Most SMBs will remain loyal to Intel-based PCs, but smaller firms may shift to Macs with Apple chips

There have been some delays in the manufacturing process for Intel’s 7nm processors and Apple has decided to stop using Intel microprocessors. As such, Apple has found space to advance in the small and medium-sized business (SMB) market. Intel will still remain the top choice for many SMBs, particularly in light of the COVID-19-driven shifts in SMB buying behaviour, but Apple will make gains among SMBs with fewer than 50 employees.

The level of marketing activity in the SMB PC space will increase due to Apple’s move away from Intel and Intel’s manufacturing delays

Intel announced delays to its 7nm processor roadmap, while its competitors are already announcing plans to deliver 5nm processors in 2021. AMD already offers 7nm processors and Apple is moving towards 5nm in partnership with TSMC.

This means that Dell, HP, Lenovo and other PC vendors can supply only 10nm Intel laptops until at least 2021; AMD models are their only 7nm option. Historically, PC vendors have sold AMD-equipped laptops at a modest discount over similar Intel-based machines, justified by Intel’s superior performance and popularity within the market. However, leading PC brands are unlikely to quickly give up on Intel and promote AMD-equipped laptops to the premium spot in their product line-ups.

We expect that Intel will emphasise the holistic performance of their machines, for example their computing power, battery life, security and manageability, as well as brand pedigree and trust. Apple is expected to highlight simplicity, user experience and its device ecosystem, in addition to the 15–20% uplift in performance and/or battery life that a 5nm-equipped Mac may deliver over a 10nm-equipped PC. How 5nm-equipped Macs perform relative to PCs with Project Athena Intel chips (10nm) remains to be seen. In the end, the performance difference to the end user may not be discernible, but the messaging and the user experience communicated will be pivotal in PC purchasing decisions.

Vendors will have to navigate a weaker sales environment and altered SMB buying behaviour due to COVID-19

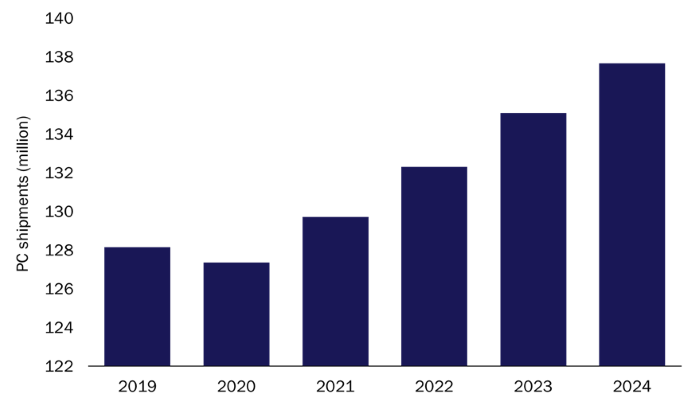

The Analysys Mason SMB Technology Forecaster shows that SMBs’ demand for PCs will remain weak throughout the rest of 2020 due to the COVID-19 pandemic (Figure 1). Longer refresh cycles will prevail, at least until economic recovery gains pace in 1Q 2021.

Figure 1: SMB PC shipments, worldwide, 2019–2024

Source: Analysys Mason, 2020

The COVID-19 pandemic will also lead to the following shifts in SMB behaviour over the next 12–18 months.

- There will be a heightened emphasis on PC security due to the increase in the number of remote workers. The results of our survey of 400 US SMBs conducted in May 2020 show that 4 in 10 SMBs increased their use of security products between February and May 2020.

- There will be a greater need for device manageability, again due to working from home measures. This is especially true for firms with more than 50 employees and a large fleet of PCs.

- Most SMBs with formal internal IT departments will not acquire PCs from different brands or with different microprocessors at this time. Having fewer PC brands reduces variability and is easier to manage.

These shifts favour Intel microprocessors (including its vPro SKU), which promise greater security, manageability, collaboration and connectivity. SMBs with more than 50 employees value these benefits and will stay loyal to Intel, regardless of the 10nm versus 7nm issue. Furthermore, Intel’s Project Athena specifications will enable an enhanced and consistent laptop experience across multiple PC brands.

However, SMBs with fewer than 50 employees and with little to no IT staff will continue to rely on easily understood benefits (simplicity, the latest generation of microprocessor, processing power and battery life) to inform their PC/brand selection criteria. It is within this SMB segment that Apple is likely to make strong gains using persuasive messaging around performance and user experience. We do recognise that Apple has succeeded in making its devices more secure and manageable for enterprise IT, and usable across various verticals with an app-led strategy, but this is a strength that Apple has yet to fully apply to the SMB space.

There are three additional factors that may further strengthen Apple’s position in the lower end of the SMB space.

- Smaller firms are generally open to a variety of PC brands. They have less in-house IT infrastructure and many use the public cloud. They are able to get work accomplished regardless of the device or brand used.

- The remote staff in small firms may depend on their neighbourhood PC repair stores in the absence of formal IT, and Apple offers a trustworthy servicing network with its genius bars and localised Apple consultant network.

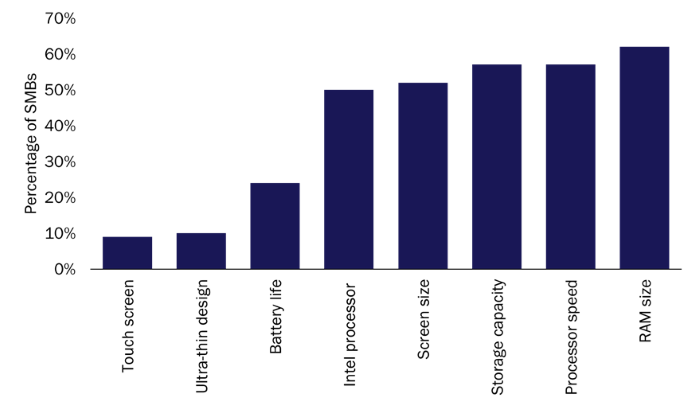

- Longer battery life may become a compelling selection criterion as travel restrictions ease. SMBs may choose Apple if the battery life on Apple laptops is noticeably longer than that for competing brands (because of 10nm versus 5nm technology). However, the results of our survey of SMBs in 12 countries show that this feature is typically just part of the overall experience, as demonstrated by its lower relative ranking in Figure 2.

Figure 2: The features deemed to be the most important to SMBs when buying a PC1

Source: Analysys Mason, 2020

Apple stands to gain net new SMB customers, but Intel should catch up by 2022

We expect that Intel will participate in some heavy joint marketing efforts with the leading PC brands to highlight the vPro and Project Athena value propositions. Apple is likely to focus on simplicity, its device ecosystem, apps, performance, experience and the uniqueness of its own microprocessors as differentiators.

We expect a large majority of SMBs to stay loyal to Intel, but Apple will probably add net new customers in the under-50-employee SMB segment at the expense of other brands. This may amount to a modest loss for Intel on top of the 5% loss of business from Apple’s departure. However, we expect that Intel will make a strong return in 2022, having fully addressed its 7nm fabrication issues (including any outsourcing choices).

1 The chart shows results from our survey of approximately 3000 SMBs that was conducted in 2Q 2019. Multiple responses were accepted, so the sum of the percentages is greater than 100%.

Download

Article (PDF)

Receive the latest news and research on SMB IT buying behaviour and forecasts

Related items

SMB IT spending forecast report: a new beginning

Report

SMBs in manufacturing and professional service industries are making big investments in CRM solutions

Article

Security vendors’ financial and operational metrics: trends and analysis