Satellite D2D will benefit early adopter MNOs in 2026

08 December 2025 | Research and Insights

Predictions| Satellite Broadband| Satellite D2D | Spectrum

Satellite direct-to-device (D2D) services are now a reality. These services will scale up very rapidly and be in everyone’s hands in the coming months. Telecoms operators need to move fast to avoid missing the opportunity.

Subscriber interest in satellite D2D is high and MNOs can start extracting value from these services now

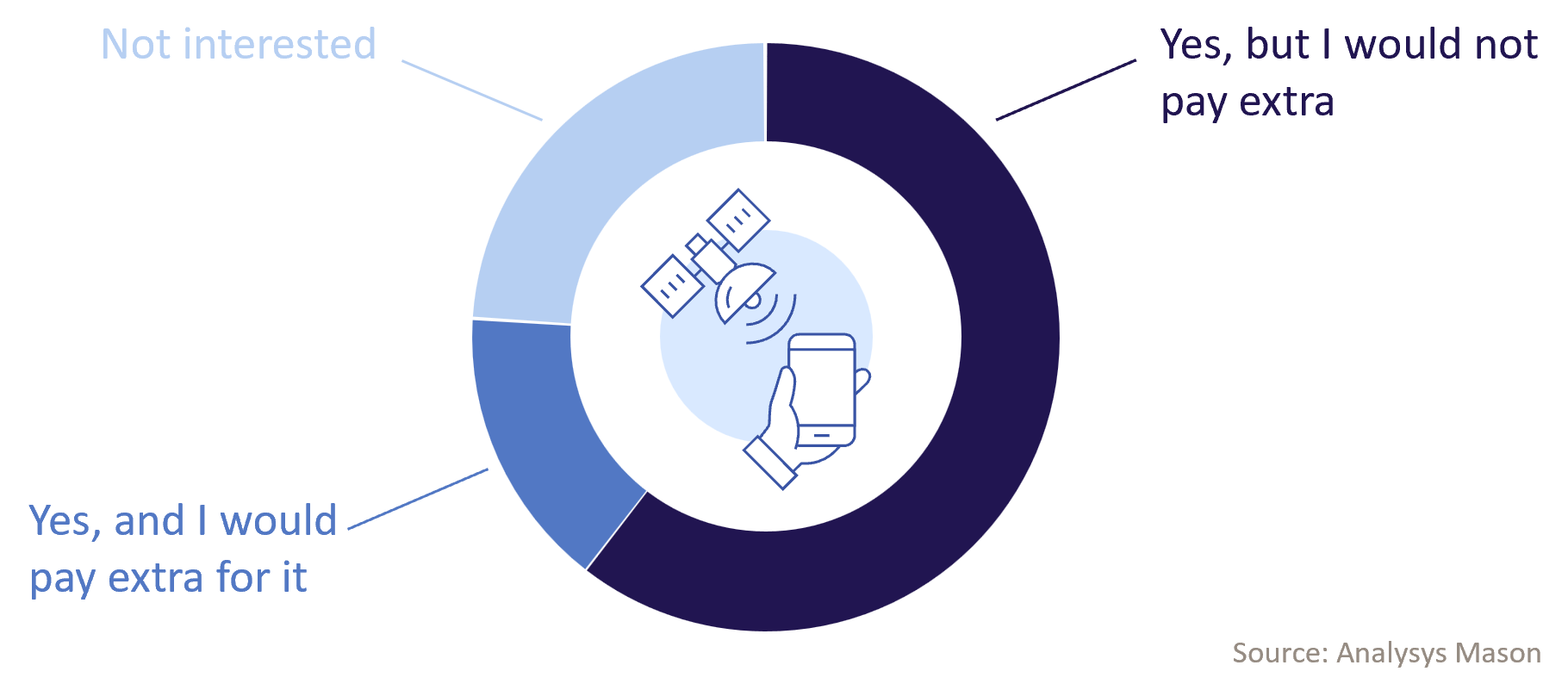

Consumer interest in D2D services is growing rapidly. In Analysys Mason’s annual satellite D2D consumer survey (part of our Satellite–Telecoms Integration programme) we found that 76% of respondents stated an interest in D2D messaging in 2025, four percentage points up from 2024.

Figure 1: Interest in satellite D2D messaging1

D2D services bring strong service differentiation, but our survey results also provide evidence that they may help win customers from rivals, increase customer retention and unlock upsell opportunities. The same survey shows that 79% of subscribers considering churning in the next 6 months express an interest in D2D services. This is the highest interest in D2D services in any population group. It is likely that bundling D2D messaging would enhance retention by a similar rate. Implementing D2D services in 2026 could give MNOs an annual revenue uplift of around 1%.

Once D2D internet services become available, the revenue impact for MNOs could grow even further. The subscriber willingness to pay skyrockets by 75% for D2D internet services compared to messaging, pointing to a new revenue stream for MNOs. However, these services will not be available before 2028 as the constellations need additional capacity, the standards need to evolve and smartphone manufacturers need to incorporate satellite capabilities. Based on the willingness to pay expressed by subscribers in the survey, MNOs could see their revenue grow by 3% when internet D2D services become available.

The D2D ecosystem is maturing and getting ready for the acceleration phase

A growing number of MNOs now understand that these services are necessary to keep their subscribers satisfied. Around 57 MNOs have launched or plan to launch D2D services imminently. Willingness to pay for D2D services is consistently high across different population groups and geographical regions (with a predictably marked peak among wealthier, younger, urban males with 5G-capable devices).

Unfortunately, the D2D ecosystem will not be able to grow at its full potential until 5G non-terrestrial network standards and satellite spectrum are embedded into consumer smartphones. Chipset vendors and smartphone manufacturers are realising that satellite capabilities are emerging as a key feature, though currently only 75 smartphone models include satellite capabilities. The number of smartphone models with satellite capabilities is expected to rapidly grow in the coming months as it becomes a standard feature.

Securing access to spectrum is crucial and has major implications in how satellite and terrestrial co-operate/compete

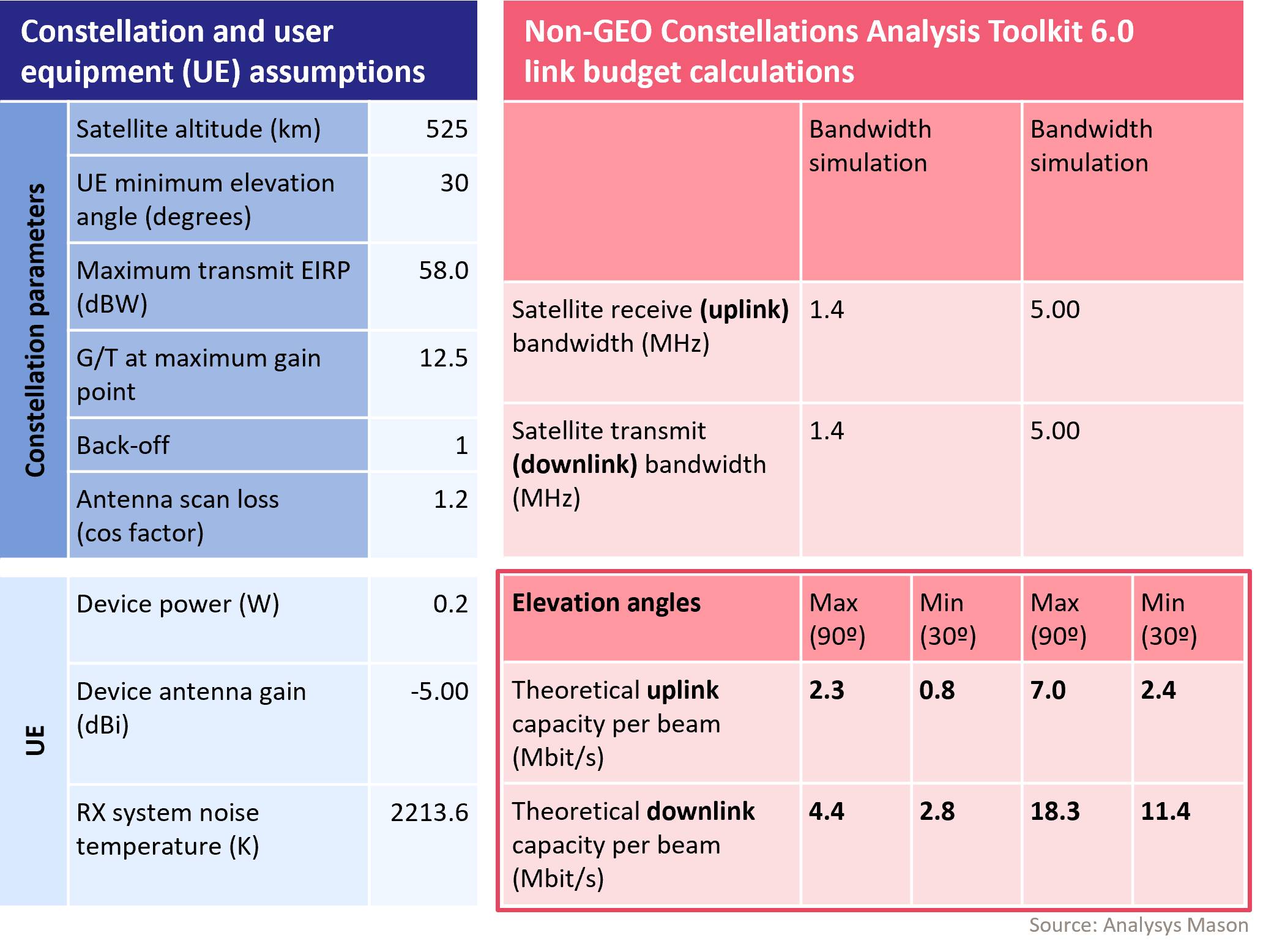

Access to sufficient spectrum is essential for scaling up voice and data D2D services to reach millions of subscribers. The calculations in Figure 2 show the theoretical capacity for Starlink’s original D2D constellation, based on the link budget for the 5MHz of spectrum obtained from T-Mobile. The maximum downlink capacity per beam under optimal conditions is 18.3Mbit/s. This capacity needs to be shared between all the users under the same beam, which typically is fairly geographically spread (~50km diameter).

Figure 2: Beam throughput calculation for Starlink D2D original constellation2

Satellite D2D operators are eager to obtain more spectrum to be able to offer higher throughputs and support more users. 2025 saw substantial activity in that direction: Starlink acquired Echostar’s D2D spectrum rights for USD17 billion; AST secured a USD550 million deal for 45MHz of spectrum from Ligado in the USA and Canada; Viasat and Space42 created Equatys as a joint venture to pool spectrum and investments as part of USD64 million deal for spectrum rights; Lynk and Omnispace recently announced their merger. These deals show the massive expectations from these companies in developing the D2D market. Investments to secure more spectrum will continue in 2026 and beyond for rights at national levels and as European mobile satellite spectrum rights expire in 2027.

Acquiring their own spectrum is also a big strategic pivot for Starlink, AST and Lynk, who previously relied on partnerships to use MNOs’ spectrum from space. They will now be negotiating partnerships from a much stronger position. Some technology giants such as Apple or Starlink could eventually consider launching a D2D overlay service direct to consumers, circumventing the MNOs.

1 This data was pulled from Analysys Mason's Consumer interest in satellite direct-to-device services: consumer survey.

2 This data was pulled from Analysys Mason's Non-GEO Constellations Analysis Toolkit 6.0.

Author

Lluc Palerm

Research Director, space and satellite, expert in satellite strategies for telcosRelated items

Article

A changing spectrum landscape offers new opportunities for creative financial sponsors

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies

Article

Why spectrum renewal policy matters for network investment and service quality