized businesses are a key driver of PaaS adoption, since PaaS solutions enable developers and operations teams to quickly deploy IaaS and SaaS resources. Medium-sized businesses account for more than 71% of SMBs’ PaaS spending and will be more resilient to the COVID-19-induced downturn than their smaller counterparts, so one might expect that the overall effect on SMB spending on PaaS will be minimised.

However, SMBs in developed regions will be severely affected by the pandemic and account for more than 60% of the total SMB spend on PaaS solutions. This explains why our forecasts for the total SMB spend on PaaS solutions in 2020 have been reduced.

PaaS spending growth is correlated with IaaS spending growth, which will remain robust

Growth in PaaS spending is highly correlated with growth in infrastructure-as-a-service (IaaS) spending, which will remain steady, despite the economic downturn due to the pandemic.

Our research indicates that SMBs are increasingly running their businesses on IaaS platforms. PaaS tools will enable companies to manage complexity, while ensuring that they maximise the benefits of their investments in IaaS. As companies’ usage of IaaS technologies matures, their range of PaaS functions used widens, including tools for cloud development, database management and business analytics.

SMB spending on IaaS will grow by 13% worldwide between 2019 and 2020, which is 3 percentage points lower than in Analysys Mason’s pre-COVID-19 forecast. However, this setback will be temporary; SMB spending on IaaS will increase by an average of 17% each year between 2020 and 2025.

Cloud investments are growing, despite the COVID-19 outbreak

PaaS solutions are an extension of public cloud platforms and enable the utilisation of public cloud resources, thereby helping businesses to manage complexity and speed up application delivery.

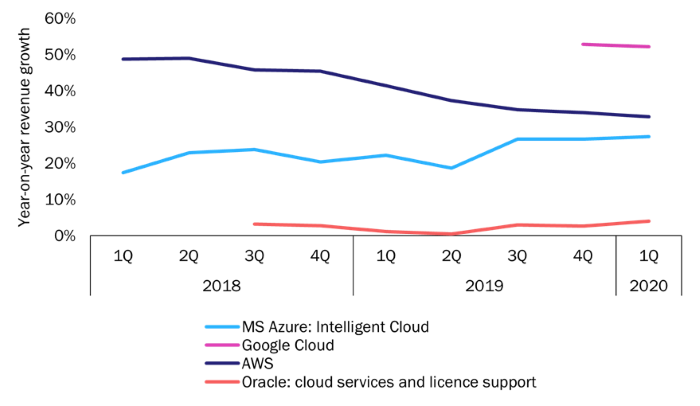

Major vendors reported year-on-year growth in cloud revenue in early 2020, even as businesses around the world dealt with the early stages of the COVID-19 outbreak (Figure 2). These vendors do not make up the entire cloud services market and the impact of the pandemic on their performance may be more apparent in subsequent earnings reports, but the overall cloud services market will continue to grow, despite the temporary decline in growth rates.

Figure 2: Year-on-year cloud service revenue growth, major vendors, worldwide, 1Q 2018–1Q 20201

Source: Analysys Mason, 2020

The long-term outlook for the PaaS market remains strong

COVID-19 will limit SMB PaaS spending growth in the short term because SMBs in developed regions will be severely affected by the pandemic. However, medium-sized businesses, which are among the heaviest users of SMB PaaS solutions, will be more resilient than small businesses, thereby mitigating the long-term impact on PaaS revenue. As such, the long-term outlook for the PaaS market remains strong. We expect that SMBs will continue to use IaaS solutions as they modernise their businesses and our research indicates that SMB spending on PaaS correlates with that on IaaS. Therefore, as the IaaS market grows, so too will the PaaS market.

1Cloud revenue includes revenue from both IaaS and PaaS.

Download

Article (PDF)

Receive the latest news and research on SMB IT buying behaviour and forecasts

Author

Youngeun Shin

Senior AnalystRelated items

SMB IT spending forecast report: a new beginning

Report

SMBs in manufacturing and professional service industries are making big investments in CRM solutions

Article

Security vendors’ financial and operational metrics: trends and analysis