AI adoption is surging, but <25% of portfolio companies’ AI tools will fully succeed in 2026

Private equity’s value-creation engine is entering a new era in 2026. Recent years have seen the twin hurdles of volatile valuations and fundraising challenges, but the rules of the game are changing again.

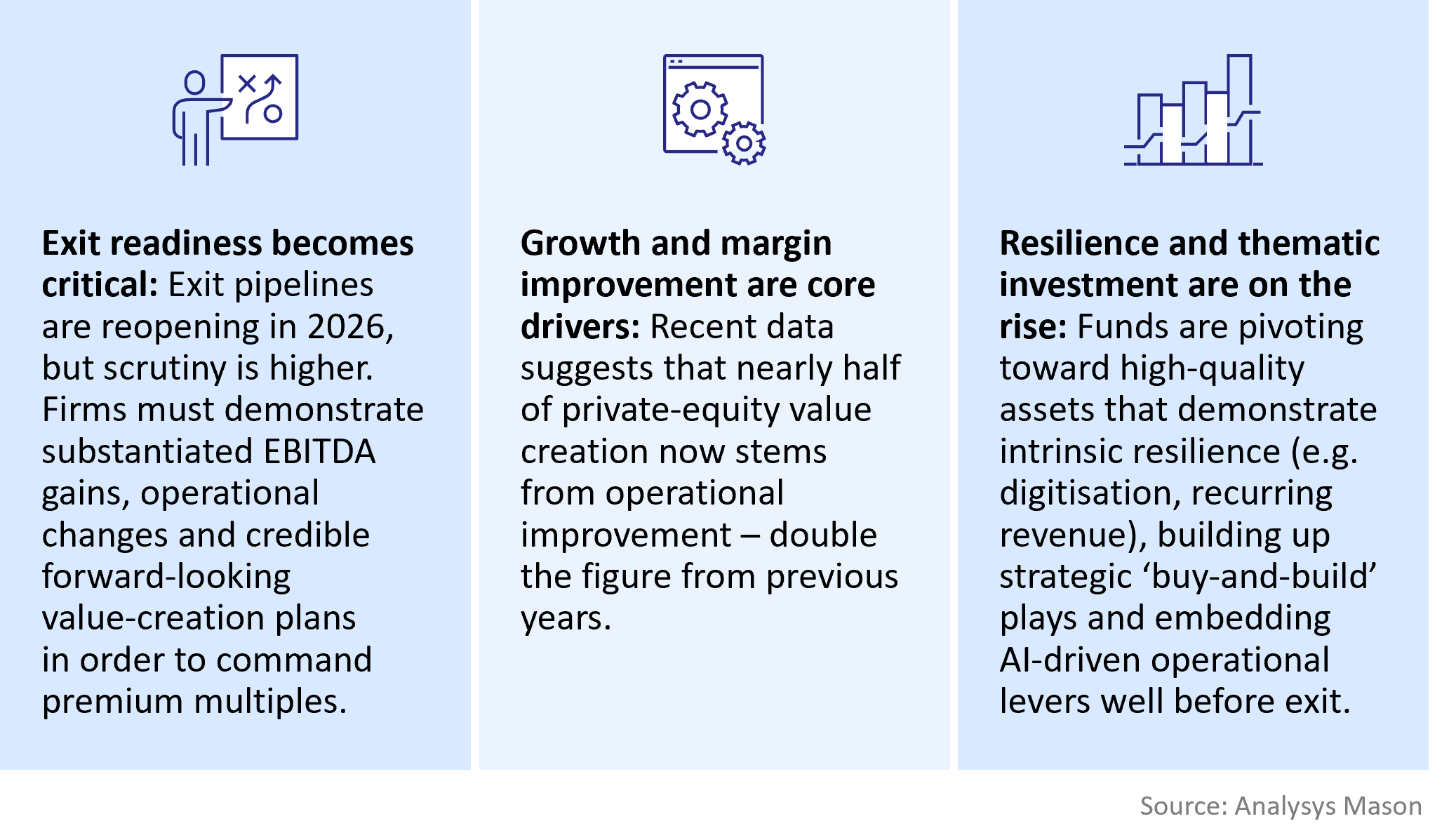

Conventionally, mergers – with a consequent increase in scale – have been sufficient to drive up the value of an asset. 2026 will see a growing requirement to demonstrate fundamental improvement in operations, as well as robust plans for a rapidly changing future. Proven playbooks for rapid AI deployment, operational scaling and rigorous exit preparation will be the key.

Investment activity in 2026 will not be constrained by a shortage of funding in the market, but finding high-quality assets and agreement between buyers and sellers is an ongoing challenge.

Private-equity funds are under mounting pressure from their limited partners to deliver realised returns. Demonstrable, data-backed improvement in margins and growth will be critical to success for fundraising and exits.

In 2026, some degree of AI adoption will be nearly universal across private-equity portfolio companies, with 80% of organisations implementing at least one AI-driven process or tool. Yet, only a fraction will manage to realise the expected returns on their investment. Success will depend not merely on having AI use cases, but on overcoming the mounting challenges from inflated vendor promises, insufficient data readiness and a lack of operational and cultural integration.

Key themes shaping 2026

Figure 1: Key themes shaping private equity in 2026

In 2026, funds that cannot show realised operational improvement across their portfolio companies will struggle to attract bids or new capital as investor scrutiny rises and benchmark dispersion widens.

AI is the defining strategic pillar for value creation

AI stands out as the defining strategic lever for value creation in 2026. The shift is no longer about AI pilots or isolated automation: it is about integrated operational transformation that reshapes asset valuations, growth trajectories and margin structures – and it applies to companies of all sizes.

Over 2026

AI will move from pilots to scale. Portfolio companies across sectors are moving from experimentation to broad AI deployment. Use cases range from predictive analytics in operations and pricing to wider margin optimisation. In software and IT services, most companies will focus on generative AI in service desk work, software development, sales and marketing.

Success rates for AI use cases will be low. While overall adoption is surging, successful scaling and meeting hyped expectations remains a challenge. Analysys Mason believes that only 20% of portfolio companies will be able to fully succeed in rolling out their AI use cases and meeting ROI expectations by year-end, due to persistent challenges around inflated vendor promises, data readiness, talent scarcity and organisational culture.

Buy-and-build will be accelerated by AI. AI-driven analytics are powering smarter integration, creating synergy and ultimately making buy-and-build strategies more repeatable and value accretive. AI-enabled platforms can more quickly standardise processes, consolidate data and capture cross-portfolio learnings, fuelling growth and margin expansion following an acquisition.

Premium valuations and differentiation require proof of AI preparedness. By late 2026, buyers and lenders will seek not just evidence of AI adoption but 20% will have a clear proof of ROI and operationalisation. Those companies demonstrating substantiated AI-driven transformation will command exit multiples 15–25% higher than peers, as buyers prioritise proven ROI and operationalisation over aspirational AI narratives.

In private equity’s new competitive equilibrium, demonstrable value improvement is the only route to premium multiples. The key lies in ambitious but judicious adoption of AI.

Author

Christian Fischer

Partner, expert in B2B strategy and value creationRelated items

Client project

Building a corporate strategy to achieve over 20% revenue growth, diversify the portfolio beyond core telecoms and harness AI-driven value creation

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Podcast

TMT predictions 2026: operators are at a crossroads