Verizon’s sale of its digital media business underscores the need to develop coherent digital advertising plays

Verizon announced the sale of a 90% stake in its digital media business, Verizon Media, for USD5 billion to private equity company Apollo Global Management in May 2021. This move marks the end of one of the big telecoms digital advertising businesses. In this article, we consider the rationale behind Verizon’s sale and the learnings for operators with digital advertising ambitions.

Verizon’s exit from digital advertising reflects Verizon Media’s struggles as well as Verizon’s increased focus on its core business

Apollo Global Management acquired a 90% stake in Verizon Media in May 2021, leaving Verizon with the remaining 10%. This transaction marks the effective end of both Verizon’s media business and one of the biggest telecoms digital advertising businesses worldwide.1

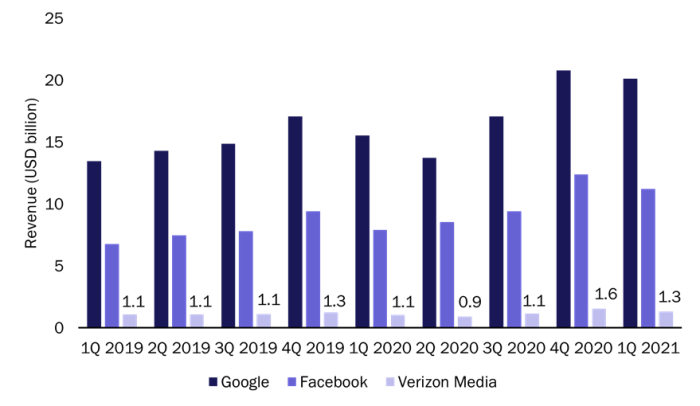

Verizon Media failed to accomplish the business targets announced in 2017 (USD10 billion in revenue by 2020 and an implied 10% share of the digital advertising market worldwide). Indeed, the venture was beset by significant challenges that make Verizon’s exit generally unsurprising. For example, the Google–Facebook digital advertising duopoly (see Figure 1) in the USA has troubled many smaller players. AT&T and Altice have also reported sluggish performance in their digital advertising businesses (Xandr and Teads, respectively) and have investigated the potential to offload their assets. Verizon sustained a USD4.6 billion write-down for Verizon Media in 2018, having acquired the underlying assets AOL and Yahoo! for a total of USD8.9 billion. Verizon has since sold off parts of Verizon Media such as Tumblr and HuffPost, reportedly at significant losses.

Figure 1: Estimated advertising revenue, Google, Facebook and Verizon Media, USA, 1Q 2019–1Q 2021

Source: Analysys Mason, 2021

In this context, Verizon’s exit perhaps represents an instance of a US operator finding a buyer for its advertising business where others have failed. The value of the transaction underscores Verizon Media’s struggles to monetise its assets efficiently. The price of USD5 billion for a 90% stake means that the effective value of each Yahoo! monthly active user (MAU) is around USD6, while the approximate price of acquiring each Facebook MAU is around USD300 (based on Facebook’s enterprise value).

Verizon’s exit is also closely linked to its strategic refocus towards its core connectivity business and its need to fund its network investments while working towards its leverage ratio target of 1.75–2.0 (net unsecured debt to EBITDA). This shift of attention to its core business is linked to the increased competition from T-Mobile and AT&T surrounding 5G roll-outs. Verizon spent USD52.9 billion (including the cost of clearing) on 161MHz of C-band spectrum in 1Q 2021, and it is aiming to achieve 50 million 5G FWA homes passed and coverage of 250 million people by 2025. Verizon expects that its net unsecured debt to EBITDA ratio to be around 2.8 at the end of 2021, and it does not expect it to return to its target range until 2025/2026, largely due to its network commitments. Selling Verizon Media has not made a significant amount of funds available relative to network costs, but it has enabled Verizon to forgo the investment commitments required to make Verizon Media competitive with Google and Facebook, thus freeing up attention and funds for its core business.

Verizon’s exit underlines the need to build clear digital advertising propositions

Verizon’s lack of success in digital advertising follows the familiar narrative of operators overpaying for digital economy assets that they do not understand and failing to make good use of them. However, the Verizon Media saga underlines the need for operators to develop clear visions in their digital advertising plays, rather than suggesting that operators should avoid areas such as digital advertising altogether. Verizon had grand ambitions for Verizon Media, but lacked a clear strategy and failed to execute on its plans to realise synergies between its advertising and telecoms businesses.

- Verizon Media’s assets were disparate and a legacy of past acquisitions. At the time of sale, Verizon Media’s brands included Techcrunch (a tech news publication), Yahoo! Sports (a sports news website) and RYOT (an immersive media company). Holding these different assets under one roof was intended to give Verizon Media a broad portfolio of advertising inventory with which to carve out a space as the third player behind Google and Facebook, but this did not work out as intended. Some of these properties (for example, Yahoo!) had already been consistently declining in value. Scrambling for a way to integrate different brands was a continuous focus for Verizon Media; for example, Yahoo! Shops, announced in March 2021, was intended to bring together brands such as Endgadget and Yahoo! Finance around a central shopping hub.

- Verizon had planned to acquire media assets so as to integrate telecoms customer data with media inventory, but these synergies failed to materialise due to internal data privacy rules that were put in place largely due to concerns over reputational risk. Verizon was fined USD1.35 million in a high-profile case in March 2016 for violating user privacy via its use of supercookies without informing users or allowing them to opt out. This and developments in privacy legislation (such as GDPR and the California Privacy Rights Act) provide some explanation for Verizon’s decision to keep its Verizon and Verizon Media data pools largely separate.2

More modest approaches with low investment commitments may be more appropriate for operators in markets such as the USA where Google and Facebook have established strong positions in digital advertising. Other operators (such as T-Mobile USA) are building revenue streams by selling consumer data to third parties, though this is not without a risk of consumer pushback over intrusive ad-placing. An alternative is to build in-house advertising capabilities, as Vodafone UK has done. Operators are likely to be able to afford to be a little more ambitious in regions where digital advertising is more nascent, higher-growth and thus potentially more open to players other than Google, Facebook and Amazon. Developing concentrated initiatives based around a clear set of advertising products is critical.

1 Verizon Media generated USD7.0 billion in revenue in 2020, the majority of which was from advertising. We estimate that Verizon Media’s advertising revenue in 2020 was 6.7 times the revenue from Singtel’s digital marketing business, 3.6 times the revenue from Altice’s digital advertising subsidiary, Teads, and 2.3 times the revenue from AT&T’s dedicated digital advertising subsidiary, Xandr.

2 According to its privacy policy, Verizon Media only had access to the data of Verizon users who opted into the Verizon Selects programme or did not opt out of the Relevant Mobile Advertising programme.

Article (PDF)

Download