Satellite connectivity’s performance and cost mean it is now a core part of the digital infrastructure ecosystem

The low-Earth orbit (LEO) space economy is accelerating fast, and features growing capacity, new players and increasing convergence with terrestrial fixed and mobile networks. Consider these developments:

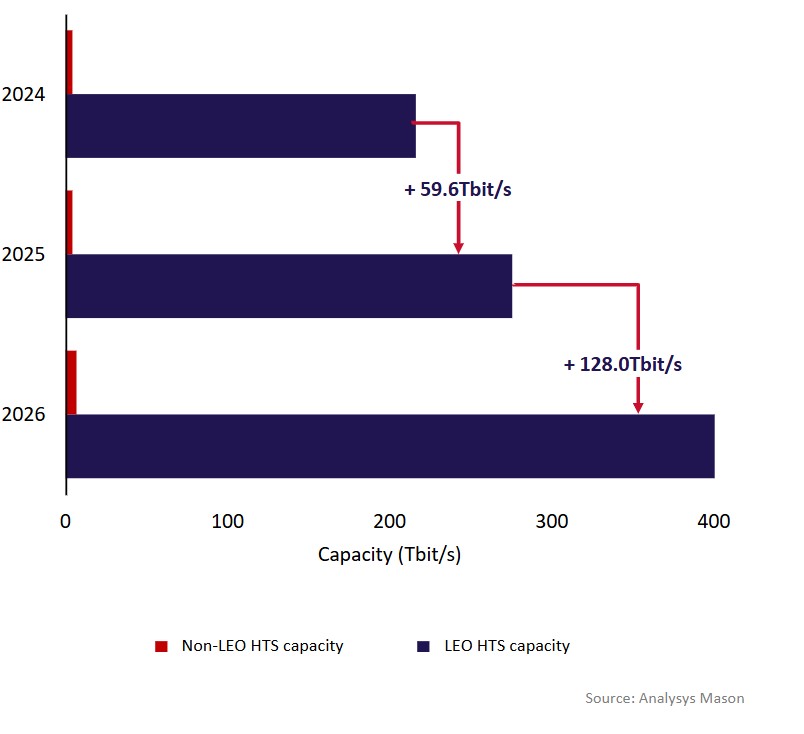

- Over 8500 broadband satellites are already active, delivering over 271Tbit/s of downlink capacity from LEO. Another 128Tbit/s (a 47% surge) is expected in 2026.

- Starlink, Amazon Kuiper, Eutelsat OneWeb, Qianfan, SES mPOWER and others are aggressively scaling up through rapid launches, market expansion and strategic partnerships.

- LEO services now offer service-level agreements, which were once the preserve of legacy providers. Starlink’s pricing remains 5–10× cheaper than industry norms, dipping as low as USD0.20 per GB.

- Amazon Kuiper, Starlink’s chief rival, is gaining ground with major wins including JetBlue (in-flight connectivity) and NBN (consumer broadband).

Figure 1: Global satellite capacity

This shifting landscape demands bold moves from traditional satellite operators. To stay competitive, they must develop their offerings to match LEO’s pricing and bandwidth, move closer to end users through managed services, and embed themselves in customer workflows with a focus on service and long-term relationships. They must also embrace risk, engage in tech development cycles, and specialise in government, enterprise or backhaul segments.

This shifting landscape demands bold moves from traditional satellite operators. To stay competitive, they must develop their offerings to match LEO’s pricing and bandwidth, move closer to end users through managed services, and embed themselves in customer workflows with a focus on service and long-term relationships. They must also embrace risk, engage in tech development cycles, and specialise in government, enterprise or backhaul segments.

Telecoms operators must act now to integrate satellite into their technology stack or risk revenue erosion and ceding ground to SpaceX and Amazon. The transformation in the performance and cost of satellite connectivity means it is no longer peripheral: it is a core part of tomorrow’s digital infrastructure.

Analysys Mason has over 30 years’ experience of providing space research, insights and strategic advisory to clients throughout the value chain. From market assessments and data-driven analyses to complete space strategy development, we have extensive expertise in helping our clients navigate the rapidly evolving space domain. For more information on our space capabilities, please visit Space industry consulting and research services.

Christopher Baugh

Partner, expert in space and satellite telecomsLatest content

Tracker

Earth observation contracts tracker 4Q 2025

Article

Satcom operators can turbocharge the space economy through launches, pricing and partnerships

Podcast

Analysys Mason’s research topics for 2026