Analysys Mason was engaged to conduct commercial and ESG due diligence of a local Norwegian dark-fibre operator

Client project

The problem

- A leading Nordic private equity firm was considering a full takeover of a medium-sized dark-fibre operator in Norway. To move forward, the firm needed a detailed understanding of the fibre industry dynamics and the operator’s standing within the market

- Recognising the complexities involved, the investor engaged Analysys Mason. The objectives were to undertake a comprehensive review encompassing the commercial, regulatory and ESG landscape, and to evaluate various scenarios to ensure a sound investment decision

The solution

- As part of our due diligence process, we carried out the following assessments

- the dark-fibre operator’s market potential within its operational domain and the prevailing competitive environment, scrutinising the repercussions for pricing dynamics and market penetration

- anticipated structural shifts in demand patterns, encompassing high-speed broadband, TV content, and other broadband-centric services

- analysis of operational costs, focusing on potential network enhancements and the implications of economies of scale on operational expenditure

- management’s projected capex across various pivotal projects, including expansions, upgrades and maintenance of core infrastructure

- We also developed an exhaustive ESG assessment tool tailored for our client, to facilitate its evaluation of this and other entities in the broadband sector

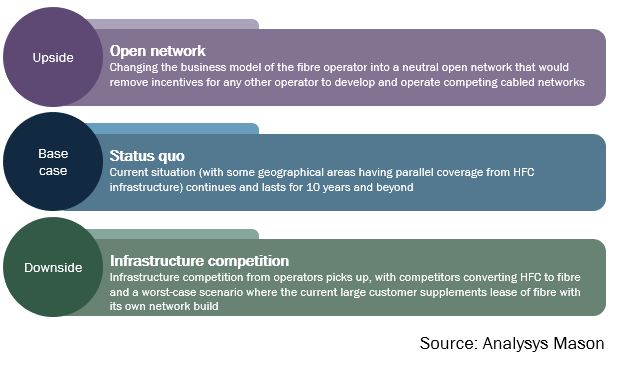

Figure: We assessed three distinct possible future scenarios

The result

- Analysys Mason’s thorough due diligence report equipped the client and its financial/legal consultants with a robust grasp of pivotal concerns

- Armed with insights from our report, the client seamlessly secured the necessary financing, leading to its successful acquisition of a 100% stake in the company