Verizon’s new 5G fixed–wireless access proposition aims to attract cable cord-cutters

Verizon will launch its new 5G Home mmWave fixed–wireless access (FWA) service on 1 October 2018. Although Verizon is a leader in the US mobile market, it lacks fixed broadband coverage beyond its traditional footprint in the Northeast of the country. The operator therefore intends to expand its broadband footprint with 5G mmWave FWA to complement its existing FiOS FTTH deployment. This comment analyses Verizon's upcoming 5G mmWave FWA launch (this launch is analysed in more detail in Analysys Mason’s associated case study).

Verizon will initially launch 5G mmWave FWA in four cities

Verizon's 5G Home service will be available in certain neighbourhoods of Houston, Indianapolis, Los Angeles and Sacramento from 1 October 2018. Overall, Verizon estimates the 5G mmWave FWA addressable market to be 30 million premises. To put this in context, the top-25 US markets collectively represent 60 million premises. It is unlikely that Verizon will consider deploying 5G mmWave FWA outside the areas where these 60 million premises are located. It is expected that Verizon will expand its fixed broadband footprint beyond its traditional coverage area in Northeastern USA, but 5G mmWave FWA may also be used in the Northeast, where Verizon's FiOS FTTH service is not available. Verizon is initially deploying its 5G Home service using its proprietary 5G TF standard but has noted that it will rapidly expand its coverage area once new, standards-compliant equipment is available from vendors.

Verizon is targeting cable cord-cutters with its 5G mmWave FWA offers

The US fixed broadband market is characterised by low competitive intensity, which has led to generally high fixed broadband prices. Verizon's 5G Home service will be available for USD50 per month for Verizon Wireless customers with a qualifying smartphone plan, and USD70 for other customers. Verizon 5G Home will be free for the first 3 months as part of a special introductory offer. For those that want only standalone Internet access, Verizon is not significantly cheaper than the cable companies. For instance, cable operator Spectrum (brand of Charter Communications) currently offers 100Mbps Internet access for USD44.99 per month for one year, and thereafter at USD64.99 per year. While the 400Mbps offer listed on Comcast's website is more expensive than Verizon's package, Comcast also has an entry level 60Mbps offer priced at USD39.99 for the first 12 months, which may appeal to the most price-sensitive customers. Verizon has stated that customers should expect a typical speed of 300Mbps and, depending on location, a maximum speed of up to 940Mbps. The speeds offered by cable competitors in the four launch cities range from 60Mbps up to 2Gbps, with most areas eligible for 100Mbps to 250Mbps.

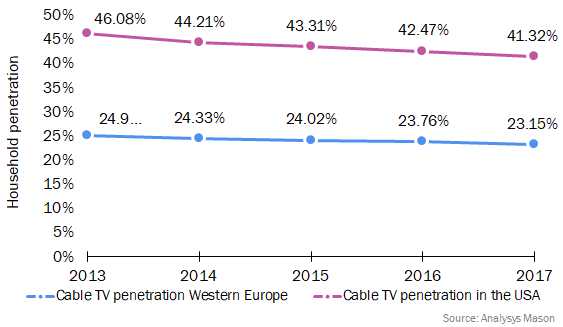

In the USA, cable cord-cutting has been more prevalent than in Western European markets (see Figure 1), and this demographic is an important target for Verizon's proposition. Rather than offering its own traditional pay-TV service, Verizon has announced partnerships with OTT players.

Figure 1: Cable TV household penetration, 2013–2017

As part of Verizon's offer, subscribers receive a YouTube TV streaming service, which includes more than 60 TV channels, free for 3 months (thereafter USD40 and billed through YouTube) and a free Apple TV 4K device or a free Google Chromecast Ultra device. For a package including internet and basic TV the Verizon price of USD90 is comparable with the 2 cable-operators (see table), but the number of channels included varies significantly between providers so direct comparison is difficult. Nonetheless, Verizon's offers do not appear to provide significant discounts compared to cable competitors.

Figure 2: Selected Internet-only and Internet+TV plans available in the four launch cities

| Verizon | Comcast1 | Spectrum | AT&T | ||

|---|---|---|---|---|---|

|

Internet-only |

Speed, Mbps |

300 |

400 |

100 |

100 |

|

Price, USD |

50 for mobile subs; 70 for others |

79.99 (99.95 after 12 months) |

44.99 (64.99 after 12 months) |

50 (60 after 12 months) |

|

|

Internet+TV |

Speed, Mbps |

300 |

100 |

100 |

100 |

|

Price, USD |

90 for mobile subs; 110 for others |

69.99 (89.99 after 12 months) |

89.98 (109.97 after 12 months) |

75 (118 after 12 months) |

|

|

Channels |

60+ with YouTube TV |

125+ |

125+ |

155+ |

|

|

Commercial terms |

CPE |

Free |

paid |

Free |

Free |

|

Installation cost |

Free |

paid |

paid |

paid |

|

|

Contract |

No |

Yes, for lowest price |

No |

Yes, for lowest price |

Source: Analysys Mason, 2018

While Verizon is not offering significant price discounts, it is aiming to take advantage of the fact US cable operators tend to have low Net Promotor Scores, as indicated by Analysys Mason's Connected Consumer Survey 2017 primary research. In addition, Verizon can promote some other advantages that its own offers have over those of its cable competitors. No annual contract is required for Verizon's offers, and while cable competitor Spectrum does not require an annual contract, Comcast and AT&T do – at least to get the lowest price (for example, with Comcast, the no-term agreement is usually USD10 more than the 2-year agreement for any given plan). Verizon has also stated that its 5G Home subscribers will be the first to be able to purchase 5G mobile devices as they become available.

Verizon is offering professional installation for its 5G mmWave FWA offers

Verizon has made an initial commitment to provide free professional installation for the 5G Home service, as well as free routers and router upgrades (from those using the proprietary 5G TF standard) as they become available in 2019, along with dedicated support using a 24-hour concierge line. Two pieces of equipment will be installed: an indoor or outdoor 5G receiver (Samsung device) and a 5G router to distribute Wi-Fi signals (Inseego device). Verizon claims that the professional installation, done by third-party company Asurion, will normally take 3 to 4 hours. The technician will decide which type of receiver (indoor or outdoor) is required, depending on the signal strength. It is somewhat surprising that Verizon is offering professional installation of the customer premises equipment (CPE), and the costs involved make the business case more challenging. The need for a professional installation also reduces the convenience of Verizon's 5G Home offers which has the potential to impact subscriber take up. However, it is possible that professional installation will not be offered for free to other customers in the future.

1 Comcast is not available in Los Angeles.