C-band spectrum auctions in the USA: wireless incumbents are paying for the weight of 5G expectation

17 February 2021 | Research

Article | PDF (3 pages) | Wireless Infrastructure Strategies

Listen to or download the associated podcast

The C-band auctions in the USA concluded on 15 January 2021 with USD80.92 billion spent on 280MHz of C-band (3.7–3.98GHz band) spectrum. This is equivalent to USD0.92/MHz/pop, the highest price yet paid for such spectrum anywhere in the world. It will be several weeks before we know how this breaks down at an operator level, but it is a reasonably safe assumption that AT&T and Verizon paid the most. In this article, we analyse what drove the high overall prices and what the impact will be on network investment in future.

The highest spectrum-to-capex ratio for C-band

The real cost to the operators is even higher than USD80.92 billion: there are relocation costs, estimated to be a further USD3.3 billion, which licence holders will incur to relocate the satellite incumbents, and potentially USD9.7 billion more to accelerate the clearance of those incumbents on the blocks that are not due to be cleared until the end of 2023. Total mobile operator revenue and capex (excluding spectrum) in the USA in 2019 stood at USD179.3 billion and USD29.1 billion respectively, so the sum paid is collectively 2.8 times higher than annual capex.

The 3G auctions in Germany and the UK in 2000 are a point of comparison – operators spent USD82.1 billion on a population base about half of that of the USA. The licence to previous year’s capex ratio for Vodafone UK (which spent the most in the UK) was 7.4 times, but this was when strong revenue growth in mobile was guaranteed. Before the US C-band auction, no established operator had spent more than 1.7 times the previous year’s capex on C-band spectrum.

Why such high prices

High prices in the USA can in part be explained by high average revenue per user (ARPU) – USD43 compared to USD19 in Europe – but even after normalising for ARPU the prices paid at auction are high.

The US mobile market is currently subject to disruption, which always drives prices up. There is new competition in the form of DISH, which has started to boost its subscriber base by acquiring MVNOs before launching 5G, and from cablecos. T-Mobile is a threat to AT&T and Verizon, with its stockpile of 2.5GHz spectrum acquired as part of the Sprint take-over. T-Mobile looks set to overtake both to become the largest MNO by subscriber base. DISH wireless and the cablecos would be a highly disruptive fixed–mobile convergence (FMC) combination (as long as DISH sold its DTH business), which would affect each of the big three MNOs.

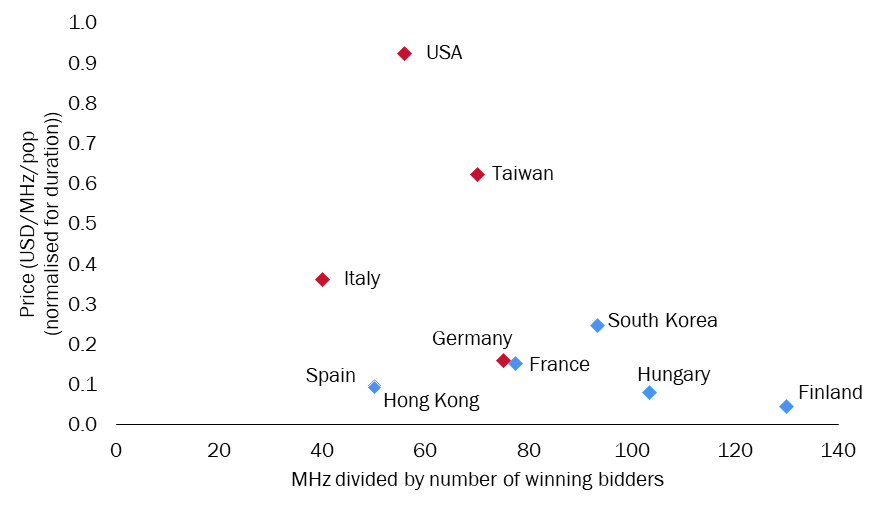

Limited release of spectrum tends to drive unit prices higher, and this is exacerbated by auctions that are engineered to facilitate new entrants, sharing the finite resource among fewer players (see Figure 1).

Figure 1: Megahertz by price and number of winning bidders, 5G mid-band spectrum auctions, selected countries

In the figure above, taken from Analysys Mason’s Spectrum auction tracker, auctions marked in red are those where the number of winning bidders (probably four or five for the USA) exceeded the number of existing national operators, or where the number of winning bidders was lower than the number of existing operators.

Increasing dependence on 5G

In the USA, the burden of expectation placed on 5G is perhaps greater than in other regions. For reasons that date back to the break-up of the original AT&T into regional fixed operators, the current AT&T and Verizon are more dependent on mobile than comparable large European or developed Asia–Pacific ex-incumbent operators. It means neither can afford not to get hold of a decent block of spectrum.

Assuming these two have spent heavily, they will be under internal pressure to build out rapidly to secure a rapid return. Few operators have ever been left so cash-strapped after auctions that roll-out is actually curtailed, and neither AT&T nor Verizon fall into this category. In fact, the sunk spectrum cost is likely to dwarf the roll-out cost. There are about 400 000 cell sites in the USA, and if each was upgraded to 5G at a high-end average cost of USD100 000, the total would still be only half the spectrum cost.

There is, however, an opportunity cost in spending so much. It entails less diversification of the kind that might make operators less reliant on securing 5G spectrum, although diversification through M&A into content has not been a happy experience for either AT&T (DirecTV, TimeWarner) or Verizon (AOL). Fibre or fixed-wireless network spend could be interrupted. AT&T’s FTTP has done well during the pandemic, but FTTP covers only a quarter of its 60 million premises wireline footprint, and it needs to spend more if it wants to defend its non-fibre base; doubling its homes-passed to 50% coverage would cost USD10–12 billion. For Verizon, the aim to cover 30 million premises outside its wireline footprint with FWA is also likely to suffer. C-band spectrum could help to overcome some of the high coverage costs associated with mmWave 5G FWA, but throwing C-band spectrum at ultra-low-yield FWA when average broadband data traffic is around 500GB per month is hardly an optimal use of a scarce resource.

Where is the pay-off?

Spectrum value is generally determined by the savings that can be made in network costs as a result of deploying the spectrum (‘technical value’) and by the commercial performance improvements that are realised due to improved network performance (‘commercial value’). The technical value of the spectrum is a measure of how much the spectrum is worth as a way of avoiding additional cost to maintain the same level of service by other means, for example through additional sites. This in turn depends on expected traffic growth, which appears to be slowing greatly in the USA, as it is in other advanced markets, hence limiting the technical value. So high prices suggest a higher commercial value, which now in the USA lies to a large extent with the competitive advantage that a higher average speed can deliver. It is not, however, obvious that the additional spectrum would deliver to either AT&T or Verizon a competitive advantage over T-Mobile on average speed.

It is therefore all the more important that AT&T and Verizon really do find ‘new wave’ 5G enterprise revenue (or ‘lead the emerging 5G economy’ as the CTIA President puts it), if only to offset the new-competition-fuelled decline in basic mobile ARPU. Neither will have the right assets this decade to avoid relative decline in mainstream consumer telecoms.

Perhaps, though, no operator – let alone the telecoms industry – should ever have got into a position where 5G carries such a weight of expectation.

C-band spectrum auctions in the USA: wireless incumbents are paying for the weight of 5G expectation

DownloadAuthor